Price is one of the most important factors to shoppers, so it’s paramount that retailers get it right.

While some may think there is an art to pricing, it’s one of the most data-driven aspects of retailing, online and offline. Price optimization is also directly tied to a company’s margins. In an October 2018 study by RIS, retailers in the US said that getting pricing strategy right and executing at a high level is extremely important to financial performance, rating it a 9.2 on a 10-point scale.

The biggest challenges are responding to competitive prices (45%) and changes with the marketplace, shoppers and competitors (42%). Keeping up with competitor’s prices is one of retailers’ greatest operational pressures, so it makes sense that, according to RIS, the most popular pricing strategy is indexing prices to specific competitors (34%).

A majority of retailers (55%) use a mix of pricing software and spreadsheets while 42% rely solely on spreadsheets. Old habits die hard, which was reinforced by respondents rating artificial intelligence (AI) only a 3.9 in importance. Most did not fully understand how emerging tech like AI fits in, even though dynamic pricing isn’t a new concept in retail merchandising.

Retailers believe this tech could help them implement dynamic pricing to compete with Amazon and Walmart (47%) and provide shoppers with fair prices, as well as healthy margins for themselves (45%).

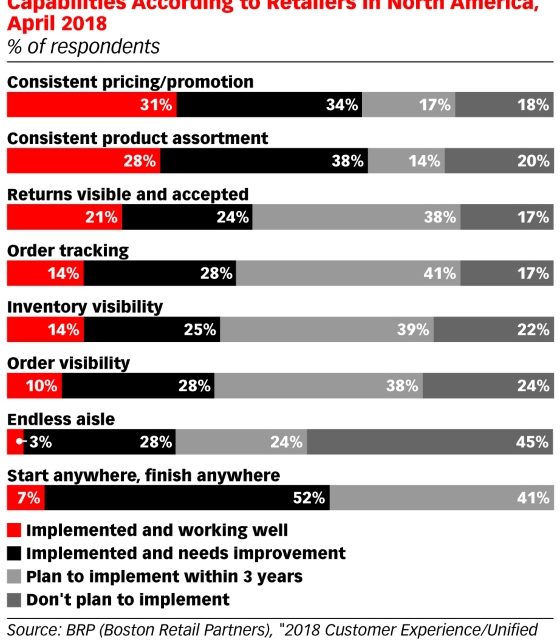

However they implement consistent pricing, it was the omnichannel capability that retailers in North America had most deployed and were satisfied with (31%), according to an April 2018 survey conducted by Boston Retail Partners (BRP). An additional 34% of respondents said they had implemented it, but it was still a work in progress.

The retailers in the RIS study were also on top of pricing optimization. More than one-third (35%) of US retailers said their pricing software was up-to-date and an additional 11% were in the midst of upgrading. Fewer than one-quarter (22%) of respondents had no plans to upgrade, similar to the 18% in the BRP survey.

Consumers were only referred to tangentially in this study, though retailers acknowledged that shoppers wanted fair prices. Dynamic pricing has a mixed reputation among shoppers, especially when they can see prices fluctuating day to day for seemingly no good reason. Shoppers are more receptive to non-static pricing when price changes don’t feel arbitrary or are based on personal shopping habits.

by Krista Garcia