Whole Foods Market

Pickup garnered the biggest online grocery sales share in February at 40%, with delivery close behind at 37%, Brick Meets Click reported.

By Russell Redman 1

Source: www.supermarketnews.com, March 2022

Growth in pickup, delivery fuel monthly and year-over-year gains, Brick Meets Click reports

After declines in January, U.S. online grocery sales in February rose 2.4% from sequentially and 8.5% versus a year ago, according to the latest Brick Meets Click/Mercatus Grocery Shopping Survey.

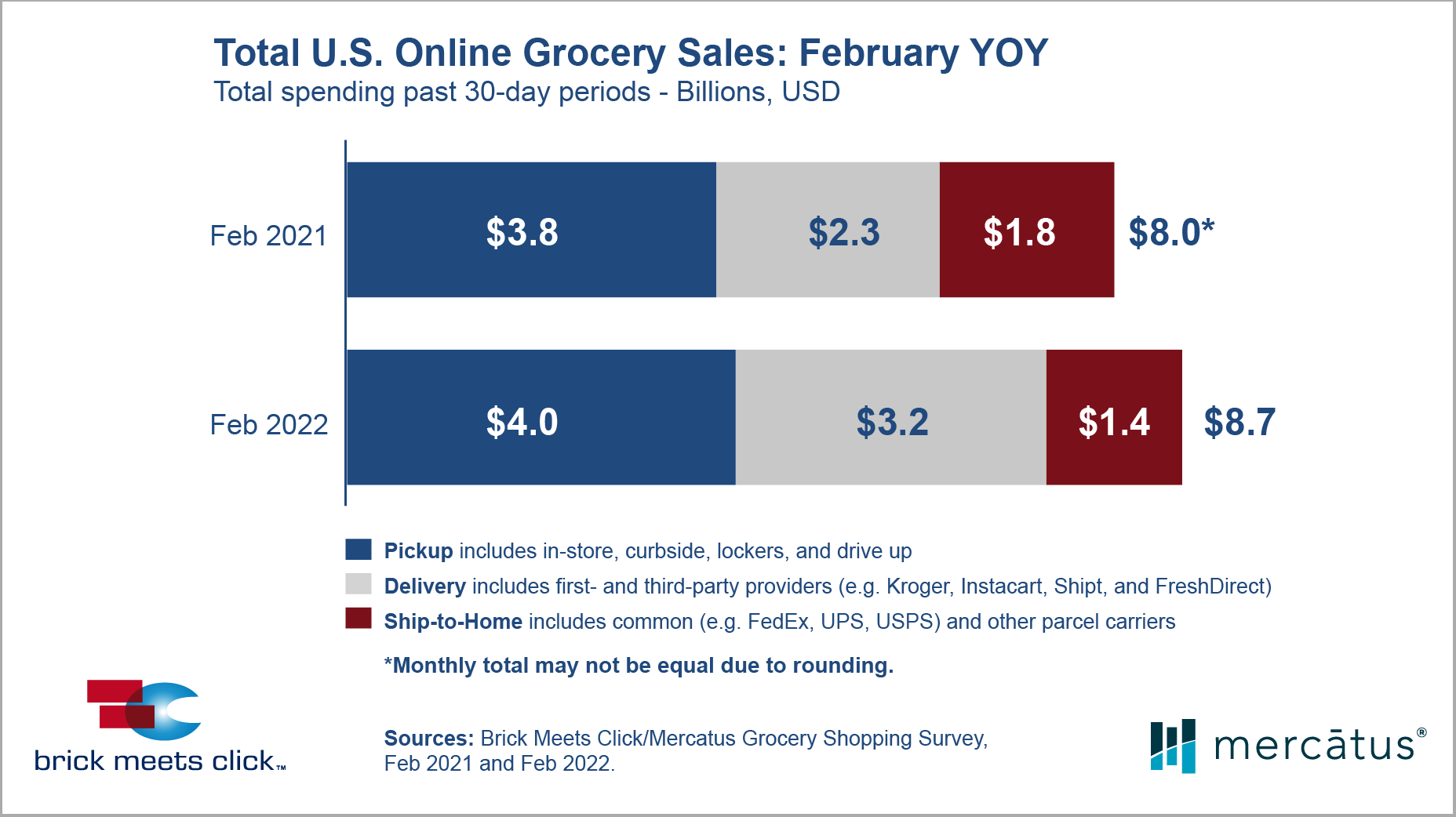

The U.S. online grocery market hit $8.7 billion for February, up from $8.5 billion in January and $8 billion in February 2021, strategic advisory firm Brick Meets Click said Thursday. February 2022 marked the seventh straight month that e-grocery sales were $8 billion or more following three consecutive months (May to July 2021) of sales at $7 billion or less. Monthly online grocery sales reached their high-water mark of $9.3 billion twice (January and March 2021) since the COVID-19 pandemic began in March 2020.

In February 2022, online grocery sales via pickup climbed 6% year over year to $4 billion, the same as in January. Delivery sales came in at $3.2 billion, jumping 37% from a year ago and advancing 6.7% month to month. Ship-to-home e-grocery sales continued to shrink in February, totaling $1.4 billion, down 6.7% from the previous month and 24% from a year ago.

Barrington, Ill.-based Brick Meets Click noted that ship-to-home now has the smallest online grocery sales share, at 16% in February, after having the largest share among fulfillment channels pre-COVID. Pickup garnered the biggest sales share for the month at 40%, with delivery close behind at 37%.

The grocery e-commerce user base remained approximately the same in February, with more than 68 million households buying groceries online during the month, down around 1% from 69 million in January but up about 11% from 60.1 million in February 2021. All three segments — pickup, delivery and ship-to-home — saw double-digit gains in their monthly active user (MAU) bases for February, with delivery generating the largest year-over-year gain at roughly 28%.

“New service providers, a broader range of retailers selling grocery-related products online, and services targeting faster cycle times contributed to delivery’s strong sales growth,” explained David Bishop, partner at Brick Meets Click, which focuses on how digital technology impacts food sales and marketing. “But even so, more shoppers still prefer pickup for range of reasons that will benefit this service model going forward.”

Fielded Feb. 26 and 27 conducted by Brick Meets Click, the study polled 1,790 U.S. adults who participated in their household’s grocery shopping and made an online grocery purchase in the previous 30 days. Delivery includes retailer and third-party services (e.g. Instacart, Shipt), while pickup includes in-store, curbside, locker and drive-up services. Ship-to-home sales cover online grocery purchases delivered by parcel couriers like Federal Express, UPS and the U.S. Postal Service.