By Rick Ducey

Source: blog.biakelsey.com, August 2020

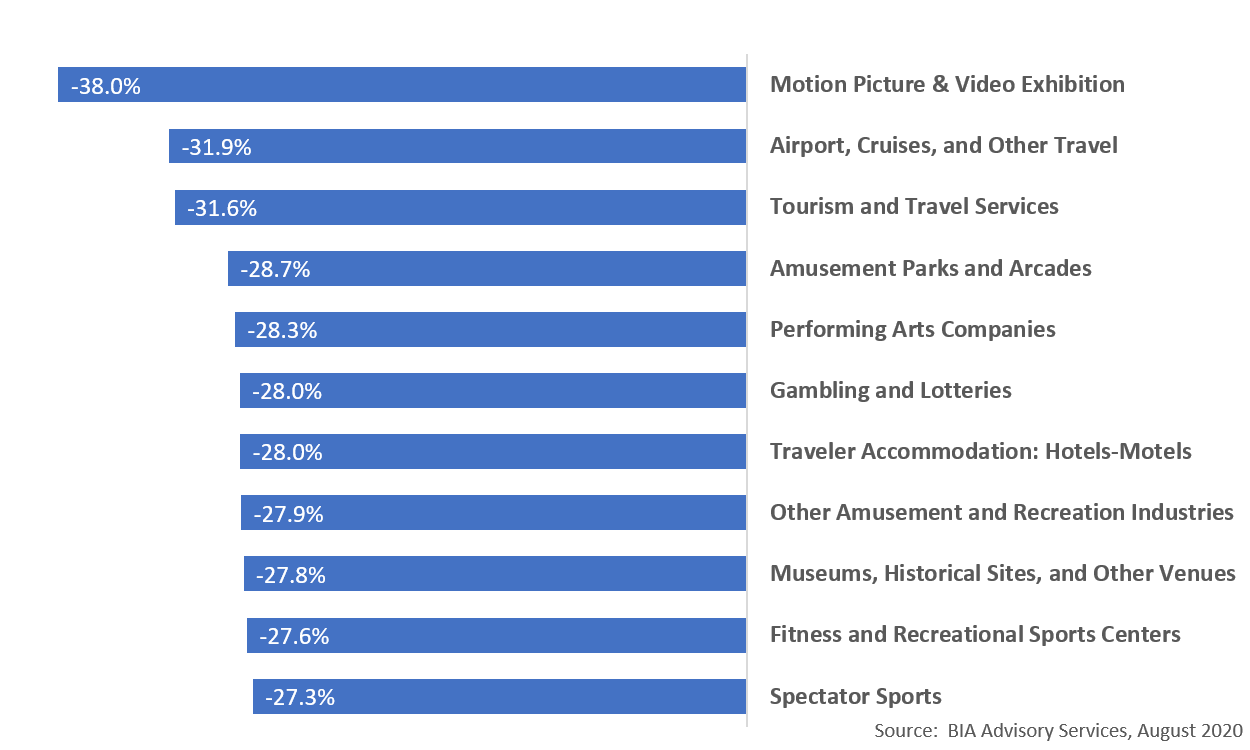

In BIA’s August forecast update, the Leisure/Recreation super vertical suffered the greatest declines in ad spending for 2020. The eleven subverticals will show overall ad spending declines in 2020 versus 2019 ranging from -27.3 percent to -38.0 percent.

Theme 1: You know what, let’s stay home and watch TV tonight.

The Motion Picture and Video Exhibition sub-vertical in the Leisure category has the unfortunate distinction of suffering the greatest (-30.0 percent) ad spending cuts year over year for 2020.

Local and state regulations are moving through different phases of business closures, restrictions and scaled re-openings. But the theater business was hit hard and hit fast. With most theaters still closed for the pandemic, AMC just opened back up recently, ad spending was slashed dramatically. Similarly, Performing Arts Companies facing the same constraints cut its ad spending -28.3 percent.

Finally, with sports events cancelled or transitioning to “spectator free” contests in empty arenas, the Spectator Sports category will see -27.3 percent ad spending reductions in 2020.

Theme 2: What does “staycation” mean again?

With states imposing travel restrictions, self-quarantining regulations and penalties, reduced business operations in the travel and tourism sectors, consumers rediscovered the “staycation” or vacationing at home.

Airports, Cruises, and Other Travel ad spending will drop -31.9 percent for the year. Tourism and Travel Services will decline -31.6 percent. Traveler Accommodations: Hotels and Motels will see -28.0 percent less ad spending.

Theme 3: Let’s think of something else to do today.

Amusement Parks and Arcades will spend -28.7 percent less in 2020 advertising as these businesses face the same restrictions and closures as other businesses challenged by social distancing and crowd size policies.

We see a similar fate of -27.9 percent ad spending decline for Other Amusement and Recreation Industries. Museum, Historical Sites and Other Venues will decrease their ad spending by -27.8 percent.

Theme 4: Sports rule, but not so much right now.

Consumers love their sports, and sports relies heavily on advertising. But the pandemic has negatively impacted various types of businesses and therefore their demand for advertising.

Gambling and Lotteries may stir competitive juices but will see a -28.0 percent decrease in ad spending. Fitness and Recreational Sports Centers will cut their ad spend by -27.6 percent as they too face closures, restrictions and consumers wary about health risks of returning to the gym.

Spectator Sports, another large group gathering business model under pressure from the pandemic, will reduce its ad spending by -27.3 percent in 2020.

Take-Aways: In each of these Leisure/Recreation sub-verticals, the overwhelming business driver for ad spending reduction is the patchwork of local and regional pandemic related business closure, restrictions and paced re-openings.

The numbers we present here are based on BIA’s aggregated forecast for 2020 ad spending (just updated earlier this month)targeting local audiences in these business categories. However, local results may vary. Things could be better or worse in different regions. For media sellers working with client in these business sectors, be clear that these companies are still buying advertising, just less of it.

Keep up strong relations and in moments where they are not buying from media sellers, they’ll have more time and inclination to plan their ad spending for when the recovery finally comes to them. Be on their side now to earn the right to their ad spending when their spigots turn back on.

For our BIA ADVantage clients, log in now to view your local market ad forecasts by media and all 95 sub-verticals. More vertical analysis is also available in the Reports and COVID areas.

Want to discuss your specific market? Email us to set up a discussion.