Source: progressivegrocer.com, June 2019

The Food Marketing Institute (FMI) released the 45th edition of its annual “U.S. Grocery Shopper Trends,” a look at grocery shopper attitudes and behavior. The 2019 report, prepared by The Hartman Group, Inc., studies what consumers want from their retailers when personalizing their grocery shopping.

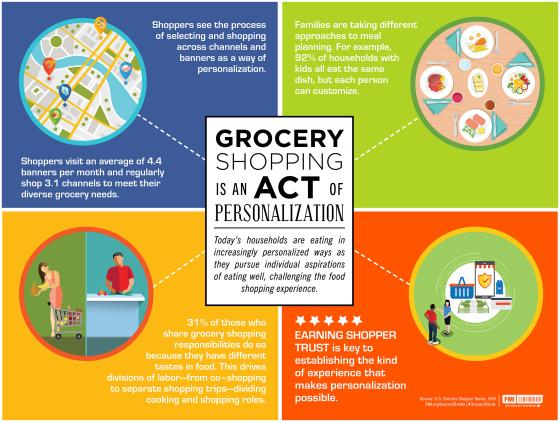

This infographic depicts how today’s households are eating in increasingly personalized ways as they pursue individual aspirations of eating well, challenging the food shopping experience

“One-third of households have at least one family member following a non-medically prescribed diet, and this rate is higher for younger generations,” said Leslie G. Sarasin, president and CEO of FMI. “In an effort to meet their idea of eating well, households are eating in increasingly personalized ways, challenging the food shopping experience.”

In order to achieve this personalized shopping, consumers visit an average of 4.4 banners per month and regularly shop 3.1 channels to meet their diverse grocery needs. They also expect their grocers to evolve with these needs, and be satisfied with their primary store’s ability to meet needs (8.7 out of 10).

When choosing a store, quality, freshness, low prices, cleanliness and product variety are the keys to retaining shopper loyalty. Convenience is driving younger consumers to shop online. Shoppers rank their online experience slightly better than those in physical stores when it comes to transparency, convenience and personalization, but online is not cannibalizing in-store visits—the 43 percent of consumers who shop online also average 1.7 trips a week to their physical stores, higher than the national average of 1.6 trips per week. These desires for both convenience and discovery also lead to shoppers experimenting with more personalized methods for collecting groceries, such as delivery or click-and-collect methods.

“Trends explores the current food retail marketplace and the influential roles health, well-being and technology play in the experience,” Sarasin said. “Food shopping is personal, and grocers help their shoppers navigate shifting needs, values, priorities and life pressures that require teamwork, negotiation and compromise at home.”

2019 Trends findings are based on ethnographic interviews and a quantitative online survey of 1,786 U.S. grocery shoppers fielded in 2019. For more information and to download the report, visit www.FMI.org/GroceryTrends.

FMI member companies operate nearly 33,000 retail food stores and 12,000 pharmacies. The trade organization has almost 500 associate member companies that provide products and services to the food retail industry.