Retailers rely heavily on the shopping season that is just a few months away

The proposed new tariffs on Chinese imports haven’t been enacted yet, though Friday President Donald Trump threatened such a tax at “short notice.” Extra fees would have implications for prices on many consumer goods, but would tariffs impact holiday sales this year?

Larger retailers might not feel the effects immediately since many manufacturers have likely stocked up in anticipation, but smaller retailers unable to warehouse extra inventory could feel the squeeze sooner.

Retailers also aren’t likely to pass along price increases to the consumer during the holiday season, one of the most important annual shopping periods. We expect 2018 holiday ecommerce sales to grow 16.2% and take 23.5% share of the full year’s retail ecommerce sales.

Heading into 2019 will be a different story, though, as tariffs on products and raw materials for the top selling US ecommerce categories will take effect.

Consumer Electronics

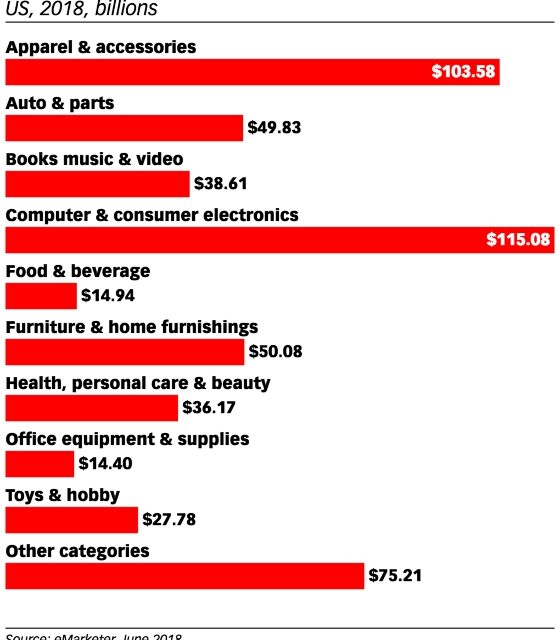

Computer and consumer electronics is the leading US retail ecommerce category with 2018 sales of $115.08 billion. The repercussions of tariffs for Apple are lower than some consumer electronics manufacturers, but for anyone who sells TVs, in particular, there could be trouble on the horizon.

Televisions, video projectors, clocks and watches are among the products subject to tariffs while raw materials such as computer chips that power PCs and smartphones, parts of printers and copy machines and TV parts were also included in the proposal. Brands like TCL, LG and Vizio would be most affected, which would ripple outward to retailers, especially Best Buy, one of the last remaining big box consumer electronics specialists.

A May 2018 joint study by the National Retail Federation (NRF) and the Consumer Technology Association (CTA) came to the conclusion that TVs imported from China could see price increases of 23% and all other imported TVs’ prices would increase by 4% if proposed tariffs were enacted.

Furniture and Home Furnishings

One way that adds value to a consumer’s shopping journey is authentic, tailored content. eMarketer has curated a Roundup of articles, insights and interviews to zero in on the trends affecting content marketing today—from creation and personalization to brand safety and more.

This ecommerce category—worth $50.08 billion in sales this year—could be the one of the first affected since it bears the brunt of a wide range of products that would be subject to tariffs: upholstery, porcelain, mirrors, air conditioners, refrigerators, vacuum cleaners, furniture, bedding, lamps and cutlery.

Pureplay online retailers like Wayfair and Overstock, which rely greatly on furniture sales and source many products from China, won’t escape unscathed. It’s estimated that 30% to 70% of US home furnishings retailers source their materials from China.

Apparel and Accessories

Apparel, the second-largest category in ecommerce sales, will see tariffs on products from rain jackets to fur clothing to wool hats. But tariffs on leather handbags and leather trunks and suitcases would be most detrimental.

Price increases would affect brands like Samsonite International, the world’s biggest luggage seller. Despite being based in the US, two-thirds of its products are made in China, which the company already pays a 25%+ tariff on. The company has been beefing up its ecommerce efforts with the purchase of eBags last year.

Ultimately, the approaching holiday season isn’t likely to experience blunted sales due to tariffs, but longer-term they could have large financial impact. In August 2018, NRF published an analysis of how tariffs would affect furniture and travel goods by looking at the estimated change in cost of Chinese production and a consequent increase in US production. Using a hypothetical 25% tariff, furniture would cost an extra $2.1 billion for consumers at a net loss of $1 billion to the US economy. For travel goods, prices would increase 9.9% and pass along an additional $1.2 billion to consumers.

by Krista Garcia