Seeing Is Believing Is Buying

Following the 2020 holiday shopping season, Silverback Strategies surveyed more than 1,000 consumers across the US for its 2021 Shopper Survey. The survey results reveal some interesting insights about “purchase intent,” which should prove valuable for your pitches to local retailers and businesses.

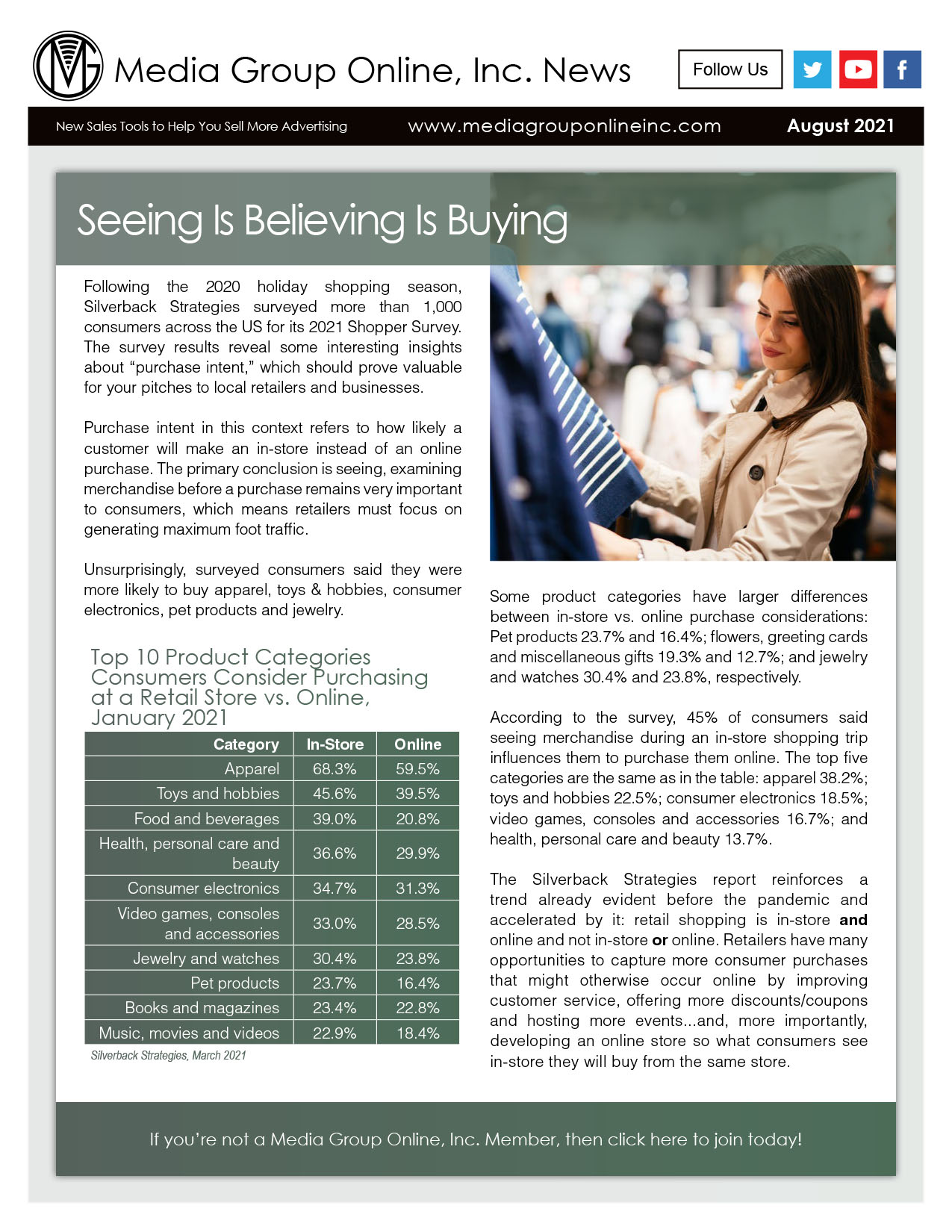

Purchase intent in this context refers to how likely a customer will make an in-store instead of an online purchase. The primary conclusion is seeing, examining merchandise before a purchase remains very important to consumers, which means retailers must focus on generating maximum foot traffic.

Unsurprisingly, surveyed consumers said they were more likely to buy apparel, toys & hobbies, consumer electronics, pet products and jewelry.

Top 10 Product Categories Consumers Consider

Purchasing at a Retail Store vs. Online, January 2021

|

Category |

In-Store |

Online |

|

Apparel |

68.3% |

59.5% |

|

Toys and hobbies |

45.6% |

39.5% |

|

Food and beverages |

39.0% |

20.8% |

|

Health, personal care and beauty |

36.6% |

29.9% |

|

Consumer electronics |

34.7% |

31.3% |

|

Video games, consoles and accessories |

33.0% |

28.5% |

|

Jewelry and watches |

30.4% |

23.8% |

|

Pet products |

23.7% |

16.4% |

|

Books and magazines |

23.4% |

22.8% |

|

Music, movies and videos |

22.9% |

18.4% |

Silverback Strategies, March 2021

Some product categories have larger differences between in-store vs. online purchase considerations: Pet products 23.7% and 16.4%; flowers, greeting cards and miscellaneous gifts 19.3% and 12.7%; and jewelry and watches 30.4% and 23.8%, respectively.

According to the survey, 45% of consumers said seeing merchandise during an in-store shopping trip influences them to purchase them online. The top five categories are the same as in the table: apparel 38.2%; toys and hobbies 22.5%; consumer electronics 18.5%; video games, consoles and accessories 16.7%; and health, personal care and beauty 13.7%.

The Silverback Strategies reinforces a trend already evident before the pandemic and accelerated by it: retail shopping is in-store and online and not in-store or online. Retailers have many opportunities to capture more consumer purchases that might otherwise occur online by improving customer service, offering more discounts/coupons and hosting more events…and, more importantly, developing an online store so what consumers see in-store they will buy from the same store.