(Image credit: IAB)

By Source: www.nexttv.com, October 2021

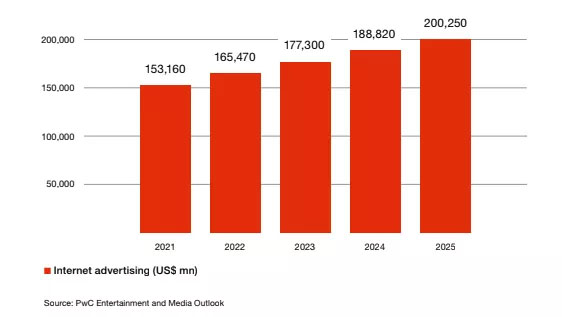

U.S, internet spending to hit $200.3 billion by 2025

The IAB released an new outlook Friday calling for continued growth in digital ad spending, but warning about some issues facing the industry.

The outlook, compiled for IAB by PwC, calls for a relatively small 8% increase in 2022 to $165.5 billion, followed by an 11.8% increase to $177.3 billion in 2023. Internet ad spending in the U.S. is forecast to be $200.3 billion in 2025.

Despite the growth the IAB highlighted concerns that could affect the industry.

The top concern identified by the leaders interviewed for the IAB’s fall report was an increasing lack of consumer tolerance for advertising — particularly within digital video. The issues requires immediate focus and change, the report said. “With more choices to obtain content via ad-free and ad-light environments than ever before, consumers require different advertising that express different values through different types of formats,” the report said.

The study found that consumers value “convenience,” “knowledgeable and friendly service” and “efficiency.” Four times as many consumers wanted “efficiency” (60%) as “fun” or “brand image” (15%).

Other issues facing internet advertising were Federal government attention and steep competition to attract talent while attending to policies that account for diversity and inclusion.

“This report makes it crystal clear that we must acknowledge that consumer expectations are rapidly changing,“ IAB CEO David Cohen said. “Irrelevant and increased ad loads are not the solution. They want better, more useful ad experiences. They want us to refocus on their needs, reimagine ad formats, and reinvent what advertising can be. The next creative revolution needs to be about utility, not just cleverness.”

The battle between AVOD (advertising-supported video-on-demand) and SVOD (subscription video-on-demand) is evolving, the report said. “New crowdsourced and user-generated platforms challenge both established digital leaders as well as traditional media players. The recent IPO boom has created opportunities for new entrants, which is expected to fuel a new wave of M&A,” the report said.

One industry leader interviewed for the study said: “It’s not a matter of if the next big deal will happen, it’s a question of when.”

“The need for actionable digital advertising insights and support models is also expected to underpin future deal activity, delivering valuable and engaged audiences and enabling brands and agencies to better understand and personalize their ad experiences. The goal is to deliver the best possible consumer experience,” the report said.