There’s Strength in Numbers and Boomers Hold the Spending Power

Remember Baby Boomers? Roughly ten years ago, it was essential for marketers to acknowledge how powerful a demographic Baby Boomers are. As noted by Pew Research, “Baby Boomers have always had an outsize presence compared with other generations. They peaked at 78.8 million in 1999 and have remained the largest living adult generation.” And while that situation is about to change (Millennials have nearly overtaken Boomers in terms of sheer numbers), the political, social and cultural influence of Baby Boomers on modern culture remains in place. And then there’s the not so subtle fact that they are wealthy beyond all other generations: current estimates are that Boomers are preparing to transfer as much as $30 trillion of wealth to Generation X and Millennials.

Today, with all the attention skewing toward younger generations, we thought we’d take a moment to highlight some food and beverage habits and beliefs relating to Boomers and in the process showcase some opportunities that marketers, restaurant operators and retailers might want to consider lest they forget this still important demographic.

From a macro perspective, for example, it’s Boomers who have driven the fresh, less processed movement in foods and beverages. It was Boomers who catalyzed the shift in food culture from predictable to diverse tastes and gave rise to the popularity of organics. Boomers were pioneers in the practice of seeking (and expecting) meaningful experiences in food consumption. They are notable in that they are the first aging demographic to approach food in a way that views quality as the key to living a better life for longer.

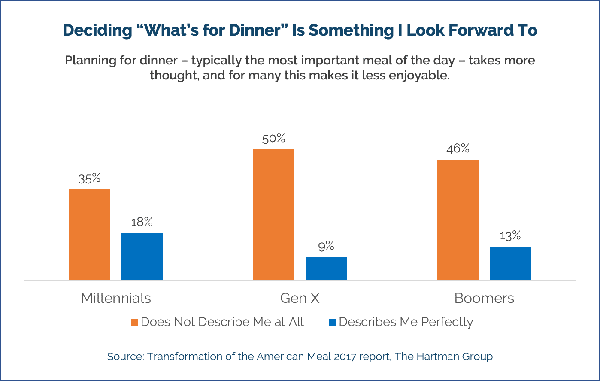

As aging consumers and empty nesters, our recent research on eating and cooking behavior finds that Boomers are quite traditional in the way they approach meals, such as dinner. They are, for instance, far more likely to say they have Sunday dinners than Millennials. And yet, planning for dinner — typically the most important meal of the day for all consumers — takes more thought, and for many this makes it less enjoyable, particularly for Boomers.

In our Transformation of the American Meal 2017 report, when asked if “deciding what’s for dinner” was something they look forward to and is an apt way to describe them, 46% of Boomer respondents noted that it didn’t describe them at all.

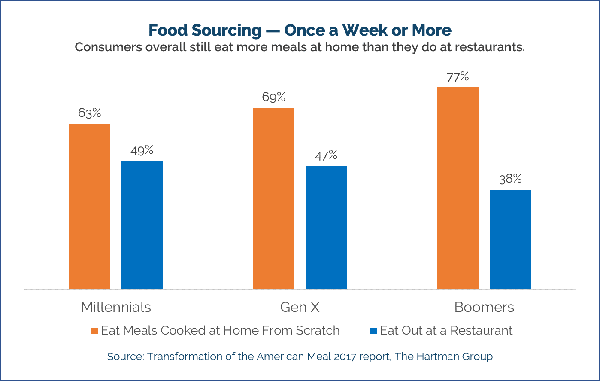

For consumers of all ages, there are several knocks against successfully pulling off dinner as an ideal home-cooked meal. In addition to the matter of coordinating schedules, assigning duties and selecting/sourcing ingredients, dinner also has the largest set of options when it comes to what to eat, and even though they are increasingly retiring, Boomers aren’t necessarily going out to eat — they’re cooking from scratch at home.

The takeaway from examining this aspect of Boomers’ eating and cooking behavior shows that while true for all consumers, opportunity space exists for helping make the dinner-planning process more enjoyable. This is especially true for Boomers and underscores the notion that despite their appreciation for “familiar” tastes (they routinely score higher on this attribute than other generations), manufacturers and food retailers have considerable opportunity to market to a demographic that enjoys cooking but seems to not like the dinner-planning process.

We know that one aspect of aging is that appetites and energy often decline, and the physicality of cooking and cleanup can become limiting — highlighting how much help Boomers might like in meal planning and preparation.

For restaurant operators, enticing Boomers away from their home cooking might require further understandings of how portions, entrees, side dishes and daypart occasions (like Sunday dinner) play into promotions and menu planning.

Our report finds that dinner is the main focus of meal planning today. The value attached to dinner, especially by Boomers, suggests significant capacity for trying new solutions that deliver on specific dinner priorities, such as social connection, pleasing all palates, or health and wellness.

Solving for consumers’ common desire for meals that are both healthy and delicious is likely the best starting point, especially if they can successfully bridge the gap between consumers’ healthy ideals and indulgent desires. Meal kits often do this for those who have tried them, but resistance to the subscription model means opportunity for retailers to successfully piggyback on this idea.

Boomers are forever in search of ever more expressive brands that communicate their belief system. Moreover, Boomers exhibit a strong desire to be seen as something more than a generational cohort or, worse yet, as “old people.” Marketers should understand that Boomers want to be marketed to both for their uniqueness as individuals and as a generation that sought to make a difference.