BY FRANK NEWPORT AND COLEEN MCMURRAY

STORY HIGHLIGHTS

- Small-business owners’ optimism is very strong, hits high point in trend

- Owners cite hiring as a top challenge

- Cash flow and revenue are strong drivers of optimism

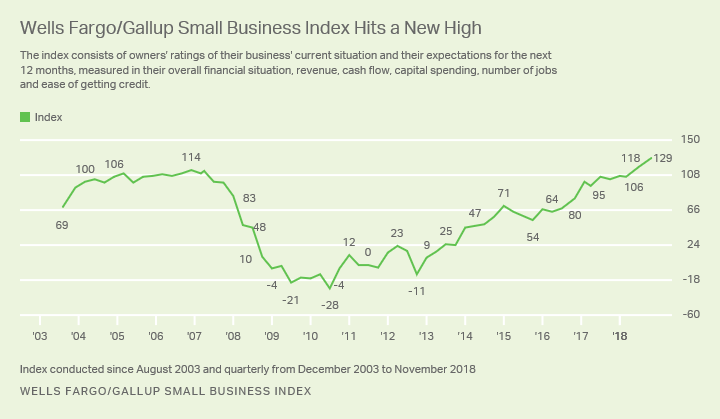

WASHINGTON, D.C. — U.S. small-business owners are more optimistic about business conditions now than at any point in the 15-year history of the Wells Fargo/Gallup Small Business Index. In the latest quarterly survey, which measures small-business owners’ attitudes about a wide variety of factors affecting their business, the overall index score is +129. This is up from the prior record high of +118 established last quarter. Confidence among small-business owners has improved steadily in 2018, and now sits well above the pre-2018 high of +114 from 2006. The current survey was fielded Nov. 8-14, just after the midterm elections.

The Wells Fargo/Gallup Small Business Index, which has generally trended upward since 2013, is currently at an all-time high. The latest jump in the overall index score is based on upticks in most of the areas that compose the score. The biggest improvements are seen in owners’ assessments of their current situation:

- Eighty percent of small-business owners rate their company’s financial situation as very or somewhat good, the highest in index history.

- A record-high 55% of business owners report increases in revenue over the past 12 months, up from 49% last quarter.

- Seventy-four percent of owners rate their company’s cash flow as very or somewhat good, up from 69% the previous quarter — another record high.

Small-business owners were also asked about their projections for 2019, and the responses suggest a modestly optimistic outlook. Thirty-three percent of owners say they are more optimistic about their business’ future going into 2019 than they were going into 2018, while 16% say they are less optimistic. The majority (51%) say their outlook is about the same going into next year.

The Newly Elected Congress and Small-Business Owners’ Outlook for 2019

While most small-business owners are either positive or neutral about their outlook for 2019 compared with their optimism going into 2018, they are more divided in their views of what the newly elected Congress will mean for their business in the new year. About half of owners (49%) say the actions of the new Congress will have no effect on their business either way, while about as many say these actions will make their company worse off (24%) as say they will make it better (21%).

Small-business owners were also asked to name the most important issue they would like the new Congress to focus on in 2019. Owners are clearly most concerned about taxes, with 29% naming this issue. Two other issues were named by more than 10% of owners — healthcare (12%) and government regulations (11%).

| Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxes | 29 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Healthcare | 12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government regulations/stability/government reform | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Small business focus | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Immigration | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Economy | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government unity | 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| National debt/spending | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Truth/honesty/leadership/impeachment of Trump | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| City infrastructure/education/housing | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jobs/employment/job training | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial stability/sustainability | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| National security/terrorism | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Minimum wage | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trade (import and export) | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global climate changes | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Welfare/socialism | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agriculture/supporting the farmers | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Don’t know/refused | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WELLS FARGO/GALLUP SMALL BUSINESS INDEX, Q4 2018 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Small-business owners were also asked to rate the importance of Congress taking action on a range of issues. The same three issues that topped the open-ended responses are rated as most important in this list: taxes, government regulations and healthcare.

Owners attach the least importance to congressional actions on infrastructure, immigration and increasing the minimum wage.

| Extremely/Very important | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actions relating to changes in the tax code, tax regulations and tax rates for small businesses | 74 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Overall action on government regulations impacting small-business owners | 61 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actions relating to healthcare and the current healthcare law | 60 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actions relating to trade laws and regulations that could affect small businesses | 50 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actions that could impact oil prices or energy costs | 48 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actions relating to terrorism and national security | 42 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actions relating to the SBA or Small Business Administration | 40 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actions on trade agreements with other nations | 40 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actions relating to immigration | 38 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actions on increasing the minimum wage | 37 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actions relating to federal spending on infrastructure, such as roads and bridges | 36 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WELLS FARGO/GALLUP SMALL BUSINESS INDEX, Q4 2018 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finding Qualified Workers Presents Challenge for Small-Business Owners

The Wells Fargo/Gallup Small Business Index includes an open-ended question asking owners to name the most important challenge facing their business. In the current update, owners remain most likely to say that hiring — finding and retaining qualified workers — is their greatest challenge, with 18% again citing this as their top concern. Hiring emerged as small-business owners’ top concern in the second quarter of 2018 and has subsequently remained in that spot. Other frequently mentioned challenges today include finding and attracting customers, taxes, government regulations, and maintaining cash flow.

Bottom Line

Small-business owners are very positive about their current operating environment, with high ratings on finances, cash flow and revenue driving their overall record optimism. A third of owners say they are more optimistic about the coming year than they were going into 2018, with the majority saying they are neither more nor less optimistic.

The newly elected Congress produces mixed reactions among owners. About half say it won’t affect their business either way, but slightly more believe it will have a negative rather than positive effect. Owners’ overall mandate to Congress points more to the tax situation than anything else, followed by their desire that Congress focus on government regulations and deal with healthcare costs.

As has been the case in recent quarters, the prosperity being felt by these owners has its downside; owners continue to say that being able to find, hire and retain qualified employees is their biggest challenge.

BY FRANK NEWPORT AND COLEEN MCMURRAY