By Vincent Salandro

Source: www.remodeling.hw.net, August 2022

As economic conditions change, remodeling remains exceptionally strong for 2022, but the rate of growth is expected to fall sharply in the long term.

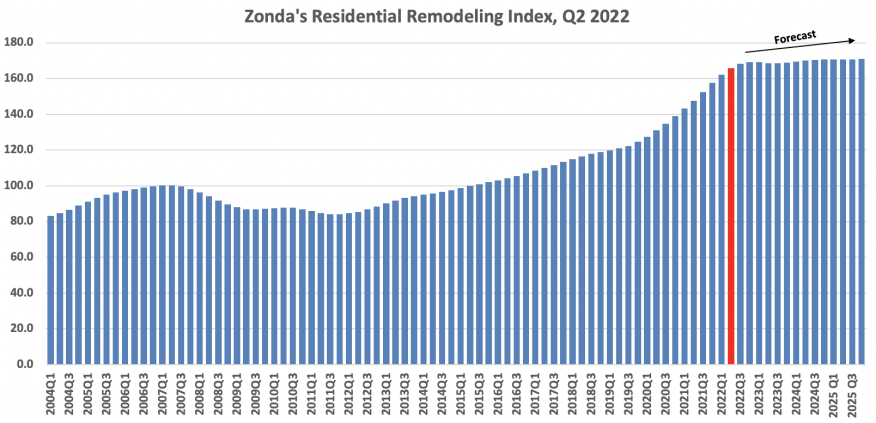

Zonda’s Residential Remodeling Index (RRI) posted a record-high reading of 166.0 in the second quarter of 2022, a 2.3% increase from the first quarter and a 12.4% gain on a year-over-year (YOY) basis. According to the latest estimates, the RRI grew 12.9% in 2021, which was the strongest increase in the RRI’s history dating back to 2004. The latest RRI reading indicates big-ticket remodeling activity is 66% higher than the baseline year of 2007, the peak year of remodeling activity in the 2000s.

Zonda forecasts the RRI will grow 10.7% for all of 2022 before leveling off into “much more moderate” growth rates of 1.4% in 2023, 0.8% in 2024, and 0.4% in 2025. Zonda says the strong estimate of remodeling growth is due to higher expectations for home price appreciation compared to the previous two RRI releases. Despite slowing home sales, the national median sales price of existing homes was up 13.4% year-over-year in June and Moody Analytics, the forecast source for the RRI variables, boosted their 2022 home price projection.

Due to price growth, low housing supply, and the “extraordinary run-up over the last two years,” homeowners have record levels of home equity, which supports continued confidence and the ability to finance home improvement projects, according to Zonda. Existing home sales are expected to continue declining through next year, but the decrease in housing turnover is only expected to amount to a small impact on remodeling activity. Due to higher mortgage rates, non-movers who have locked in low mortgage rates over the years will be more inclined to stay put and upgrade their homes. Zonda says the remodeling industry can weather declines in existing home sales, but “not large declines in home prices, incomes, or a collapse in credit.” While employment remains “surprisingly strong,” the economy is susceptible to the possibility of stagflation, which Zonda says is weighing down the growth outlook of the RRI’s economic variables.

The RRI estimates the number of pro-worthy remodeling projects undertaken in 2021 was 16.2 million. Zonda projects the number of projects will increase to 17.9 million projects in 2022, and will reach 18.4 million by 2025.

As part of the RRI estimation, Zonda predicts that 383 metropolitan statistical areas are expected to see growth in annual project volume. Among the markets expected to see growth, the average growth rate is predicted to be 10.9%.