KEY POINTS

- US gas prices are seeing a double-digit increase year over year, threatening to pressure consumers’ disposable incomes.

- Traditionally, higher gas prices have prompted a weakening in discretionary retail sales growth. However, we have not seen this pattern in recent months.

- Consumer sentiment and retail sales have so far held up, as tax reforms and solid economic growth provide an otherwise-benign environment.

- We remain bullish on the prospects for US retail in 2018. We expect total retail sales excluding automobiles and gasoline to rise by around 4.4% to $3.6 trillion.

No Evidence of Higher Gas Prices Denting Spending

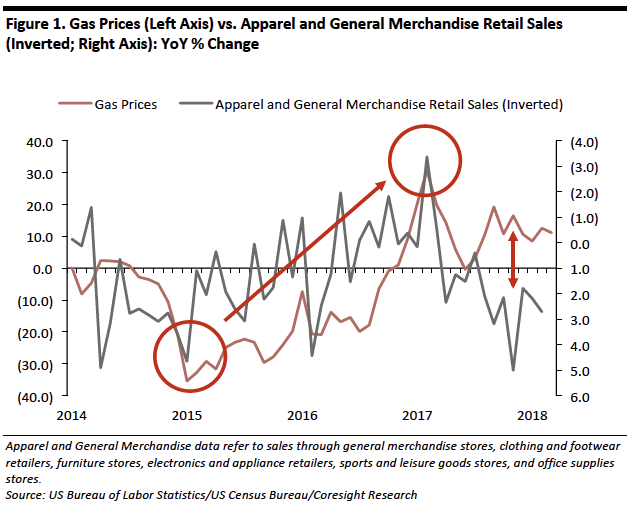

US gas prices are on the rise, increasing by 11.1% year over year in March (latest data).

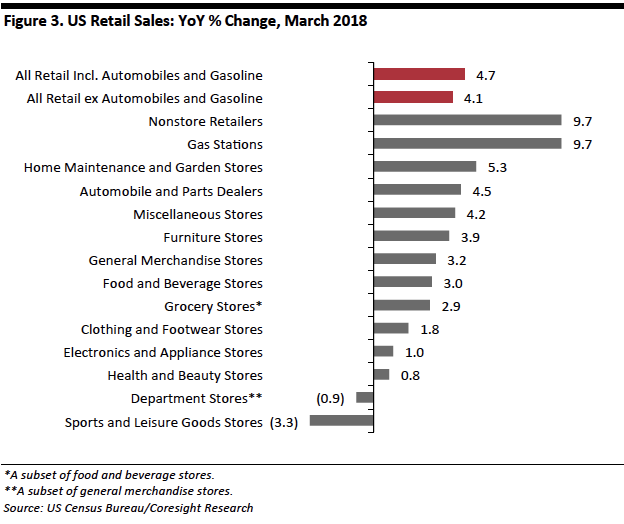

Traditionally, higher gas prices dented growth in discretionary retail sales. However, we are currently seeing a break in this correlation. In the graph below, we chart the year-over-year percentage increase in gasoline prices versus that for apparel and general merchandise retail sales, with the latter inverted to more clearly show any correlation.

- As gas-price deflation eased and inflation returned between early 2015 and early 2017, apparel and general merchandise retail sales growth softened and then turned negative. This negative growth in discretionary categories lasted until April 2017.

- The correlation is most evidently seen in the circled months of January 2015 and February 2017, when gas prices slumped and spiked, respectively.

- Unusually, recent months have seen a divergence from this trend: apparel and general merchandise sales growth has strengthened even in months when gas-price inflation has deepened.

- Gas prices jumped in September and November 2017, yet growth in retail sales of apparel and general merchandise spiked, too.

Nor is there evidence of higher gas prices denting consumer sentiment.

Benign Economic Environment Encourages Retail Growth

Although higher gas prices could take a further $27.5 billion from US consumers’ wallets this year, the otherwise-benign economic environment looks set to support discretionary spending and total retail sales:

- US consumers spent $274.8 billion on gasoline in 2017, up 11.8% year over year, per the US Bureau of Economic Analysis. In absolute terms, US consumers spent $29 billion more on gasoline in 2017 than they did in 2016.

- If we assume a 10% increase in spending this year, that adds a further $27.5 billion to Americans’ gas bills for 2018.

- Those extra costs are likely to pressure discretionary spending among some cash-strapped consumers, although the total remains minor relative to overall consumer spending.

- We estimate that total US consumer spending will reach $14.0 trillion this year, of which $1.4 trillion will be spent on discretionary goods categories.

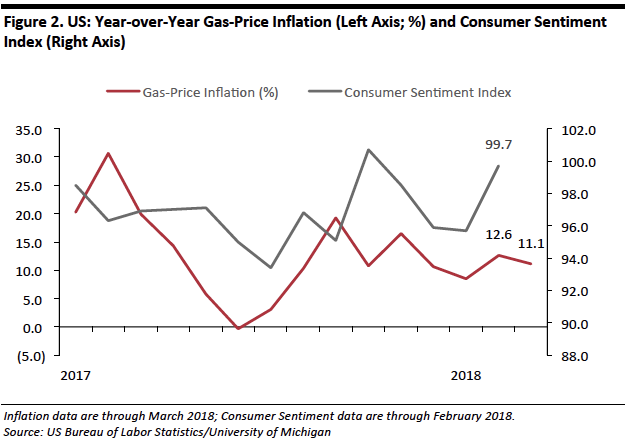

- We remain bullish on the prospects for US retail in 2018. We estimate that total retail sales excluding automobiles and gasoline will reach $3.6 trillion this year, up by around 4.4% year over year. Income tax changes, higher wages resulting from corporate tax changes and solid economic growth are supporting retail spending.

In March (latest data), year-over-year retail sales growth excluding automobiles and gasoline remained above 4.0%.