(Image credit: Nielsen)

By

Source: www.nexttv.com, November 2022

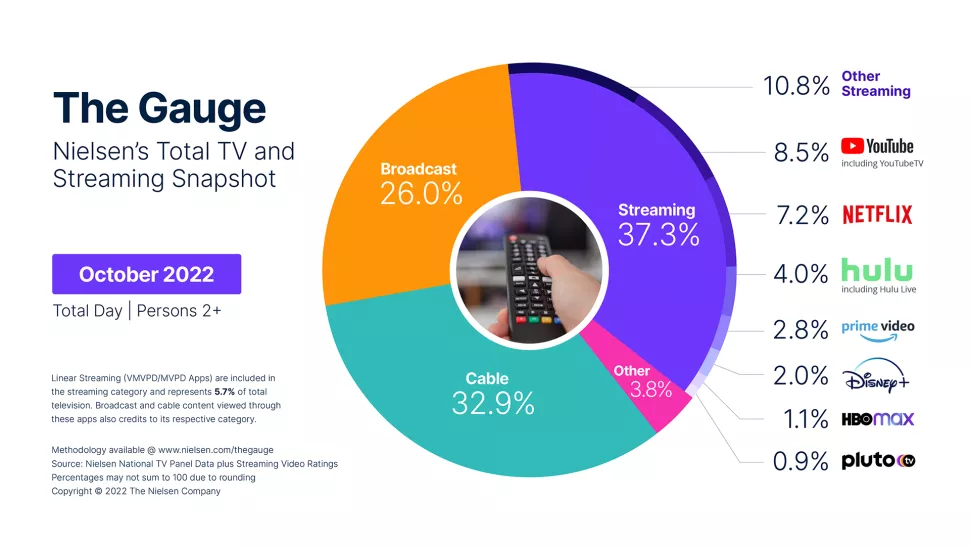

Nielsen says cable’s share drops to 21.9%

TV usage rose 2.2% in October, with streaming and broadcast increasing their share and cable falling to a new low, according to Nielsen’s latest monthly report.

Total viewing was up 2.8% from a year ago in October.

Broadcast viewing increased by 9.8% from September, and its share grew to 26% from 24.2%. With the new TV season in full swing, viewing of shows in the general drama category jumped 42% and sports viewing climbed 25%. Drama represented 27% of broadcast usage and sports accounted for 25%.

Compared to a year ago, broadcast usage was down 6.2% and it lost 2.5 share points.

Streaming’s share edged up to a new record at 37.3% from 36.9% and usage increased 3.3% Streaming usage is up 35.1% from a year ago, when it had a 28.4% share.

October was a mixed month for individual streaming services. YouTube’s share jumped to 8.5% from 8% in September. Netflix’s share fell.to 7.2% from 7.3%.

Hulu rose to 4.0 from 3.8%; Amazon Prime Video dipped to 2.8% from 2.9%, Disney Plus rose to 2% from 1.9%, and HBO Max fell to 1.1% from 1.3%

Pluto TV, which made the list for the first time in September for cracking the 1% share mark, stayed on the list in October, despite dipping to a 0.9% share.

Nielsen notes that despite slower viewing growth in October, most streaming services are still way up from last year. Viewing of Disney Plus is up 46.5% and its share increase to 2% from 1.4%. Netflix is up 9.1% in viewing and its share is 7.2%, compared to 6.8% and Prime Video is up 35% with its share growing to 2.8% from 2.1%.

Viewing of virtual multichannel video programming distributors represented 5.7% of total TV usage and 15.4% of streaming.

Cable’s share has dropped every month since March 2022, hitting 32.9% in October, compared to 33.8% in September. Compared to a year ago Cable viewing was down 8.6% and 4.1 share points. ■