Sales of packaged ice cream rise 6.5% , while unit sales of frozen novelties are stuck in a rut.

IRI’s ice cream/sherbet category consists of these segments:

- Ice cream ($5.9 billion, units up 6.5%)

- Frozen yogurt/Tofu ($277.7 million, units down 11.7%)

- Ice milk/Frozen dairy dessert ($225.9 million, units down 8.9%)

- Sherbet ($191.4 million, units down 2%)

The frozen novelties category consists of these segments:

- Frozen novelties ($4.5 billion, units up 0.1%)

- Frozen ice cream/ice milk desserts ($226.6 million, units up 3.5%)

- Ice pop novelties ($151.9 million, units down 2.5%)

Ice cream numbers tick up

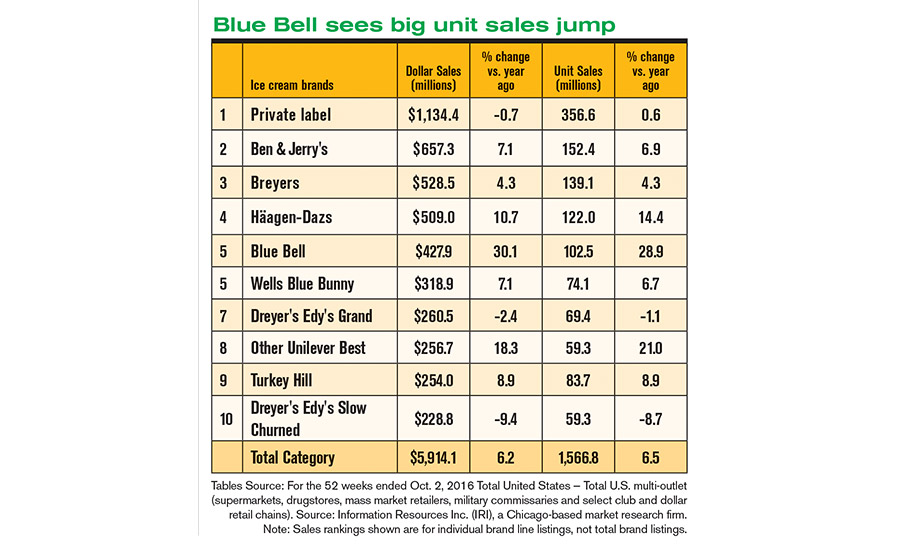

In the ice cream segment, dollar sales increased 6.2% to $5.9 billion and unit sales jumped 6.5% to 1.5 billion. The top 10 was dominated by private label, with $1.1 billion sales, but dollar sales dropped 0.7% and unit sales were up just 0.6%.

Unilever brands performed well. Coming up second in the segment was Ben & Jerry’s with $657.3 million — dollar sales jumped 7.1% and unit sales increased 6.9%. Breyers saw dollar and unit sales up 4.3%.

The story was mixed for Nestlé brands. Dollar sales for Häagen-Dazs rose 10.7% and unit sales improved 14.4%. Dollar sales for Nestlé’s Dreyer’s Edy’s Grand were down 2.4% and for Dreyer’s Edy’s Slow Churned sales were down 9.4%. Unit sales also dropped for each brand — down 1.1% and 8.7%, respectively.

Blue Bell Creamery saw the biggest sales boost among the top 10, with dollar sales up 30.1% and unit sales up 28.9%. The Texas-based ice cream maker is still recovering from product recalls in 2015 and 2016. Wells Blue Bunny saw dollar sales rise 7.1% and unit sales climbed 6.7%.

Frozen novelty sales are frozen

In the frozen novelty segment, dollar sales rose 3% to $4.5 billion, but unit sales only increased 0.1% to 1.4 billion. Among the top 10, Nestlé Drumstick saw dollar sales climb 6.3% and unit sales were up 2.8%. Dollar sales for Dreyer’s Edy’s Outshine (also a Nestlé brand) improved 3.9% and unit sales jumped 7.6%. The Nestlé brand saw the most impressive numbers in the top 10. Dollar and unit sales jumped 46.1% and 23.7%, respectively. Meanwhile, another Nestlé brand, Skinny Cow, did not fare as well — dollar sales fell 7.5% and unit sales dropped 8.4%.

Sales for Klondike (Good Humor from Unilever) improved 2.5%, with unit sales up only 0.6%. Popsicle (Good Humor) saw dollar sales tick up 1.7%, but unit sales dropped 2.6%.

Wells Blue Bunny’s dollar and unit sales increased 3.5% and 1.5%, respectively.

The frozen ice cream/ice milk desserts segment saw a boost with dollar sales up 3.6% to $226.6 million, and unit sales rising 3.5% to 13.9 million. Carvel led the segment with $125.8 million — dollar sales improved 4% and unit sales were up 3%. Dollar sales for Jon Donaire (Rich Products) were in a standstill at 0%, and units decreased 1.4%. Friendly’s Ice Cream got a boost — dollar sales increased 16.8% and unit sales jumped 25.7%. Dollar and unit sales for Kroger’s Turkey Hill brand improved 3.1% and 1.1%, respectively. Struggling was Tickleberry Desserts with dollar sales down 55.5% and unit sales dropping 51.4%.