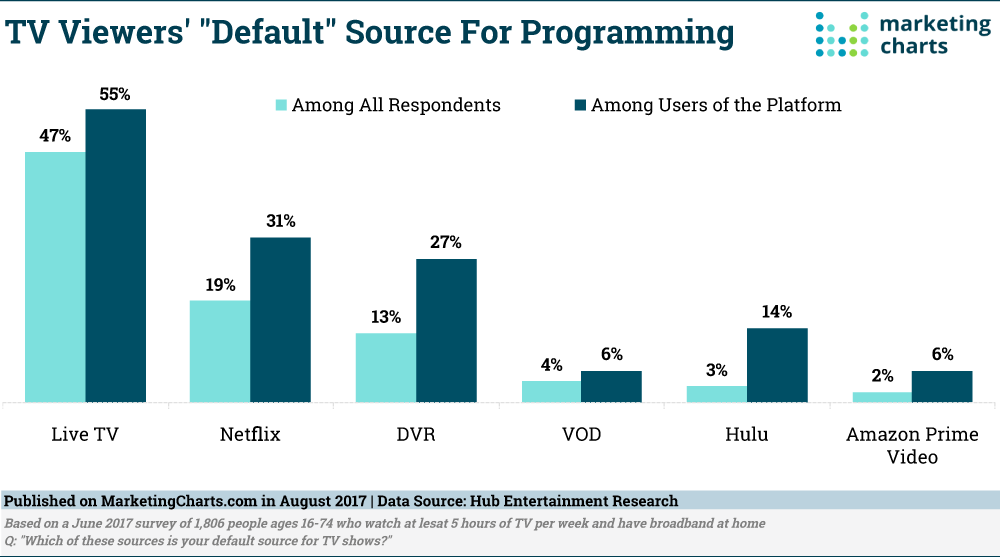

What do do people turn to first when they want to watch a TV show? Turns out it’s still live TV for almost half of TV viewers, according to a recent Hub Entertainment Research study. Even so, about 1 in 4 turn to a subscription video-on-demand service (SVOD), including 1 in 5 who say their “default” source of TV programming is Netflix.

Predictably, the default use of Netflix is higher among Netflix users themselves, almost one-third (31%) of whom say they turn to the platform first when they want to watch something. That figure jumps to 50% among Netflix users ages 16-24 (admittedly a small sample size).

While this isn’t necessarily reflective of Netflix’s investments in original programming, it does suggest that those efforts are paying off. In fact, one-third of subscribers now say they watch Netflix’s original content most often.

Notably, Netflix users are more likely to claim it as their default source than Hulu or Amazon Prime users. That’s an interesting finding: while research has shown that OTT households spend more time with Netflix than any other SVOD, Hulu actually tops Netflix in terms of engagement.

In tandem, the findings suggest that while Hulu viewers are committed to the platform, it might not be their default source of programming.

Which Platform Survives the Rest?

The Hub Entertainment Research study also pits the various services against each other in another way, by asking respondents which service they would keep if they could only keep one.

Live TV and Netflix emerge neck and neck on this one: 36% of live TV viewers would keep that service, while 33% of Netflix subscribers would choose the SVOD platform.

Among 18-34-year-olds, though, Netflix would be harder to let go than live TV. That brings to mind a recent study from the Solutions Research Group (SRG), in which 18-34-year-olds named Netflix their #1 must-keep TV brand, as well as research from TDG, which found 18-34-year-olds more likely to choose an SVOD than pay-TV subscription if forced to make the choice.

Proving the power of gaining “default” source status, the Hub Entertainment Research study reveals that 63% of those who default to Netflix would keep it over all other TV sources, compared to 19% of subscribers who don’t use it as their default source of programming.

2 in 3 Pay-TV Subscribers Use SVOD

The survey – which was fielded among 1,806 people aged 16-74 who watch at least 5 hours of TV a week – discovered that 53% of those with a pay-TV subscription have a DVR. But that’s outpaced by the 65% of pay-TV subscribers who use Netflix, Amazon or Hulu. (Separate data suggests that more TV households have Netflix than DVR.)

Among viewers with a pay-TV subscription, this year 38% use at least two of the three major SVOD platforms, up from 25% last year.

Overall, 14% of the survey’s respondents use all three services, up from 6% last year. That aligns with multiple pieces of research indicating that more people are subscribing to multiple SVOD platforms.

For now, live TV remains the default source for most, but it will be interesting to see how that changes as SVOD penetration grows and Netflix spends more on original content.

About the Data: The Hub Entertainment Research survey was fielded in June 2017 among viewers with broadband at home.