by Laurie Sullivan @lauriesullivan

Source: www.mediapost.com, April 2022

Borrell Associates plans to release its 2022 Benchmarking report on Wednesday, which estimates that local digital advertising will grow 9%, to $92.8 billion — accounting for two-thirds of all ad spending. By 2025, the firm expects it to account for 72% of all spending.

The report — 2022 Benchmarking Local Media’s Digital Revenues — identified that the amount of money local businesses invest in digital advertising continues to increase, but the annual growth rate has declined, dropping to single digits from two years ago.

There also has been a shift in the type of media that companies are buying.

When asked how much their digital ad revenue changed in 2021 and what they expect in this year, 53% of local media managers surveyed said that in 2022 they expect to see budgets grow between 1% to 24% — up from 38% in 2021.

Some 29% in 2022 — up from 27% in 2021 — expect to see budgets grow between 25% and 49%. About 42% saw revenue grow 25% or more last year, while 40% expect that type of growth this year.

About 14% of digital advertising remains in local markets, spent with local-based media companies that offer local businesses a variety of marketing products rather than just one. Borrell calls this amount “Obtainable Digital Revenue.”

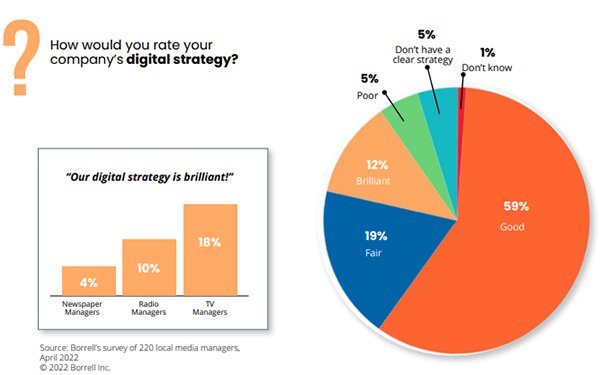

One major change identified among the 220 local media managers participating in the study — which was fielded between April 1 and April 6, 2022 — is that as 2022 progresses, more local media companies will adopt streaming video advertising, or over-the-top (OTT) media.

Of those completing the survey, 28% work for print media, while 30% work for broadcast TV or cable TV, 36% work for radio, and 6% for a combination of those companies or for local pure-play online media.

The data suggests that OTT is already the largest source of digital revenue for 17.7% of local media companies.

The data shows that local businesses shifted spending during the COVID-19 pandemic from paid search supported by companies such as Google and Microsoft Bing to targeted banners via social media and to OTT.

Borrell’s survey of 220 local media managers from April 2022 said the bestselling digital products in 2022 include:

- OTT/CTV/Video 36%

- Targeted Banners 16%

- Banner Ads 9%

- Geo-fencing 6%

- SEM/SEO 4%

- Streaming Audio 4%

- O&O Site Banners 3%

- Programmatic 3%

- Social Media 3%

- Sponsored Content 3%

- Email 2%

- Recruitment Ads 2%

- All Others 8%