Whole Foods Market

By Russell Redman 1

Source: www.supermarketnews.com, September 2020

Brick Meets Click reports August sales decline but new high in spend per order

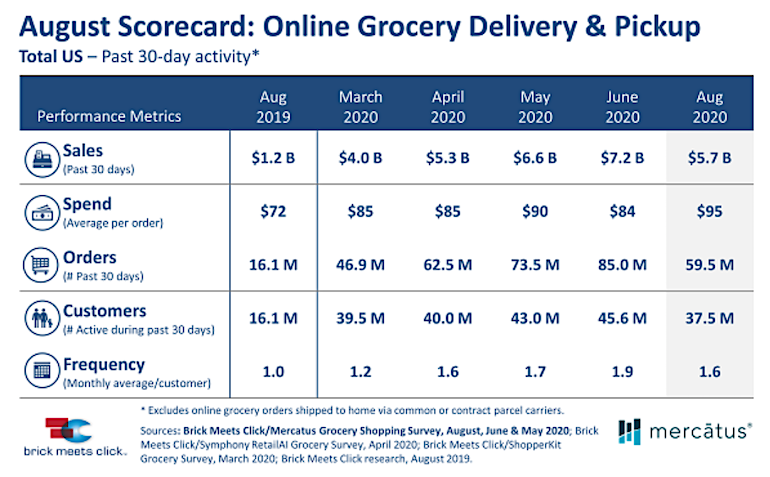

Online grocery delivery and pickup sales came in at $5.7 billion in August, down 20.8% from $7.2 billion in the previous Brick Meets Click/Mercatus survey in June but up 475% from $1.2 billion in August 2019.

Despite a drop-off from a June peak, U.S. online grocery sales are nearly five times what they were a year ago, according to the the Brick Meets Click/Mercatus Grocery Shopping Survey.

Sales from online grocery delivery and pickup services came in at $5.7 billion in August, down 20.8% from $7.2 billion in the previous Brick Meets Click/Mercatus survey in June but up 475% from $1.2 billion in August 2019. The study, released Thursday and conducted Aug. 24 to 26, polled 1,817 U.S. adults who participated in the household’s grocery shopping.

Brick Meets Click said the August online grocery sales falloff, in part, reflects changing shopper attitudes about COVID-19. The Barrington, Ill.-based strategic advisory firm noted that its ongoing research has tracked a steady decline in the percentage of households expressing a high level of concern about catching the virus, from a high of 47% in April to 38% in August.

However, average order value for online grocery sales hit a record high of $95 in August, up 13% from $84 in June and eclipsing the previous high of $90 in May. What’s more, 75% of those surveyed said they’re extremely or very likely to use online grocery delivery and/or pickup again within the next 30 days, up from 57% in June and 43% in March, when the coronavirus pandemic was declared a national emergency.

Based on the August data, about 37.5 million people — or 29% of all U.S. households — are considered monthly active users of online grocery delivery and pickup services, compared with 16.1 million a year ago. Though down from an apex of 45.6 million customers in June, the August year-over-year increase marks a 133% gain in the number of active households placing at least one delivery or pickup order in the past month.

Similarly, active shoppers placed an average of 1.6 orders in August, up from 1.0 orders a year ago yet down slightly from a high of 1.9 orders in June.

Increased order frequency and basket size, plus the larger user base, versus a year ago indicate that improved retail conditions are driving stronger online grocery shopping experiences, according to Brick Meets Click and Mercatus, a Charlotte, N.C.-based digital shopping solution provider.

“The rise in repeat purchases and spending means grocers are successfully acquiring new online shoppers and, equally as important, converting existing digitally engaged customers,” according Sylvain Perrier, president and CEO of Mercatus. “Even with diminished concern about COVID-19, grocery shoppers are realizing the benefits of a streamlined and frictionless online shopping experience. Going forward, it’s critical that grocery executives focus their teams on rewarding online shoppers by delivering a differentiated e-commerce experience that caters to consumers’ high expectations.”

Total online orders (covering the previous 30 days) were 59.5 million in August, down from a high of 85 million in June but up about 370% from 16.1 million in August 2019.

“These results reinforce that grocery delivery and pickup services will continue to play an important role for both shoppers and retailers going forward,” Bishop added. “What’s also evident is that customers’ expectations will grow even higher, making it critical for retailers to continue improving the entire shopping experience.”