By Sara Fischer, author of Media Trends

Source: www.axios.com, January 2021

The pandemic has taken a huge toll on the Pay-TV industry, and with the near-term future of live sports in question, there are no signs of it getting better in 2021.

Why it matters: The fraught Pay-TV landscape is forcing some smaller, niche cable channels out of business altogether.

Driving the news: Comcast’s NBCUniversal said Friday it will shut down its sports cable channel, NBCSN, at the end of the year and move some of its premium programming, including NHL playoff games and NASCAR races, to its USA Network.

- Reports previously suggested that NBCU was considering nixing some of its other “long-tail” channels, like E! and Oxygen, for leverage in cable bundle negotiations.

- NBCU is hopeful that beefing up its USA Network offerings can strengthen the network’s appeal in cable and satellite negotiations.

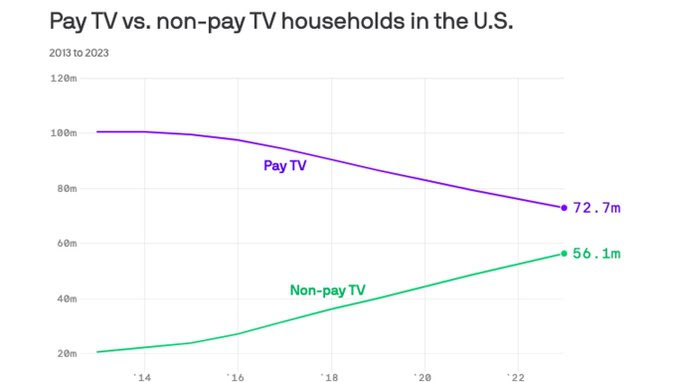

The big picture: The pandemic will drive cable and satellite TV providers to lose the most subscribers ever, according to the most recent data from eMarketer.

- Early estimates suggest roughly 5 million people cancelled their cable subscriptions last year.

- Last year’s lockdowns slowed cord-cutting by forcing people to stay inside, but it will accelerate again as the country opens back up.

- Streaming has also taken off during the pandemic, which will push more consumers to cut the cord in coming years.

- One forecast expects that pay-TV subscriptions will shrink by 36% in the next 5 years, compared to 9.5% from 2015-2019.

Be smart: Sports networks are often the most costly channels within a cable bundle. Telecom operators have been under pressure to rebate consumers for the expensive cable packages that lacked live sports during the pandemic.

- While some networks, like news and variety programming, are struggling to demonstrate value in the cable bundle, sports networks are by far under the most pressure, given much cable operators are required to pay them for live sports rights.

What’s next: With many major sports contracts set to expire in the next few years, analysts predict that the ultimate collapse of the cable TV model will happen when a tech or streaming company finally is granted rights to stream a major sports franchise.

- AT&T’s top executive John Stankey has said the telecom giant would consider dropping its exclusive rights to the NFL’s Sunday Ticket package from its DirecTV satellite service.

The bottom line: In the interim, expect a flood of cable programming to start migrating over to streaming in anticipation for the day when cable is no longer a viable platform for networks to reach audiences.

- News networks — NBC, CBS, ABC, FOX News and others — have begun building streaming services tailored to news and opinion programming.

- Big entertainment giants — like Disney, Discovery, Comcast/NBCU and AT&T — have all set up streaming networks in the past year during the pandemic that mostly combined content from all of their outlets