A survey of emerging young adults finds that the next generation of consumers is more likely to use digital payment platforms and is even more focused on instant gratification than the millennials who preceded them.

The survey by Forrester and American Express compared attitudes and behaviors of millennials, identified by the study as those age 23-37, and Gen Z shoppers, those 16-22.

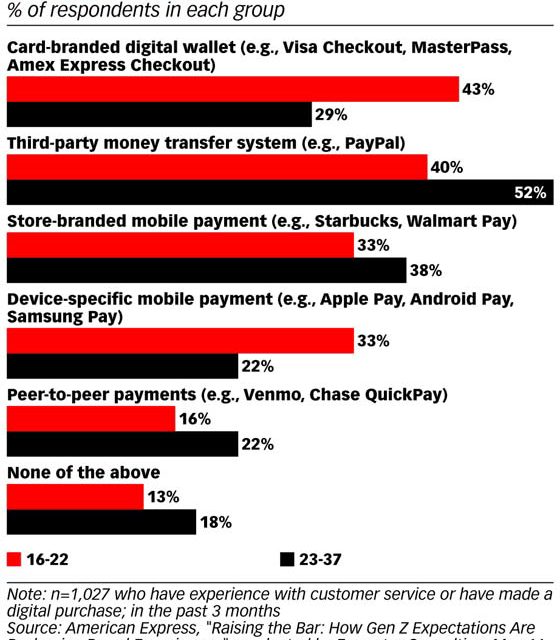

The younger shoppers were overall more likely to use digital and mobile payment platforms. Although third-party money transfers like PayPal were more commonly used among the older group, the younger demographic was considerably more likely to have used card-branded wallets such as Visa Checkout and device-specific mobile payment platforms such as Apple Pay.

When asked what kinds of services would be likely to win their loyalty, both the younger and older shoppers signaled that they wanted speed (same-day delivery) and frictionless transactions (mobile self-checkouts.)

But the younger respondents were considerably more interested in one-hour delivery via drone. This might be a sign of increased impatience or, maybe, simply a desire for novelty. Either way, the younger group signaled much more interest.

A recent study from RetailMeNot shows retailers will have an increased focus on mobile and social marketing channels in 2017. Additionally, more than half will change their advertising approach for the back-to-school season.

The younger group was also notably more interested in options like voice-assisted purchasing, social/chat commerce, and wearable-enabled commerce.

Gen Z shoppers use their phones in store more than older consumers

The data underscores findings in other studies that show the new generation’s proclivity for in-store phone usage. A February 2017 survey of US smartphone users conducted by Euclid Analytics found that respondents ages 16 to 21 use their smartphones while in-store more than the average consumer. And the study found that they overindex for most smartphone shopping-related activities compared with smartphone users in general.

by Monica Melton