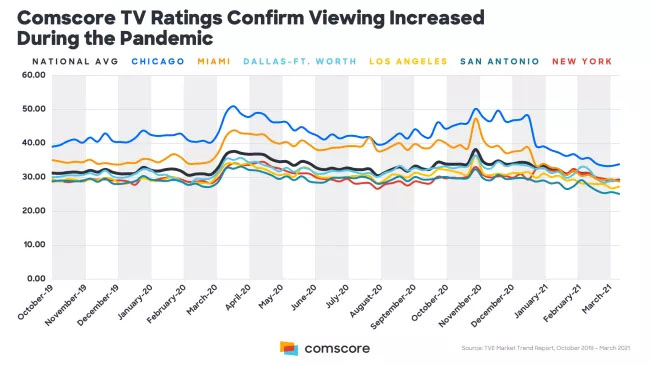

Chart from Comscore shows relatively steady total household ratings during the pandemic (Image credit: Comscore)

By

Source: www.nexttv.com, May 2021

The pressure continues on Nielsen as data from rival Comscore contradict Nielsen’s metrics showing that TV usage went down during the pandemic.

Nielsen’s data has been criticized by networks and distributors represented by the VAB. The VAB contends that Nielsen is caused under-reporting TV usage because of faulty reporting from homes in the Nielsen sample that Nielsen was unable to verify because Nielsen had to stop doing in-home maintenance while following COVID-19 protocols.

VAB has asked for an independent audit of the situation.

Nielsen has defended how it maintained its panel during the pandemic and said that whatever variance was caused by sample issues was not significant. It refused the request for a special audit, noting that it is working on an ongoing audit of its local market ratings with the Media Rating Council.

During its first-quarter earnings call Thursday, Nielsen CEO David Kenny noted the controversy.

“Without a doubt, the pandemic affected audience behavior,” Kenny said. “As with any change or disruptive event, such as extreme weather in the past, we recorded our changes with the Media Rating Council, or MRC, and committed to assessing the full impact of the changes as soon as possible.”

Kenny said Nielsen will continue to work with the MRC and “our panel remains robust and representative, and the integrity of our ratings estimates remains high.”

VAB is expected to revisit the issue in a conference call with reporters Monday afternoon.

Comscore’s data shows total households ratings were largely stable from March 2020 through March 2021, falling a bit more recent.

Also Read: ViacomCBS Expands TV Ratings Deal with Comscore

“You can look at it at a market level, big markets, small markets, and you can look at it nationally and you see continuity and consistency in viewing,” said Comscore chief revenue officer Carol Hinnant.

“As the world has gone back to work in the last couple of months and kids are back in school,, you’re starting to see some declines. But I think that’s to be expected,” Hinnant said.

With the way Comscore collects viewing information, by using return path data from set-top boxes, “during the pandemic, our data set was growing, and the panel was suffering declines,” Hinnant said.

Comscore relies on “big data” from millions of cable set-top boxes to measure viewing, while Nielsen relies more heavily on its panel of viewers. NIelsen maintains its system yields superior results.

In response to Comscore’s data, Nielsen said in a statement: “When a measurement service relies on big data alone, a third party demographic provider is often utilized to assign household characteristics. However, based on our own research, their data can be subject to inaccuracies. It is also important to note that Nielsen’s metrics are fundamentally different from our competitors.

“While competitors report on an ‘opportunity to view’ basis, Nielsen is the only measurement provider able to measure viewers at an individual level. An ‘opportunity to view’ metric assumes all persons that live in the home are viewing if the TV is on. So, for example, if there are 3 people in the home and 3 TVs are on, it assumes that there are a total of 9 viewers. This inaccurate approach will elevate HUTs/PUTs and ratings,” Nielsen said.

“It’s very hard to have precise measurement from a small sample,” Comscore’s Hinnant countered. She called the panel method of measuring viewing outdated. “We’ve built an engine for the 21st century.”

Comscore’s system is passive, not requiring activity from viewers beyond clicking a remote control and watching something, unlike Nielsen, which required its sample families to push buttons to indicate who is watching.

“You get that reliable source of data coming in day in and day out, with every hour accounted for in all 210 markets,” Hinnant said, “And it’s one methodology for local and national consistently.”

Also Read: Nielsen Says COVID-19 Has Disrupted Local Rating Panels

The controversy has attracted interest in local markets as well.

Erik Schrader, GM of Gray Television’s duopoly stations in Cleveland, said he reached out to media buyers to make sure that they were aware of the controversy.

Schrader said his station stopped using Nieisen in 2018. He called the numbers reported by the VAB troubling, and a concern for the industry as a whole, including viewers, agencies and advertisers.

“Even though we don’t, a lot of people still use Nielsen and I think the veracity of those numbers is hugely important,” he said.

“I did reach out to all our local and national agencies, and the message wasn’t to leave Nielsen. But the message was make sure that if you are a Nielsen client, you should be making sure your numbers are accurate holding them accountable,” Schrader said.

“It was kind of shocking to hear that Nielsen believes that viewership was down for the greater part of last year. That certainly flies in the face of not just anecdotal evidence, but there are other measurement companies out there,” he said.