Source: www.kitchenbathdesign.com, March 2021

The post-pandemic economic rebound, improving job conditions, stable interest rates and lifestyle changes are forecast to continue in 2021, boosting both new construction and residential remodeling, according to top U.S. economic and housing experts. Among the key statistics and forecasts released in recent weeks by government agencies, research firms and industry-related trade associations were the following:

HOUSING STARTS & NEW-HOME SALES

Historically low mortgage rates, favorable demographics and a shift in homeowner preference for the suburbs, exurbs and small towns continue to spur builder confidence, buyer demand and gains in new-home sales, the National Association of Home Builders said last month. Builder confidence in the market for newly built single-family homes fell in December, but nevertheless posted its second-highest reading ever, according to the Washington, DC-based association. NAHB Chief Economist Robert Dietz cautioned, however, that affordability “remains an ongoing concern,” as both construction costs and interest rates are expected to rise in 2021. In addition, headwinds due to shortages of lots, labor, lumber and other key building materials are lengthening construction times and continue to hinder more-robust growth, Dietz said. The growing demand for single- and multi-family construction in lower-density markets stems from the fact that housing is less expensive compared to urban areas and buyers can afford larger homes to accommodate home offices, exercise rooms and other specialty rooms which are in higher demand due to the pandemic, noted NAHB Chairman Chuck Fowke.

EXISTING-HOME SALES

Housing markets that have been performing well throughout the COVID-19 pandemic are likely to carry that momentum into 2021 and beyond due to strong in-migration of new residents, faster local job-market recoveries and environments that are conducive to work-from-home arrangements, the chief economist of the National Association of Realtors said. “With the latest (government) stimulus package, vaccine distribution underway and very strong demand for homeownership still prevalent, robust growth is forthcoming for 2021,” said Lawrence Yun, chief economist for the Washington, DC-based NAR. Existing-home sales hit 5.52 million units in 2020, the highest annual mark since 2006, according to the NAR, which also reported a significant rise in the purchase of multi-generational homes, as well as homes featuring a home office and/or gym.

RESIDENTIAL REMODELING

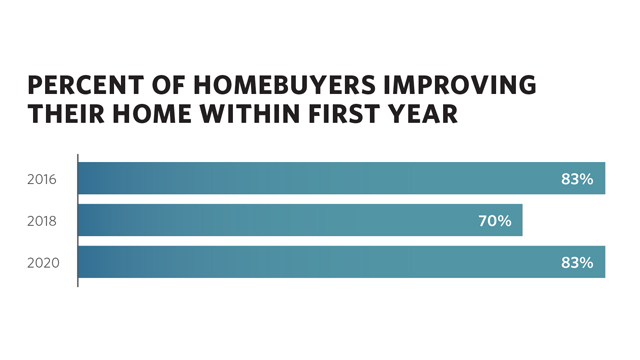

The demand for home improvement remains “robust,” given the growing importance of home as the economy recovers and Americans adapt to the impact of COVID-19, the remodeling arm of the National Association of Home Builders said. “With refinancing activity surging, homeowners are investing in their homes,” said NAHB Remodelers Chair Tom Ashley, Jr. “As a result of the rapid changes for work and the economy after the virus-induced recession, homes are serving multiple roles such as school, office and gym.” Ashley’s comments came in the wake of the latest NAHB Remodeling Market Index (RMI), a quarterly gauge that reflected “strong remodeler sentiment, as business has strengthened and homeowners focus on the importance of home,” observed NAHB Chief Economist Robert Dietz. Dietz added, however, that remodelers are reporting double-digit percentage increases for material pricing, as delays in obtaining materials “have become a critical near-term challenge due to disrupted supply chains.”

Pandemic Seen Boosting Custom Residential Design Sector

WASHINGTON, DC — The COVID-19 pandemic has buoyed the custom residential design sector while impacting homeowner design preferences and increasing demand for multi-generational housing accommodations, according to the latest “Home Design Trends Survey” conducted by the American Institute of Architects.

The AIA’s fourth-quarter 2020 survey, focusing on community and neighborhood design, also revealed a decline in homeowner demand for higher-density development, reversing a multi-year trend. Project billings, inquiries and design contracts also rebounded from a record decline in the first quarter. All custom residential sectors reported improved market conditions, with home improvement reporting the strongest gains.

“The uneven impact of the pandemic on specific construction sectors is nowhere more apparent than in custom residential,” said Kermit Baker, chief economist of the Washington, DC-based AIA. “Although the initial impact of the pandemic hit residential architects hard, a stay-at-home lifestyle and the desire for more space and less density has increased homeowners’ desires to modify their accommodations.”

The AIA’s Home Design Trends Surveys are conducted quarterly among a panel of more than 500 architecture firms that concentrate their practice in the residential sector.