, Bloomberg News

Source: www.bnnbloomberg.ca, March 2023

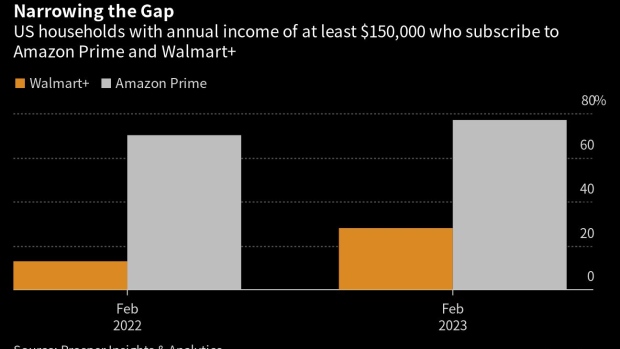

(Bloomberg) — Walmart Inc.’s online subscription service is narrowing the gap with Amazon.com Inc. in a key demographic: affluent shoppers.

Launched in 2020 as a competitor to Amazon Prime, Walmart+ is resonating with higher-income households eager to fend off inflation. At $98 a year, Walmart+ costs $41 less than Prime and offers many of the same perks, such as shipping discounts and video streaming. Walmart’s subscription service also has benefits Amazon can’t match, including discounted fuel at gas stations around the US.

In February, 28% of US households with annual income of at least $150,000 were members of Walmart+, up from 13% a year earlier, according to Prosper Insights & Analytics, which conducts monthly consumer surveys. Amazon Prime still has a commanding lead with 77% of those households, up 7 percentage points from the previous year.

Walmart’s inroads with this cohort mirror what’s been happening in its stores as the company gradually sheds its reputation as a destination for lower- and middle-income shoppers. Attracting and hanging onto wealthier customers is now a key priority for the company, and executives see e-commerce as a big selling point.

Walmart+ is benefiting from the same “flywheel” effect Amazon experienced when it launched Prime in 2005: As Walmart attracts more shoppers, it lures more brands, which in turn bring in even more shoppers.

Besides borrowing Amazon’s online playbook, Walmart is capitalizing on a network of stores located within 10 miles of 90% of Americans. Shoppers can pick up online orders from their closest Walmart. America’s largest grocer also has a decided advantage in fresh food, a market Amazon has been trying to crack for years. Walmart+ offers members free delivery on orders of at least $35. Amazon last month raised its free grocery delivery threshold to orders of at least $150.

“Walmart is eating into Amazon’s e-commerce market share and legitimately becoming a competitor,” said Alasdair McLean-Foreman, founder and chief executive officer of Teikametrics, a Boston-based software firm that helps merchants buy advertising on Amazon, Walmart and other platforms. “People are seeing Walmart as a viable marketplace, and that wasn’t the case in 2019 or 2020.”

To be clear, Amazon remains the undisputed king of online commerce in its home market. US shoppers will spend $431 billion on Amazon this year, almost six times the $74 billion they’ll spend on Walmart, according to Insider Intelligence. Walmart is expected to have 6.3% of the US online market this year, a fraction of Amazon’s estimated 37.6% share.

Still, Walmart is gradually gaining on Amazon. In 2020 the company surpassed EBay Inc. as the second largest e-commerce player in the US. And there are signs that the Bentonville, Arkansas-based retailer will continue to gain momentum. Walmart+ members skew younger than Amazon Prime members, a promising trend for Walmart if it can hang on to them. About 65% of Walmart+ members are between 18 and 44 years old, compared with 51% for Amazon Prime, according to Prosper.

Walmart+ has plenty of room to grow. About 11 million US shoppers are “very likely” to subscribe to the service, adding to the approximately 18.5 million existing members, according to a February survey conducted by Morgan Stanley. Meanwhile, Amazon Prime had 168 million members in the US as of December, unchanged from a year earlier, according to Consumer Intelligence Research Partners.

Amazon spokesman Bradley Mattinger disputed that the subscription service has stopped growing. “Prime membership continues to grow — in the US and worldwide — as the value members receive continues to increase,” he said.

Walmart’s online advertising business is a fraction the size of Amazon’s. But here, too, Walmart has an advantage because it can provide brands with data on how shoppers spend not just online but also in stores, said Sreenath Reddy, the founder and CEO of Intentwise, which helps clients place ads on web marketplaces. Walmart.com is also less crowded than Amazon.com, with about 135,000 merchants compared with some 2 million on Amazon. That makes it easier for brands to stand out on Walmart, he said.

“I think Walmart+ is about more than just handing savings to people,” Reddy said. “It’s connecting the online and offline world in a way that wasn’t possible before.”

©2023 Bloomberg L.P.