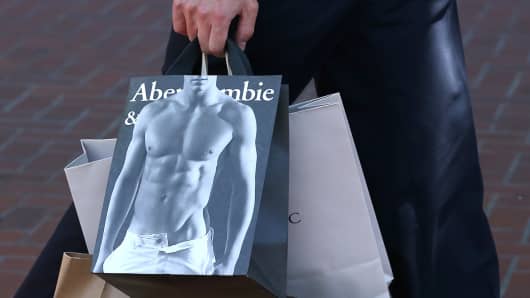

Abercrombie & Fitch is taking another step further from its sexy, cool-kids-only reputation.

As part of the about-face underway at its namesake label, Abercrombie’s designs and marketing will now focus on its shopper’s “best self and inner confidence,” Chief Merchandising Officer Fran Horowitz said Tuesday.

That’s a marked shift from the brand’s heyday in the 1990s, when the label defined itself through overtly sexy imagery and said its clothes were meant exclusively for the popular crowd.

The stock was down 20 percent Tuesday after the company said it expects a challenging second half of the year. Click here for the latest price.

The marketing change comes as Abercrombie is in the midst of reworking its assortment to cater toward 20-something shoppers who are chasing well-made yet affordable clothing, in an attempt to recapture market share it has lost to fast-fashion and other retailers.

“Image is less important than character,” Horowitz told analysts.

Abercrombie has gradually been leaving its bad boy (and girl) reputation in the dust, including last year’s decision to stop using shirtless models in its marketing. The brand is also reworking its aesthetic, by channeling a “casual luxury” vibe.

Getty Images

The retailer plans to ramp up its marketing budget in the second half to communicate this new image, and plans to test a new store format early next year. The company’s Hollister label is in the process of remodeling its fleet, which has led to double-digit increases in sales and traffic, management said.

After showing signs of stabilization, Abercrombie’s recovery tookanother step back during the second quarter. The company posted a wider-than-expected loss of 25 cents a share during the period. Though its $783 million in revenue came in slightly above Wall Street’s expectations, the company said it now expects the second half of the year to remain challenging, after previously calling for an improvement in comparable sales.

Along with pressure from competitors including H&M and a reboundingAmerican Eagle, a strong U.S. dollar and sluggish tourism have weighed on the company’s sales. This has been particularly troublesome for the Abercrombie label, which has more flagship stores in tourist locations than Hollister.

During the quarter, comparable sales at Abercrombie fell 7 percent, while those at Hollister dipped 2 percent.

Source: CNBC, August 2016