In March, delivery sales climbed 9.3% from February and were up 20.7% versus March 2021, Brick Meets Click reported.

By Russell Redman 1

Source: www.supermarketnews.com, April 2022

Online share dips to 13.1% of overall grocery sales in first quarter

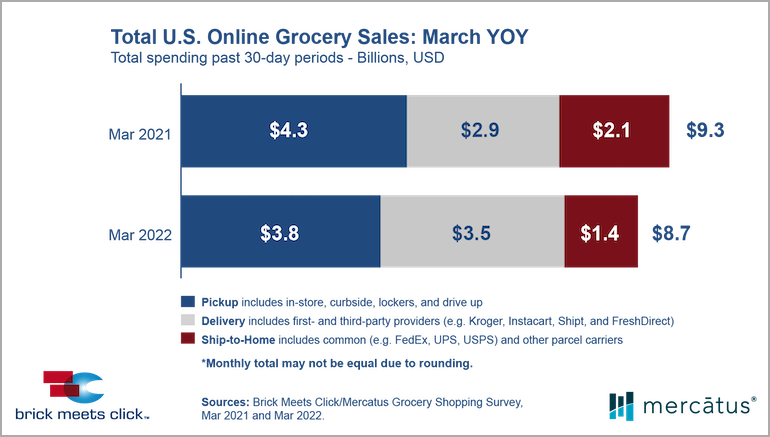

The U.S. online grocery market totaled $8.7 billion in March, the same as in February but down 6.5% from a record high of $9.3 billion a year ago, strategic advisory firm Brick Meets Click reported.

E-grocery sales through pickup in March came in at $3.8 billion, down 5% from $4 billion in February and an 11.6% decline from $4.3 billion in March 2021, according to the latest Brick Meets Click/Mercatus Grocery Shopping Survey, released Thursday. Delivery sales grew during March, up 9.3% to $3.5 billion from $3.2 billion in February and climbing 20.7% from $2.9 billion in March 2021.

Month-to-month, ship-to-home online grocery sales held firm at $1.4 billion for March, the same as in February. Still, that channel continues to shrink, as sales on a year-over-year basis fell by a third in March after a 22.2% drop in February.

For first-quarter 2022, online grocery sales totaled $25.9 billion, dipping 2.6% from $26.6 billion in the 2021 first quarter. Brick Meets Click noted that Q1 delivery sales rose 15%, while pickup and ship-to-home experienced respective year-over-year decreases of 2% and 29%. Ship-to-home ceded six points of market share to delivery, whereas pickup’s share held steady. Delivery accounted for 38% of e-grocery sales in Q1 2022 versus 46% for pickup and 17% for ship-to-home, the Barrington, Ill.-based advisory firm said.

Online grocery sales represented 13.1% of total U.S. grocery sales in the first quarter of 2022, down from 13.7% a year earlier. However, Brick Meets Click pointed out, combined delivery and pickup wallet share — excluding ship-to-home, a service not offered by most conventional grocers — has gained around 40 basis points, accounting for 10.9% of total grocery spending during the first quarter.

“Two factors continued to drive Delivery’s strong performance in March,” explained David Bishop, partner at Brick Meets Click, which focuses on how digital technology impacts food sales and marketing. “First, the aggressive expansion of third-party providers into grocery is enabling additional ways for people to shop online, and second, newer services focused on faster cycle times are appealing to a broader range of trip missions and usage occasions.”

Conducted March 28 and 29 by Brick Meets Click, and sponsored by grocery e-commerce specialist Mercatus, the study surveyed 1,681 U.S. adults who participated in their household’s grocery shopping and made an online grocery purchase in the previous 30 days. Delivery includes retailer and third-party services (e.g. Instacart, Shipt), and pickup includes in-store, curbside, locker and drive-up services. Ship-to-home sales cover online grocery purchases delivered by parcel couriers like Federal Express, UPS and the U.S. Postal Service.

The strong delivery sales growth in March reflects year-to-year increases of 13% in the number of orders placed by monthly active users (MAUs) and 7% in average order value (AOV), according to Brick Meets Click’s analysis. Meanwhile, click-and-collect saw order frequency fall by 8% and AOV by 4% from a year ago. The drop-off was much larger for the ship-to-home segment, which had a 13% reduction in the number of orders placed by MAUs and a 23% plunge in AOV.

By retail channel, online grocery cross-shopping between supermarkets and mass merchants continued momentum. In March, 29% of grocery’s MAU base also shopped online with mass, up about four percentage points versus a year ago. That followed an uptick of 1.3 percentage points in February, when the grocery/mass cross-shopping share was 26%.

Repeat intent, or the likelihood of an online grocery shopper to use the same service again within the next month, came in at nearly 64% for March, up 1.4 percentage points year over year. Month-over-month, repeat intent rates at mass retailers advanced eight points, whereas supermarkets’ intent rates declined more than five percentage points from February.

“A key takeaway from March’s report is that online grocery sales have retained much of the gains from a year ago, proving the resilience of grocery eCommerce,” according to Sylvain Perrier, president and CEO of Toronto-based Mercatus. “Even so, conventional grocers need to develop and strengthen their first-party web and mobile channels, leverage third-party solutions to fill in the gaps and excel at executing the services they offer.”