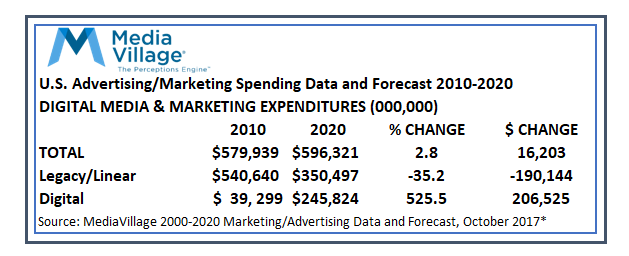

Total marketing communications investments have remained flat since 2010 and are projected to increase only 2.8% from $580 billion in 2010 to a projected $596 billion in 2020. When factoring inflation, the real dollars invested by marketers in the U.S. marketing and media economy has declined precipitously. A new analysis by MediaVillage, which has been tracking media and marketing expenditures since 1988, reflects the value of digital for replacing the steady declines in legacy media and marketing expenditures. However, we also conclude that the fragmentation and commoditization of marketing and media, the effectiveness of search and social advertising for achieving corporate below-the-line sales objectives, and the increased involvement of procurement officers in the marketing budgeting process has enabled marketers to reduce their corporate commitment to marketing. (Scroll down for more of Jack Myers’ commentary.)

Digital advertising/marketing expenditures increased 20% in 2017 to $157 billion, down from a 26% spending increase in 2016 vs. 2015. Total digital investments are projected to increase only an average of 15.0% annually in 2019 and 2020, according to Myers, which is forecasting a continuing slowdown in digital spending growth across all media and marketing sectors. 2017 digital media/marketing growth of 20% offsets overall 2017 declines in linear/legacy marketer expenditures of 6.2%, with only out-of-home/place-based media, cinema, broadcast syndication and branded content receiving increased investments from marketers for their legacy inventory. Myers forecasts that broadcast network linear expenditures will decline 2.2% in 2017 and grow 1.6% in 2018, while marketers’ investments in broadcast network digital inventory will increase 18% annually, bringing total broadcast network industry ad revenues into the black — to +0.3% this year and +4.0% next year.

MediaVillage is the only independent non-publicly traded media industry forecaster, with an unequaled record of accuracy. MediaVillage is the only economic analyst that covers and reports data on all 28 marketing communications categories, including ten “below-the-line” and 18 traditional “above-the-line” media advertising categories. Myers economic reports also exclusively separate legacy/linear and digital spending within each category.

MediaVillage’s full 2000-2020 Marketing/Advertising Expenditure Report is being issued later this month and is available to MediaVillage member companies.

BY JACK MYERS