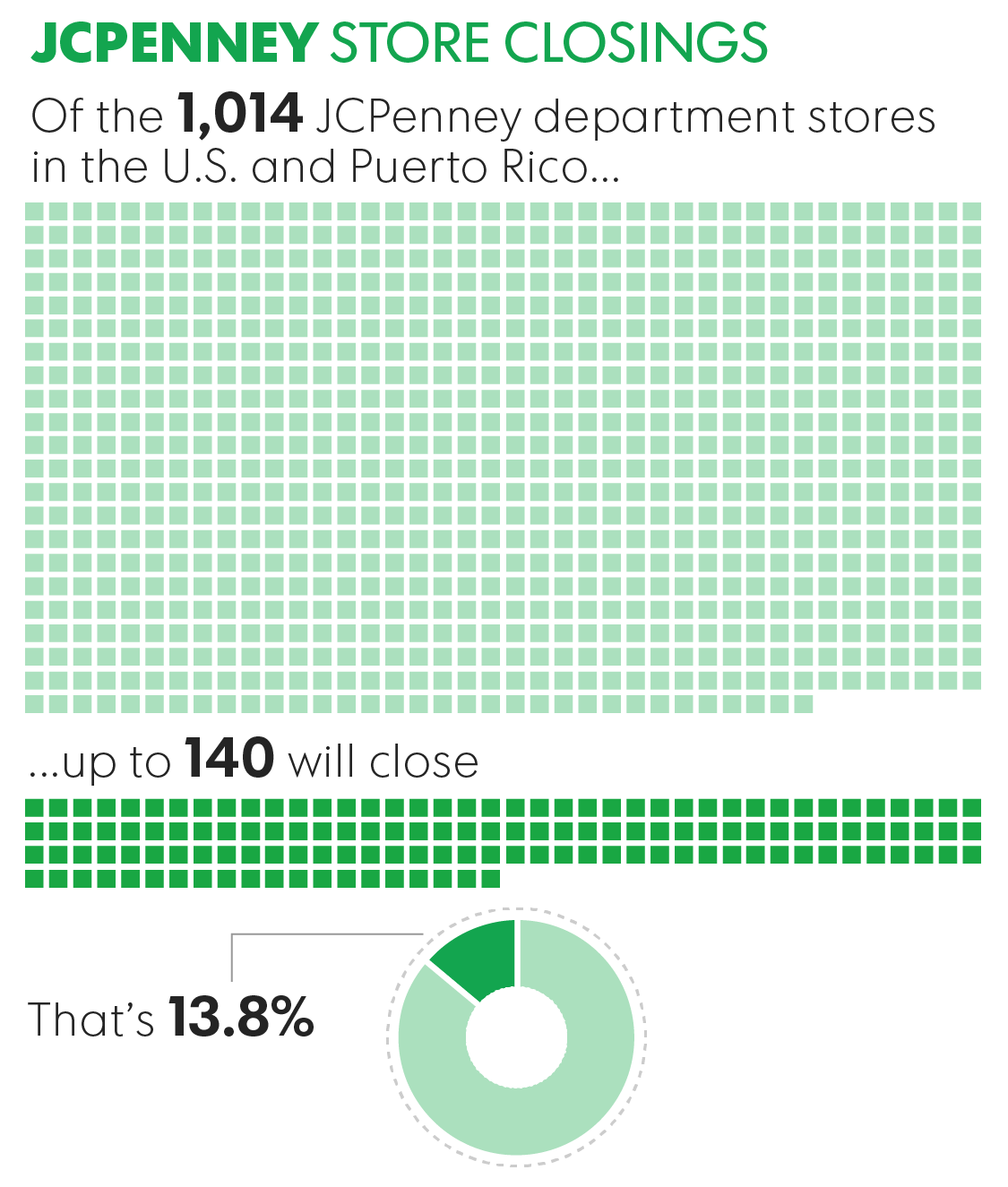

J.C. Penney (JCP) plans to close 130 to 140 stores and offer buyouts to 6,000 workers as the department-store industry sags in competition with online sellers and nimble niche retailers.

The company said Friday that it would shutter 13% to 14% of its locations and introduce new goods and services aimed at the shifting preferences of its customer base.

The cuts come amid mounting challenges for once-stalwart department-store chains such as Macy’s and Sears, which are also aggressively closing stores to shed costs as shoppers flock to alternatives.

Macy’s recently announced plans to cut 100 of its 675 full-line stores. Sears said it plans to close 150 stores, including 108 Kmart locations, leaving it with more than 1,300.

“It became apparent to us that our footprint was too large,” Penney CEO Marvin Ellison told investors Friday, and the closures will “allow us to raise the overall brand standard of J.C. Penney” and invest in remaining stores.

A list of Penney stores to close will be released in mid-March. Liquidation sales are expected to take place by the second quarter.

The closures mark a departure from Penney’s relatively steady store count over the last 15 years. The company had 1,021 stores as of Jan. 30, 2016, according to corporate documents, down from a high of 1,108 in 2009.

“This is just a market correction,’’ Farla Efros, president of HRC Retail Advisory, said in an interview. “There were too many stores, and too many retailers and too much noise in the market.’’

Online competition, fast-fashion retailers such as H&M and Forever 21 and discounters such as T.J. Maxx have undermined Penney’s business. Ellison said the company is responding by overhauling its products.

Penney is adding toys, beauty products, appliances and home goods as it tries to appeal to the customer base. Some 70% of the base is composed of women. And 70% of all customers own their home.

The appliances push, paired with the introduction of new home installation services, is targeted at swiping business from ailing competitor Sears.

The retailer is also reducing its emphasis on women’s apparel previously geared toward business outfits and formal wear. Instead, the company is adding athletic and leisure wear, widening the availability of Nike and Adidas items and introducing more plus-size clothes. And the company will shift all of its women’s shoe departments toward “open-sell” environments, reducing the need for sales workers to have to hunt through back rooms to find them the right pair.

Ellison told investors that the company would “pivot our retail strategy toward non-apparel.”

That includes a plan to “significantly expand” toy sales after encouraging results from toy sales in a limited number of stores during the holiday season, Ellison said.

Despite the moves, Penney’s projected that sales at stores open at least a year would to relatively stagnant overall — from a 1% decline to a 1% increase.

That projection “reduces conviction” in the company’s long-term strategy after a previous projection of 3% annual growth through 2019, UBS analyst Michael Binetti said in a note to investors.

“They are moving to match consumer shopping preferences, which should spark opportunity,” Greg Portell, lead partner in the retail practice of consultancy A.T. Kearney, said in an email. “But the challenge will be to execute new merchandising and marketing strategies.”

Penney expects to save $200 million in annual costs in connection with the store-closure plan, including the shuttering of two distribution centers. It will record an initial pre-tax charge of $225 million to cover the initial closure costs.

In a related move, the retailer said it would offer a “voluntary early retirement program” to about 6,000 workers, including corporate, store and supply chain workers.

Ellison said many workers affected by store closures would be hired to fill jobs vacated by employees who accept buyouts.

More on store closings:

Penney said Friday that sales at stores open at least a year fell 0.7% in the fiscal fourth quarter, which included the crucial holiday shopping season. Overall, net sales were down 0.9% to $3.96 billion, while the company swung from a loss of $131 million to net income of $192 million.

But the company said that discounts dragged down profitability and warned that its women’s clothing business struggled.

The company’s stock fell 4.8% to $6.53 at 1:44 p.m.

“The department store concept is being put under severe pressure by multiple prevailing trends,” Portell said. “Other channels are simply better suited to drive those consumer promises.”

One possible route to improved profitability is charging more at some stores than others, called “regional pricing,” Chief Financial Officer Ed Record said. The company is testing variable pricing at about 60 locations.

“We know we have big opportunities around that,” Record said.

Despite the difficulties, Penney turned a full-year net profit for the first time since 2010, reflecting considerable progress after a brief period in which the company experimented with limiting discounts.

Encouraging signs included sales of home goods, Sephora beauty products, the salon division and fine jewelry. Penney also said it had “record” online sales during the holiday shopping season, without providing figures.

by Nathan Bomey