by Rick Vosper

Source: www.bicycleretailer.com, March 2021

The US bicycle market is dominated by its four largest brands, a group I’ve termed The Quadrumvirate: Trek, Specialized, Giant and Cannondale, in order of size. Together these brands are represented in more than half of US bike shops and likely account for the lion’s share of new bike sales nationwide.

As I’ve mentioned previously in this space, each member of The Quadrumvirate’s greatest challenge is to differentiate itself from the other three. In a mature category like bicycles, where technology gains are at best incremental, that makes the retail shop floor a primary target for differentiation. (See footnote: Are supplier-owned stores “real” bike shops?)

But if independent bicycle dealers are anything at all, they are independent. And in the struggle for control of in-store branding, the only way for a supplier to control how its product is inventoried, displayed and sold is to increase its control of the retail environment itself.

In the 2000s, this led to the development of the concept store, a retail space primarily dedicated to a single brand. In exchange for floor space and control over things like displays, signage and fixturing, suppliers offered retailers financial support and access to internal marketing resources.

The logical next step was for suppliers to move to outright shop ownership in target markets.

Trek, Specialized and Giant have all dabbled in retail ownership, both in the USA and globally, from the mid-2000s onward. But since about 2015, Trek has pursued the ownership course most aggressively, as a generation of retailers who came up in the bike boom and mountain bike eras approach retirement age.

Interestingly, each member of The Quadrumvirate is pursuing a different strategy in the retail ownership game. I reached out to executives at each of the four major players for comment and analysis.

TREK: THE ACQUISITION STRATEGY THAT ALMOST WASN’T

“In regards to retail, we believe it’s a really good business to be in with a great future. We have long been committed to investing in our retailers’ success, and our retail experience has helped us amplify and refine those efforts.”

That’s Trek director of brand marketing and public relations Eric Bjorling speaking. For Trek, company-owned bike shops are just part of larger and seamless strategy for overall retail success.

But as strategies go, the move to large-scale acquisition of dealers is a fairly recent one.

I spoke with Roger Ray Bird, director of retail and concept stores for Trek from late 2004 through 2015 about this.

“We did not intend to build a company-owned retail store network the way they are doing now,” he told me.

Bird continued, “John Burke had always said we want independent retailers running the stores in their markets instead of us because they can do a better job than we can. (But he later) made the move to full ownership because he wanted a consistent brand experience, customer experience, product experience and a full range of product available to consumers among the various stores.”

The inescapable conclusion is that Trek is operating the largest chain of bike shops in the United States currently, if not in all of industry history.

Speaking of the various stores, just how many locations does Trek currently own? I put the question to Eric Bjorling.

“Like our sales and specific financial information,” he told me via email, “as a privately held company we don’t release that data publicly.”

Fair enough. But in the past ten years, Trek has publicly announced the acquisition of some 54 new US locations right here on the Bicycle Retailer website, according to BRAIN researchers. It has also advertised open positions at an additional 40 locations, bringing its total to at least 94 storefronts.

Add this to Trek’s own dealer locator, which according to Georger Data Services lists 203 locations with Trek in the store name, and we may estimate the total number of company-owned Trek stores at somewhere between one and two hundred.

What matters is not the exact number, but the inescapable conclusion: Trek is operating the largest chain of bike shops in the United States currently, if not in all of industry history.

SPECIALIZED RESPONDS, JOINS ARMS RACE

Perhaps in response to recent multi-store purchases by Trek (both the Goodale’s (NH) and Bicycle Sports Shop (TX) chains were Specialized retailers prior to being purchased), Specialized USA sales & business development leader Jesse Porter sent a letter to Specialized dealers nationwide on January 15th.

In part, the letter said:

If you are considering divesting, investing, exiting or transferring ownership, we have options that may interest you — from Specialized financing or outright ownership to helping identify local or regional investors, we want to be sure that the community you’ve worked so hard to develop has continuous and uninterrupted access to the products and services they’ve come to expect.

Reached by email for follow-up, Porter confirmed there are a number of Specialized-owned stores already. “We have owned and operated retail in the USA for over 10 years,” he told me, “including shops in Santa Monica and Costa Mesa. Additionally, we have Experience Centers in Boulder and Santa Cruz.”

“We are aggressively pursuing the market opportunity, and part of that pursuit is ensuring that riders and the riding communities we serve have uninterrupted service.” —Jesse Porter, Specialized

Asked about the company’s plans to acquire additional dealers, Porter said “We are currently engaged in conversation with a number of retailers to explore their succession plans. We are approaching this initiative with an open mind, not a determination to acquire a target number of stores.” And most significantly, “We are aggressively pursuing the market opportunity, and part of that pursuit is ensuring that riders and the riding communities we serve have uninterrupted service.”

So it appears Specialized is moving deeper into the dealer acquisition business on an as-needed basis, presumably to protect or expand its foothold in key markets.

GIANT DIVESTS IN OWNERSHIP, REINVESTS IN IBDS

Next I reached out to Giant USA’s general manager, John “JT” Thompson. When asked about store ownership, he is adamant.

“We are not in the retail ownership game, period!” he told me in an email exchange. “We’ve had company owned stores in America, so we know that challenge well. Through that experience we’ve learned that day in/day out) retail store operations is not our expertise.

“We’ve determined our best path to the consumer is through competent and energized (LBS) retailers,” Thompson continued. “As a business strategy we moved away from store ownership as we developed our Retail Support execution. We do not trust company-owned stores are the best approach to the retail environment of localized America. Local love and knowledge is the success story for stores where the primary objective is creating a positive experience while building long-term customer relationships.”

In conclusion, Thompson said, “We do not compete in any way with our retailers. They are all independent. This is a natural action from a brand that is manned by people who came from the retail environment. With all due respect, retailers are the hardest working people in this industry, if we can make their life a bit less challenging and more rewarding that’s super cool in our view.”

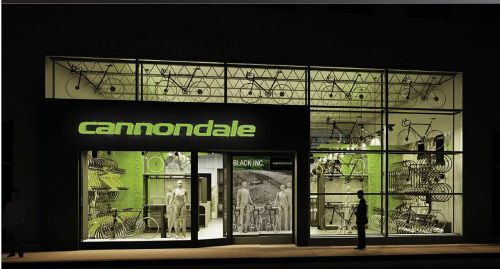

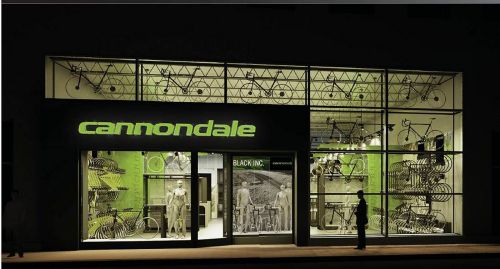

CANNONDALE: STEADY AS SHE GOES

Finally, I put the retail ownership question to Nick Hage, Cannondale’s general manager for North America and Japan.

Cannondale had three company-owned stores at one time; two in Boston and one in Long Island. “We only had them for a couple years and we shut them down five or six years ago,” Hage said.

“Cannondale has gained market share the last three years as more and more dealers move away from a single-brand strategy.” — Nick Hage, Cannondale

“We have no plans of getting into retail (again),” he told me in a video interview. “We remain committed to partnering with quality retailers that support a multi-brand portfolio, provide great customer service and help build cycling in the community. This remains our long term strategy.

“Retailers have repeatedly told us they don’t want to compete with their supplier, nor do they want their supplier having too much control of their business,” Hage said. “Cannondale has gained market share the last three years as more and more dealers move away from a single-brand strategy and this past year has reinforced the fact that retailers can’t afford to put all their eggs in one supplier’s basket. We see this as a massive opportunity to continue embracing a leadership role with independent dealers. The IBD isn’t going away and the good retailers are only going to get stronger.”

IN CONCLUSION

At a time when the supply chain is in greater chaos than we’ve seen since the collapse of the Bike Boom in 1977, the four leading bicycle brands are pursuing four very different strategies regarding the future of bicycle retail.

Ultimately, the move to supplier-owned stores is neither good nor bad; it is simply the way things are, and the market will decide whether it’s successful.

But here’s the kicker. With product orders currently extending into 2022, retailers will be unable to vote with their checkbooks on company-owned stores, even if they want to. In the meantime, suppliers on the retail acquisition path can continue with impunity, and those with an IBD-only strategy will have trouble gaining market share, simply because retailers’ open-to-buy dollars are already committed with their existing suppliers. In other words, the trend to supplier-owned stores will only continue, and dealer pushback (if any) won’t be felt for years yet to come.

FOOTNOTE: ARE SUPPLIER-OWNED STORES “REAL” BIKE SHOPS?

The National Bicycle Dealers Association certainly seems to think so.

“The NBDA welcomes membership from all Bicycle Specialty retailers,” says NBDA president Heather Mason. “A specialty bicycle retailer is simply a retailer who is an expert at the trade of bicycle sales. A supplier-owned store would fall into this category; we are all-inclusive and invite all to membership.”