STORY HIGHLIGHTS

- Latest index score still among highest in a decade

- Owners particularly positive about future

- Over half say finding qualified employees is a challenge

WASHINGTON, D.C. — Small-business owners remain optimistic about their business situation, with the Wells Fargo/Gallup Small Business Index at +95 in the latest update conducted April 3-7. Although this is down marginally from the +100 recorded in February, the two measurements this year represent a strong increase over 2016 index scores and are at the highest level since the Great Recession. One year ago, the index was at +64.

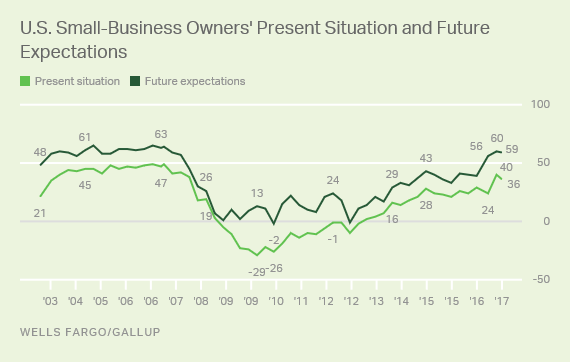

Small-business owners are asked to evaluate both their present business situation and their expectations for their business going forward. Owners remain more positive about the future than about their current circumstances, a sentiment which has generally prevailed historically.

Specifically, the future expectations score this quarter is +59, essentially unchanged from +60 in February, while the present situation score slipped by four points, from +40 to +36. Both scores are well above where they were a year ago.

Small-business owners are particularly positive about their finances, with 73% saying their current financial situation is “very good” or “somewhat good.” In addition, 46% say their business’ revenue increased “a little” or “a lot” over the past 12 months. And 63% say their cash flow has been very or somewhat good over the past 12 months. Credit access continues to be positive, with only 19% saying that credit was “somewhat difficult” or “very difficult” to obtain over the past 12 months. These measures are all more positive than they were a year ago.

Small-Business Hiring Is Up Compared With Last Year

As is typically the case, owners are more positive than negative about the future size of their workforce. Almost a third, 31%, say the number of jobs at their business will increase over the next 12 months, significantly more than the 6% who predict it will decrease. The last time owners were more likely to project shrinking rather than expanding the size of their workforce was the fourth quarter of 2012.

All owners are asked to evaluate five statements pertaining to the challenge of hiring new employees. More than half of those surveyed, 52%, agree that they have difficulty finding qualified people to apply for jobs at their business, making this the top challenge of those tested. At the other end of the spectrum, relatively few (19%) agree that being forced to choose among multiple qualified candidates is a problem.

Two other hiring challenges get higher levels of agreement than disagreement from owners: difficulty knowing how well an applicant will do once hired (43% agree) and applicants being either overqualified or underqualified for the position (32%).

| Agree | Neither agree nor disagree | Disagree | Don’t know | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You have difficulty finding good people to apply for jobs at your business | 52 | 20 | 16 | 12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You have difficulty knowing how well the applicants will do once they are hired | 43 | 28 | 17 | 12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Candidates who apply for jobs at your business are over- or underqualified for position | 32 | 33 | 20 | 15 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You do not have the time and resources to devote to finding the best candidates | 32 | 20 | 36 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You have difficulty deciding which of multiple qualified candidates to hire | 19 | 18 | 49 | 14 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Scale 1-5: Agree (1 or 2); Neither agree nor disagree (3); Disagree (4 or 5) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WELLS FARGO/GALLUP, APRIL 3-7, 2017 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Implications

Small-business owners have become sharply more positive about business conditions since the 2016 presidential election, and have generally maintained that increased confidence in the latest update of the Wells Fargo/Gallup Small Business Index. Previous Small Business Index surveys have shown that owners have become more upbeat because they feel the new administration will be better for small businesses, and in particular will help in the areas of taxes, healthcare and government regulation.

Although President Donald Trump at the time of this survey was unable to pass new legislation dealing with taxes or healthcare, he did issue executive orders calling for a decrease in federal regulations. Additionally, his broad tax plan proposal issued last week included the promise of significantly lower taxes on small businesses, helping justify — at least theoretically — some of small-business owners’ renewed optimism after his election.

by Coleen McMurray and Frank Newport