Online grocery sales will grow to an estimated 21.5% of the total U.S. grocery market by 2025, up from 10.2% in 2020 and 3.4% last year, according to Mercatus/Incisiv’s new “eGrocery’s New Reality” study.

By Russell Redman 1

Source: www.supermarketnews.com, September 2020

Post-pandemic, e-grocery sales expected to climb from nearly $35 billion to more than $250 billion, says new study

Online grocery will swell to 21.5% of total U.S. grocery sales by 2025, more than doubling its current share of the overall grocery market, a new study by grocery e-commerce specialist Mercatus and research firm Incisiv projects.

For 2020, online grocery’s percentage of the $1.04 trillion grocery market is pegged at 10.2%, or about $106 billion, up from 3.4%, or $34.54 billion, of the $1.02 billion market in 2019, according to the study, titled “eGrocery’s New Reality: The Pandemic’s Lasting Impact on U.S. Grocery Shopping Behavior”. By 2025, online grocery’s dollar share stands to climb to $250.26 billion of the estimated $1.16 trillion overall grocery market.

The five-year growth forecast marks a more than 60% increase over pre-coronavirus pandemic dollar sales estimates for the online grocery space, Mercatus and Incisiv noted.

Before the COVID-19 outbreak, e-grocery sales were reckoned at 4.3% of the 2020 total grocery market and projected to rise to 5.4% in 2021, reach a double-digit share of 10.7% in 2024 and then hit 13.5% in 2025. However, with online grocery reaching a double-digit share this year, post-pandemic estimates show the channel growing to 12.5% ($132.88 billion) of the $1.06 trillion grocery market in 2021 on its way to surpassing a 20% share in 2025.

Released Thursday, the “eGrocery’s New Reality” study polled nearly 60,000 U.S. consumers across 20 states, Mercatus and Incisiv said.

“This comprehensive survey proves that COVID-19 has fundamentally changed the way shoppers approach their grocery options, so much so that we now expect to see online sales reach an unprecedented $250 billion by 2025,” Sylvain Perrier, president and CEO of Toronto-based Mercatus, said in a statement. “The growth of online grocery in 2020 and its predicted long-term impact, coupled with customers’ continued loyalty to brick-and-mortar, makes it clear that these avenues must complement each other in creating a great customer experience across a grocer’s entire brand.”

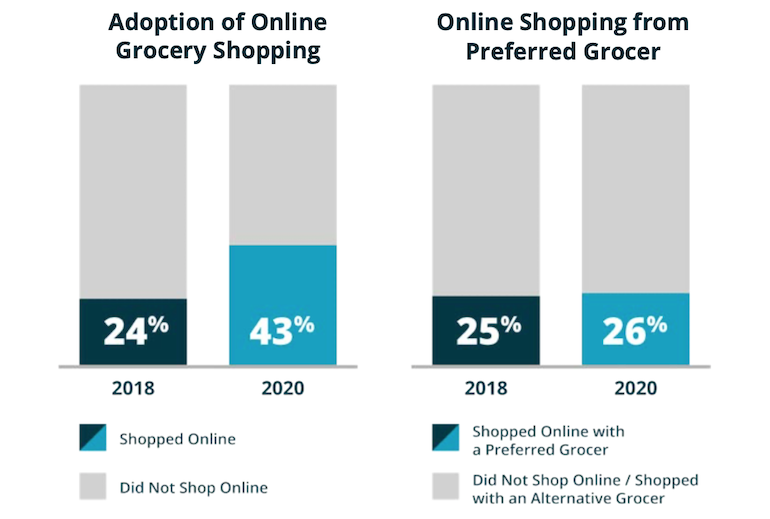

Growth for online grocery skyrocketed amid the pandemic, with 43% of shoppers surveyed reporting that they shopped online in the last six months versus 24% two years ago. Consumers cited COVID-19 concerns (62%), convenience (62%) and time savings (42%) as the top three reasons for shifting to online grocery shopping. Also, 66% of respondents who shop online described real-time inventory visibility as very important.

Post-pandemic, 90% of e-grocery customers are expected to continue shopping online, the study said. And once shelter-in-place orders are lifted, just 7% of online grocery shoppers said they will return to brick-and-mortar stores.

Adoption of online grocery jumped this year, Mercatus and Incisiv reported. Of respondents, 43% shopped online in the past six months compared with 24% in 2018. Still, the percentage of customers continuing to shop online from their preferred grocer hasn’t grown much, to 26% in 2020 from 25% in 2018. The study said those numbers reflect “a highly competitive marketplace and experimentation by customers,” with attractive discounts and promotions, in-stocks, a choice of fulfillment options (e.g., free curbside pickup and home delivery) and other online order incentives being key factors.

Overall, 93% of respondents indicated they’ll continue to shop with their preferred grocer (in-store and online), and 87% said they’re satisfied with the shopping experience.

“With close to 60,000 respondents across the U.S., we analyzed more than 48 million data points and found that shoppers are highly satisfied and loyal to their preferred grocery store, but this loyalty does not extend to the online channel,” explained Amar Mokha, COO and benchmarking lead at West New York, N.J.-based Incisiv. “While the adoption rate of online grocery has increased significantly, grocers need to improve pickup and delivery slot availability, promotion and coupon availability, and product substitutions to improve customer loyalty online.”

Seventy-eight percent of all shoppers surveyed said they still prefer to visit a brick-and-mortar grocery store, either to shop in-store or pick up curbside orders, indicating that most grocery shoppers remain loyal to retailers and online brands with a physical store presence, according to the study.

Among respondents, 30% reported changing their preferred shopping destination during shelter-in-place practices arising from the pandemic. Of those shoppers, 60% moved from one brick-and-mortar store to another, and 40% shifted to other online shopping venues. Pure-play e-grocers saw much less loyalty versus brick-and-mortar retailers; for example, only 8% of those polled said they switched to an online-only operator such as Amazon.

Not changing during the pandemic were traditional drivers of preference, such as proximity/location, value, product quality and convenience, the study found. Yet shoppers exhibited less price sensitivity as product availability took precedence. Lack of product availability (56%) and concerns over safety protocols (33%) were the top reasons for customers deciding to shop elsewhere.

Grocery retailers able to “best bridge both online and offline shopping journeys” while providing a seamless shopping experience with minimal friction points will see the most success post-pandemic, Mercatus and Incisiv said in the study.

“In order to round out the loyalty to online channels, this data makes it clear that brands should make investments in digital functionality, especially regarding product search, discovery and product information,” Perrier added.

For our most up-to-date coverage, visit the coronavirus homepage.