This story was delivered to BI Intelligence “Digital Media Briefing” subscribers. To learn more and subscribe, please click here.

Microsoft-owned LinkedIn has launched an ad network to let advertisers target users elsewhere online, including in Microsoft Outlook. The ad network, LinkedIn Audience Network, allows it to better compete for digital ad dollars alongside incumbents Google and Facebook, Ad Age reports. The move to serve ads in Microsoft Outlook’s users’ inboxes is a part of the push of this new ad network, Adweek reports.

LinkedIn Audience Network is currently limited to sponsored posts but could include other formats in the future. It operates similarly to Facebook Audience Network and will cover tens of thousands of apps and sites globally. The new offering is focused on native and mobile ad formats. LinkedIn previously operated an ad network in 2015 but closed it down to focus on sponsored content within its own ecosystem. Outlook users may now start to see LinkedIn sponsored content ads in their inboxes. But unlike Google, which serves text ads within Gmail, LinkedIn’s ads will include images.

Advertising has been a relatively small portion of LinkedIn’s overall revenue. In Q3 2016, when LinkedIn’s last reported earnings before being acquired by Microsoft, Marketing Solutions — its advertising unit — generated $175 million, or 18% of its total $960 million in revenue. In comparison, Talent Solutions, which is its recruitment business, generated $623 million in revenue, which was 65% of its total revenue. This could indicate that LinkedIn’s advertising business has room for growth, which LinkedIn Audience Network and serving Outlook users ads are likely to boost.

The broad advertising push by LinkedIn is overall beneficial to its ambitions as an advertising business:

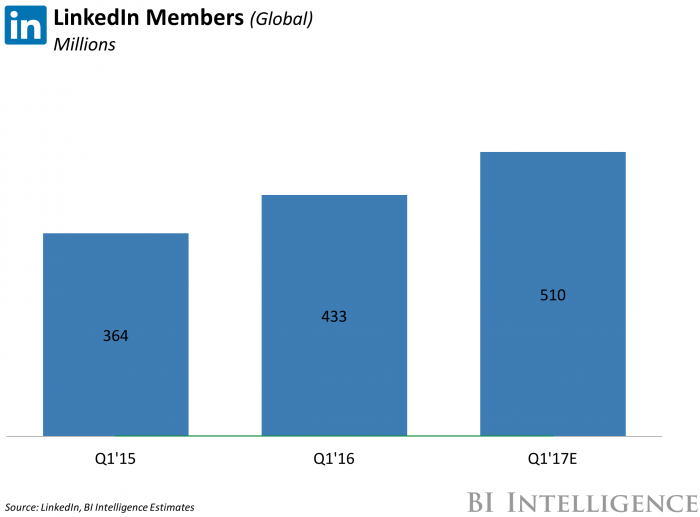

- The new ad network gives marketers more chances to reach audiences using LinkedIn data. And the network will result in will boost engagement with ads that are served, LinkedIn Marketing Solutions group product manager Divye Raj Khilnani said, per AdWeek. This is likely due to the fact that not all of LinkedIn’s more than 500 million users will come to the platform during the course of an advertiser’s campaign.

- Advertisers have already seen success with LinkedIn Audience Network. The ad network has been tested by over 6,000 advertisers since the beginning of 2017, which have resulted in an 80% increase in unique clicks, a 3% to 13% increase in impressions served, and some saw up to four times higher engagement for ads served via LinkedIn, versus those not.

- Outlook has a sizable user base, heightening the chances served ads will be seen. Outlook now counts more than 400 million active users, which gives marketers ample opportunity to reach potential customers through targeted campaigns.

- Microsoft isn’t the only company looking to monetize a platform where conversations occur, which is essentially what Microsoft Outlook and its update represent. WhatsApp will begin charging businesses for tools that let them answer customers’ questions.

- LinkedIn is home to high-income users, which makes the audience segment valuable to advertisers. Forty-five percent of US adult internet users with higher than an annual income of $75,000 are LinkedIn users, which makes it more popular among this demographic than Twitter (30%), Instagram (31%), and Pinterest (35%). LinkedIn Audience Network provides a valuable opportunity for advertisers to target a demographic which is in a good position to spend.

Social networks are here to stay, and they’re constantly evolving. Globally, more than 2.8 billion people — or 37% of the world’s population — use social media, but the way those users interact with each other, and the platforms they adopt, vary widely.

Kevin Gallagher, research analyst for BI Intelligence, Business Insider’s premium research service, has put together a report on social media demographics that highlights the key audience demographics for six major social platforms: Facebook, Instagram, Snapchat, Twitter, LinkedIn, and Pinterest. It also:

- Breaks down the reach of social platform audiences in terms of age, income, education, and gender.

- Examines how time spent and monthly users across major age brackets have changed in the past three years.

- Explores the preferences of US teens and young millennials, and how they’re changing.

- Identifies the most important demographic changes that advertisers should monitor as social platforms continue to grow.

by Kevin Tran

Source: Business Insider, September 2017