by Laurie Sullivan @lauriesullivan

Source: www.mediapost.com, January 2023

U.S. agencies anticipate the cost of running digital campaigns will rise by 22% in 2023, according to a report released Wednesday.

The cost of social will increase the most, suggests the data in Criteo’s report The Advertiser’s Guide to New and Emerging Channels in 2023.

Overall, the cost to run global digital campaigns will rise 25% on average, according to Criteo.

The findings suggest rising costs will leave clear priorities when it comes to campaign measurement. Cost-per-order is now a top metric for advertisers, alongside overall return on ad spend.

Criteo surveyed more than 800 senior agency professionals across the U.S. and EMEA to understand the various areas of major digital media channels.

Incrementality is becoming a key concept in measurement, with cost-per-order now a top metric alongside overall return on ad spend (ROAS), according to the report titled The Advertiser’s Guide to New and Emerging Channels in 2023.

The metric is turning agencies further toward retail media, which offers first-party commerce data that helps measurement on other emerging channels such as connected television (CTV).

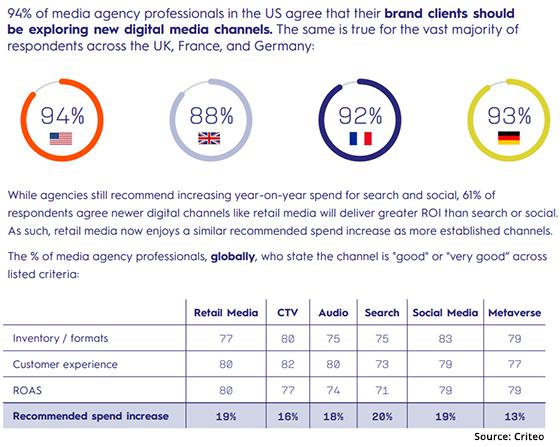

Retail media scored the highest for ROAS, with the majority of U.S. media agency respondents agreeing this will deliver greater return on investment (ROI) than search or social.

CTV scored the highest for consumer experience, whereas the metaverse scored the lowest for audience-targeting options, but saw high interest for shoppability and ad formats.

Still, with the correct strategy, the data shows 55% of media agency professionals are confident growth for clients is possible.

Growth and innovation remain among clients’ most pressing goals, according to survey respondents. By contrast, just one in five, 21%, choose survival, indicating few are concerned about clients weathering the storm.

Growth, however, is tied to the exploration of new media channels. Some 32% said economic conditions, and 45% said data privacy regulations will shape media strategies during the coming year.

Still, 94% of media agency professionals in the U.S. agree that brand clients should be exploring new digital media channels. The same is true for the vast majority of respondents across the U.K. (88%), France (92%), and Germany (93%).

Economic pressures persist, but 79% of U.S. agency respondents rule out any need for clients to adjust the price of products. It really comes down to ensuring customers remain loyal. That means focusing on meaningful result, with 51% of agency respondents recommend brands focus on performance versus 45% who say brand awareness.

Retention is recommended by 47% versus 40% who say acquisition. The importance of commerce data in proving incrementality requires more omnichannel thinking. While 28% of U.S. agencies say they’re currently merging sources of offline audience data with online data, 54% of respondents say improving omnichannel campaign management will become a key focus area over the next year.