Was it merely the cold, wet weather? U.S. brokerage sales continued to be weaker this spring as 3,088 boats were sold in May, 6 percent fewer than in the same month last year.

Sales also were lower than the previous year in March and April, according to reports by YachtWorld member brokers in SoldBoats, their proprietary database.

The lower sales were reported mainly in the three smaller-boat market segments, which historically have been most affected by the weather. The two highest-volume segments, boats under 26 feet and boats from 26 to 35 feet, were off by 7 and 10 percent, respectively, accounting for most of the monthly decrease.

Brokers’ reports of average prices and total value of sales told a different story, with an overall increase to $472 million (from $405 million last year) changing hands in May.

Sales of yachts 80 feet and larger were a major factor in the increase. Eighteen were sold for $136 million, up from 13 sold for $70 million a year earlier.

But increasing average prices tell an important story of market strength; prices rose in four of five market segments below 80 feet despite the lower sales volumes.

In fact, the only price decline was among boats from 46 to 55 feet. In that segment the sales volume increased 3 percent and the value of the boats sold increased 2 percent, leading to a 1 percent decline in the average price.

Although the weather is easy to blame, other factors cause sales variations from year to year, and this month we studied one of them — the age of boats on the market as reflected by the age of boats reported sold.

Two years ago we reported on the age of brokerage powerboats sold during a 12-month period, and at the end of the first quarter this year we ran the same report.

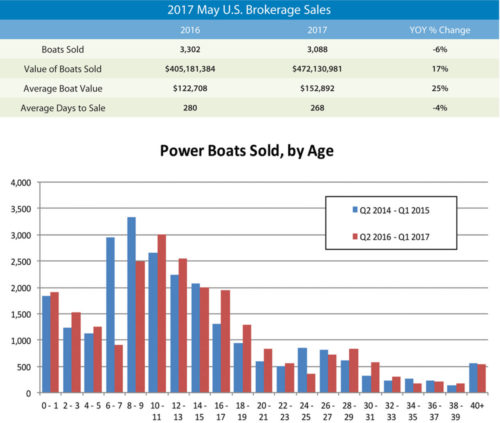

The blue bars on the accompanying chart describe powerboat sales volume during the 12 months from the second quarter of 2014 through the first quarter of 2015. The red bars represent sales during the recent 12 months, from the second quarter last year through the first quarter of this year.

The results demonstrate the continuing impact of the Great Recession of 2008-09. When the recession began there was a glut of new boats on the market and few buyers, so production levels were slashed and few new boats were built and sold.

Fast forward seven years, and it’s no surprise that not many boats six to seven years old were sold during the last 12 months. Given that many buyers look for boats precisely this age, it’s clear that this is a drag on what might otherwise be a stronger market.

The chart shows the drop in the number of boats sold that were six to nine years old. It also shows modest increases in sales of boats five years old and younger, and larger increases in sales of boats 10 to 20 years old.

The latter group represents the large number of boats built from roughly 2000 until 2008. In the years ahead, even as more post-recession boats become available for sale, this much larger group of older boats seems destined to be a dominant facet of the market.

The appeal of well-maintained, updated and repowered vessels of this age, versus those in an original, noticeably aging configuration, will play a significant role in what boats sell easily and for a good price.

Written by John Burnham, YachtWorld.com