Olympics, Super Bowl give Comcast NBCU biggest share of ad spending

Linear TV advertising sales slowed in February, leaving year-to-date linear TV investments up 6% so far this year compared to last year, according to Standard Media Index.

In January, linear TV sales were up 9%.

But sales remain down from 2020, before the COVID-19 pandemic hit the U.S. Compared to 2020, linear television ad sales are down 6% so far this year.

Broadcast TV sales are up 17% so far this year, offset by a 4% decline in cable. SMI said that TV sales were boosted by the Olympics, NFL Playoffs and Super Bowl LVl. So far, 2022 has been the best year ever for broadcast dollars.

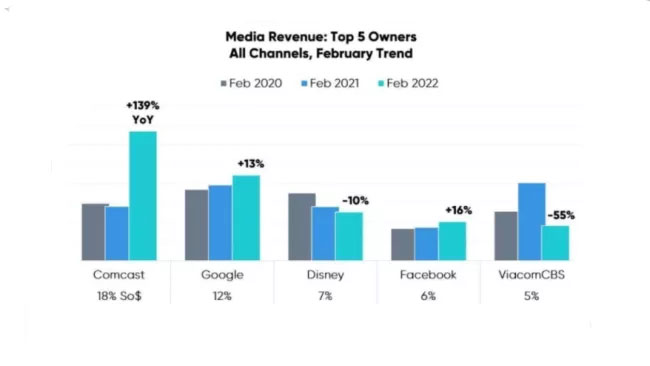

That made Comcast NBCUniversal, which carried those big sports events, a big winner. Comcast media revenue was up 139% in February, topping Google in the ad revenue tracked by SMI. Google was up 13%. Disney was down 10%, Facebook was up 16% and Paramount was down 59% after having the Super Bowl on CBS in February 2021.

Comcast’s share of ad dollars was 18%, followed by Google at 12%, The Walt Disney Co. at 7%, Facebook at 6% and Paramount at 5%.

Across all media, ad investment rose 15% year over year in February, leaving it up 17% so far in 2022.

So far this year, digital advertising is up 26% and accounts for 51% of all ad dollars.

Out of home jumped 116%, radio was up 16% and newspapers showed a 12% gain.

Magazines are down 27% so far this year.

SMI gets its figures from the invoices at all of the major holding companies and most major independents, representing 95% of national brand ad spending. ■