Historically the big leaps of the past were media reach optimization (BBDO and Y&R, 1962), passive peoplemeters (myself, 1964), ADI/DMA (myself, 1965), POS (Point Of Sale) scanners (many pioneers in the 1980s), Marketing Mix Modeling or MMM (Ed Dittus, MMA, 1989, presaged by Herb Krugman, 1958, Grand Scale Analysis), set top box (Next Century Media, 1997) and other Big Data, linking same to purchase (TRA, 2005).

These leaps gave us many tangible strides forward, often adding links between ads and sales. Media optimization improved reach of target by about +15% on average. Passive peoplemeters — still not being used for TV currency in the U.S. — are currency for radio in the U.S. and for either or both in other markets. ADI/DMA made it possible to compare sales and advertising geographically; its progenitors before me included Roger Cooper, Gus Priemer and Bob Coen. Scanners made the measurement of promotion accurate, revealing an average 80% of promotions produce net loss (IRI; which finding hasn’t changed advertiser-heavy usage of promotion). Scanners and their brilliant use by BehaviorScan, ScanAmerica et al also gave John Philip Jones and Erwin Ephron the findings they needed to create recency theory (which is still not being activated enough). BehaviorScan also got ARF into studying How Advertising Works (HAW) in their first Adworks studies (in the 1990s); HAW has been brought back and is providing multiplication of the indispensable value of ARF. Big Data and Purchaser Targeting (average +28% ROI lift, TRA) have brought the valuable toolsets of direct marketing to brand advertising.

So what’s the next Big Leap? There are two; one is big, the other enormous, and they both have substantive effects on ROI lift. The one that Turner, Fox and Viacom are doing now via Open AP is to whitelist the shows allowed in rotations for a specific brand. This is important because rotations can reduce the ROI lift of purchaser targeting to as little as +4%, whereas with program specificity, ROI lift caused by purchaser targeting has gone over +200%. Whitelisting shows within rotations allows most of the ROI lift value to come through.

All of the historical accomplishments noted above have had their impacts on media planning/buying, but no impact on creative, which is 65% of ROI. The next Big Leap includes the creative in optimization. How can anyone do that? It involves the general principle of being able to code four things based on psychological variables:

- Individuals and households

- Rollups of the latter into category/brand buyers, etc.

- Ads

- Environments into which ads can be placed

In what is probably the largest and most ambitious psychographic study that has ever been attempted, Simmons Research in January conducted >3000 intab re-interviews of its 2017 national probability sample. These re-interviews measured hundreds more psychographics in addition to the nearly 600 already in the main Simmons questionnaire. Those in the Simmons regular questionnaire tend to be specific to verticals and those added are a compendium of the most promising and validated scientific instruments in the world of psychology today. Simmons at the ARF in March began sharing findings which for the first time “qualitatively quantify” the ineffable creation and environment variables. At the same time the findings shown drill more holistically into the psychological differences among human beings than has ever before been activated in marketing or any other field.

What truly distinguishes this effort is that every psychographic variable is being validated based on the degree to which it is predictive of brand usage for the top 8000 brands in America, all of which are measured by Simmons.

RMT’s DriverTagsTM are among these ~1500 psychographic variables being validated against brand choice. The DriverTagsTM, validated against ROI, series renewals and ratings, are also showing high predictivity of the psychographic battery as well. This is good because DriverTagsTM are the empirically derived breakthrough which enables psychological coding of ads and programs in ways that are predictive of the outcomes marketers want. It also means that set-top box data can be used to predict everything else using DriverTagsTM as fusion hooks, since they predict the psychographics which predict the behaviors and the demographics. This turns fusion usefully on its head, since today fusion starts from geodemographics which have the least predictivity of all the other variables in the game. This opens the door to the possibility of far better fusion in the future and greatly increased value of set-top box and other such data.

Simmons envisions a four-step process for advertisers and their agencies to follow in order to extract maximum value from this work and to maximize brand ROI and long-term brand equity:

- Study market structure and brand usage trends, informed by purchase data and psychographic segmentology

- Select the target audience for the next campaign based on these factors plus what the competition is doing; simultaneously decide on the approximate messaging

- Produce the creative brief for the campaign

- Media selection including targeting not only current targets (proven to lift ROI +28% by TRA) but people with their same psychographics/DriverTagsTM and maximizing resonance between ads and programs, which has been proven to lift ROI +36% by ARF/Turner/Nielsen Catalina/RMT.

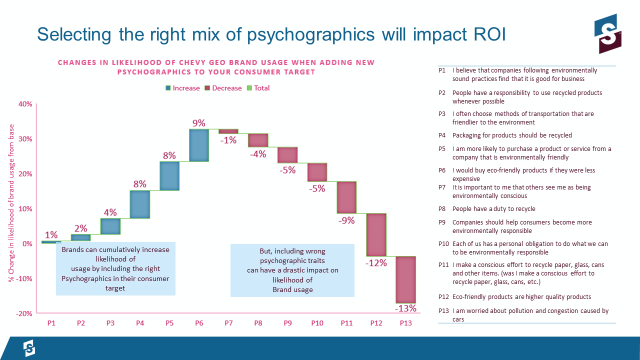

Consider for example the following slide presented by Simmons at the March ARF:

This type of analysis would be a part of the first step in that four-step process, studying the segments and deciding which ones to focus on, why, and what must then logically be conveyed in the creative based on the needs and wants of those segments. This brand of car ought to convey the ideas shown in blue and not convey those in red, because the people who describe themselves according to the blue attitudes are the ones who have in the past wound up buying that brand, while those of the red attitudes have tended to buy competitors.

BY BILL HARVEY

Source: MediaVillage.com, May 2017