KEY POINTS

Mastercard SpendingPulse reported that US holiday retail sales increased by 4.9% year over year, setting a new record for dollars spent. The firm’s holiday report details retail sales made from November 1 through December 24. Key findings of the report include:

- Online holiday retail sales increased by 18.1% compared with 2016.

- Home categories performed strongly over the holiday period, with sales of electronics and appliances increasing by 7.5% year over year and sales of home furniture and furnishings increasing by 5.1% year over year.

- Timing was a contributing factor to the healthy holiday retail season. Many consumers shopped early this year, in the first three weeks of November, and with Christmas falling on a Monday, they continued to shop throughout the weekend before Christmas. Saturday, December 23, was the season’s second-largest single day for retail sales.

Holiday Sales Rise 4.9% from 2016

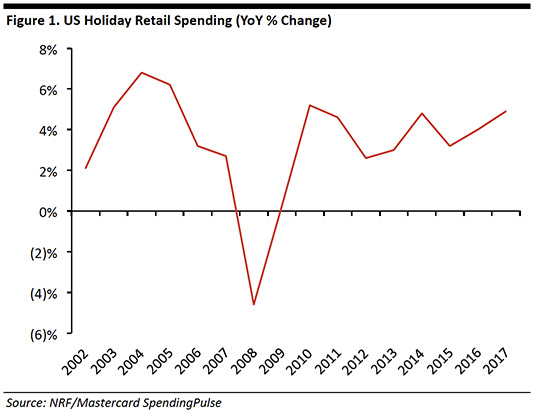

On December 27, Mastercard SpendingPulse released its holiday spending report, which covers US holiday retail sales from November 1 through December 24. The report details aggregate spending for all retail sales across all payment types. The firm reported that holiday sales this year increased by 4.9%, the biggest year-over-year increase since 2011, when sales rose by 6.8%. The growth rate beat the National Retail Federation’s (NRF’s) estimate of 3.6%–4% growth as well as FGRT’s estimate of 3%–4% growth. The graph below shows year-over-year holiday retail spending growth for 2000–2016, according to the NRF, and Mastercard SpendingPulse’s figure for 2017.

According to the Mastercard SpendingPulse report, online holiday retail sales increased by 18.1% compared with 2016. This is consistent with Adobe data, which indicated that Cyber Monday 2017 was the largest e-commerce day in history, with a record $6.59 billion in online sales, up by more than $1 billion from 2016.

Mastercard SpendingPulse also reported that specialty apparel and department stores experienced moderate sales growth gains over the holiday season. This is notable, given that the number of store closing announcements in 2017 was a record 6,985 (including nearly 600 department stores), up 229% from 2016.

Home Categories Are Growing

This holiday season, consumers were focused on the home. Sales of electronics and appliances increased by 7.5%, the strongest holiday growth the category has seen in the last 10 years. Additionally, home furniture and furnishings sales grew by 5.1%, as did home improvement sales. As millennials are now the largest group of homebuyers in the US, accounting for 34% of home purchases according to the National Association of Realtors, these holiday category sales may reflect a combination of a robust housing market and a large demographic starting to set up new homes.

Timing Critical to Retail Sales This Year

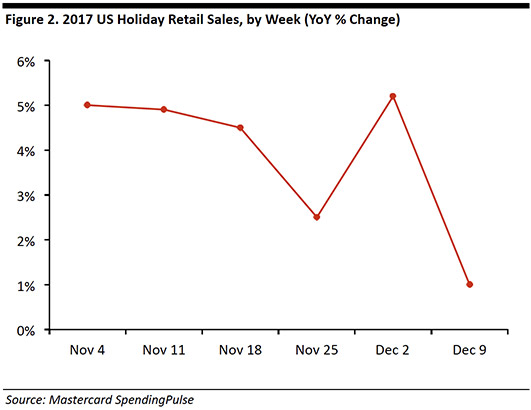

This year, timing played an important role in holiday retail sales. Consumers began spending very early in the season and continued to spend all the way through Christmas Eve. Mastercard SpendingPulse highlighted that retailers that invested in heavy early-season promotions benefited. The first three weeks of November saw significant jumps in retail sales, particularly in the electronics, home improvement and jewelry categories. The graph below shows holiday sales through mid-December.

With Christmas falling on a Monday this year, Saturday, December 23, ended up being the second-largest single sales day after Black Friday, according to Mastercard SpendingPulse. Consumers continued to spend both in stores and online throughout the pre-Christmas weekend, perhaps encouraged by the availability of last-minute shipping options. Mastercard SpendingPulse reported that jewelry sales grew by 5.9% year over year over the holiday period, boosted by last-minute purchases.