by Dana Anderson and Tim Ellis

Source: www.redfin.com, January 2022

Historically fast home-price growth has homebuyers and sellers worried the market has become detached from reality. But Redfin’s chief economist says rising mortgage rates and buyers who can afford their homes are preventing a bubble.

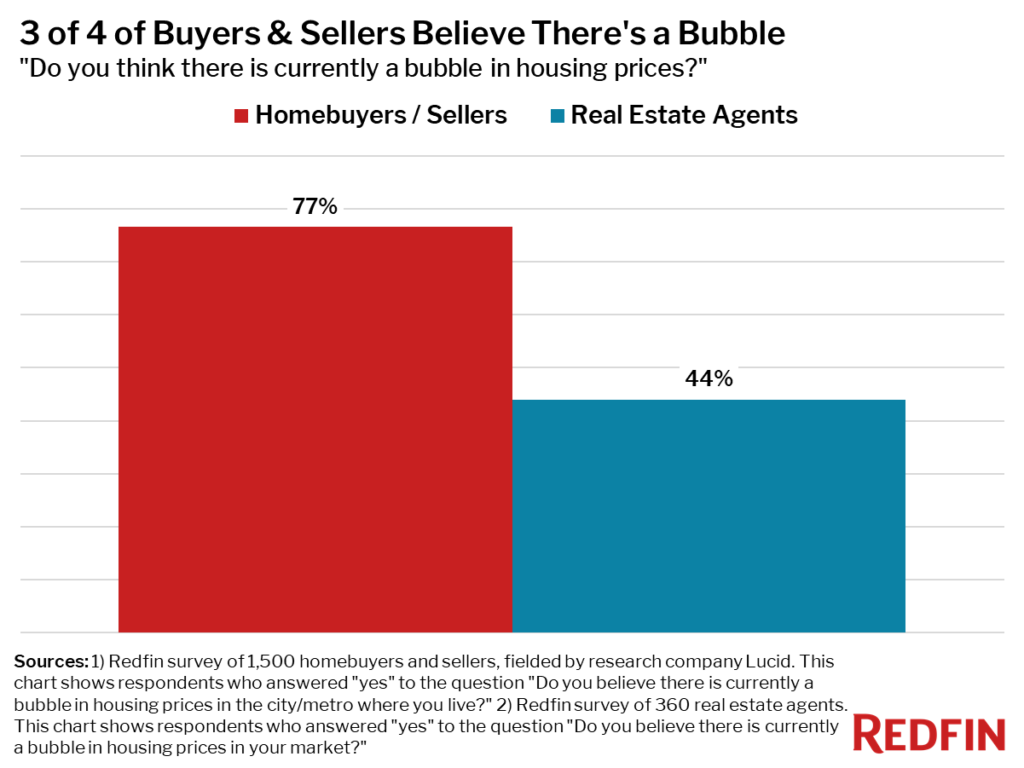

More than three-quarters (77%) of homebuyers and sellers believe there’s a housing price bubble in the area where they live, according to a recent Redfin survey.

Meanwhile, 44% of real estate agents believe there’s a housing bubble in the market where they work.

The former is from a Redfin-commissioned survey of 1,500 U.S. residents who are planning to buy or sell a home in the next 12 months fielded by research technology company Lucid from December 10 to 13, 2021. The latter is from a Redfin survey of 360 real estate agents from October 2021.

What is a housing bubble?

A housing bubble is characterized by rapid unsustainable growth in home prices, eventually “bursting” when demand no longer supports the high home values, followed by sharp price declines. It’s typically caused by an influx of demand from homebuyers and real estate investors.

Redfin Chief Economist: We’re not in a housing bubble

The housing market has been ultra-competitive since the coronavirus pandemic upended American society in mid-2020, ushering in an era of remote work and record-low mortgage rates that have resulted in strong homebuyer demand and a severe supply shortage. Median home prices have been growing by double digits all year long.

“Homebuyers and sellers are rightfully concerned about how fast prices are rising, especially those who remember the housing market crash during the Great Recession,” said Redfin Chief Economist Daryl Fairweather. “If this rate of price growth were to continue for another year, I would be worried about a bubble, too, but I predict home-price growth will slow significantly in 2022. What we’re going through right now is closer to a ripple in the water than a bubble. Mortgage rates are already going up, which will likely stabilize demand and reduce the risk of a bubble that could burst.”

Average 30-year mortgage interest rates have already risen roughly 0.5 percentage points since the beginning of the year, landing at 3.56% in the week ending January 20, and they’re likely to continue increasing.

Inflation, which climbed to its highest level in 40 years at the end of 2021, also reduces the risk of a housing bubble, Fairweather said. With the prices of goods and services significantly higher than they were a year ago, people have less disposable income to put into the housing market.

The pandemic-driven housing boom is fundamentally different from that of the mid-2000s, when loose lending criteria allowed many homebuyers to take out mortgages they couldn’t afford. That resulted in millions of foreclosures and a sharp decline in home prices. Today’s lending practices are much stricter, ensuring that buyers can afford their monthly payments. Additionally, this boom is characterized by Americans moving to new parts of the country and new neighborhoods because of their relative affordability.

“The housing market is much stronger than it was before and during the Great Recession,” Fairweather said. “There’s a very low likelihood that home prices will go down anytime soon.”