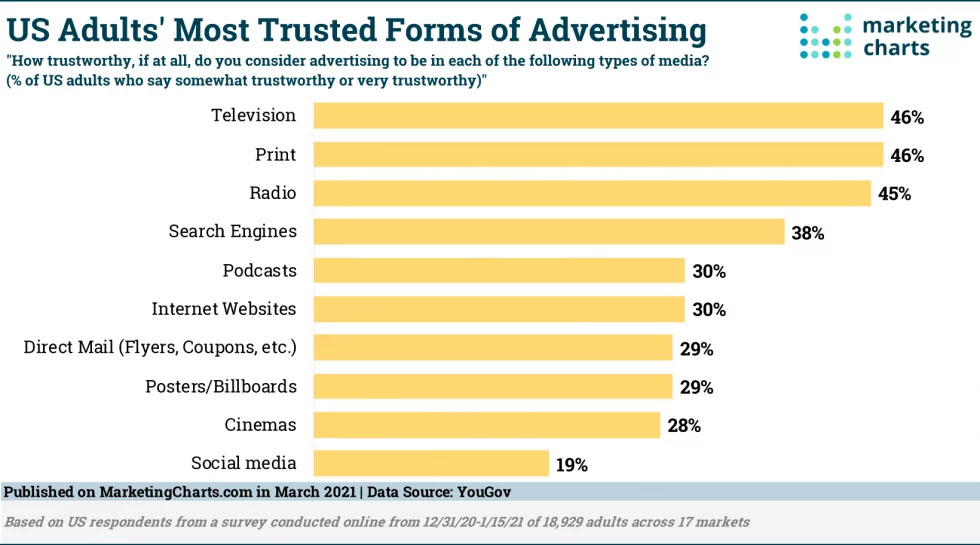

Source: www.marketingcharts.com, March 2021

Advertisers continue to up their investment in online advertising, with traditional media ceding share of ad spend. However, when it comes to trusting ads, adults in the US put more trust in ads from legacy than newer media, per data from YouGov.

Indeed, close to half of the US adults surveyed consider advertising on television (46%), print (46%) and radio (45%) to be somewhat or very trustworthy. While 38% consider search engine advertising to be trustworthy, half as many say the same about social media advertising (19%).

Trust in social media advertising among US adults is one of the lowest of the 17 markets surveyed. For example, close to half (48%) of respondents from India and 45% of respondents from UAE consider ads on social media to be somewhat/very trustworthy. However, more US adults find social media ads trustworthy compared to respondents from France (17%), Germany (17%) Denmark (14%), Sweden (11%) and the UK (10%).

One difficulty advertisers are facing is that even if adults trust ads on traditional media more, there are more ways to actively avoid advertising altogether, and many adults are doing just that. A further report [download page] from YouGov found that for those US adults who prefer ad-free entertainment, 65% say they tend to mute the ads on TV. This is compared to 50% of the US public who say the same. These ad-free Americans, as labeled by YouGov, are also more likely than the general US public to pay for access to magazine content online (36% vs. 19%) and pay for access to newspaper content online (38% vs. 23%), which the report points out as problematic considering ad-free tiers are being offered for some subscriptions.

Ad-free Americans are also more likely than the US public to say that streaming services have changed TV watching for them (74% vs. 59%). This is as more adults in all age groups are watching streamed video, catch-up/on-demand or recorded TV and spending more time with these forms of media, while, for the most part, spending less time with live TV.

The full report can be found here.

About the Data: Findings are based on a global survey of 18,929 adults across 17 marketers conducted online from December 31, 2020 – January 15, 2021.