Author|Bill Harvey

Source: www.mediavillage.com, April 2023

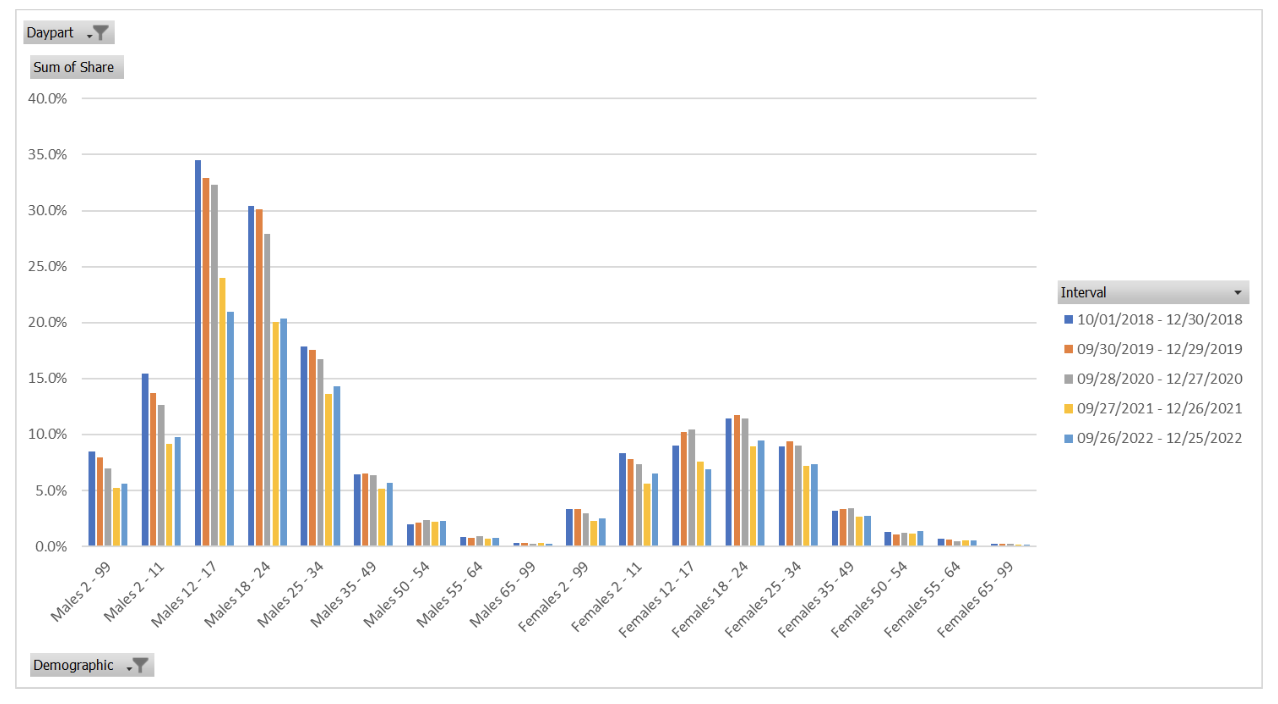

Some would say that videogames are not even a part of television, let alone an important part of it. Nielsen has two different measures of the total use of television, the traditional Homes Using Television (HUT) which includes all the normal TV programming we have always associated with the medium, and TUT (Total Use of TV Set) which includes videogame usage, use of Blu-Ray devices, and in the near future might include virtual reality. So, videogames are a part of the use of the TV set, and the share of audience that is playing a game versus watching a normal TV show has been growing steadily over the years and peaked during Q4 2018 at nearly a 35 share among Males 12-17 and over a 30 share among Males 18-24. Even in Q4 2022 videogame share among Males 12-24 remained over 20%.

TREND IN VIDEOGAME SHARE OF TOTAL USAGE OF TELEVISION

Perhaps it’s a healthy sign that videogame usage is moderating a bit. Maybe it means that young men are getting out more and experiencing life itself, hopefully having gained something of permanent value from their many role-playing simulations. Often people ask, “Whatever happened to interactive TV?” Perhaps in retrospect the answer is that interactivity in television became dominated by videogaming.

READ MORE

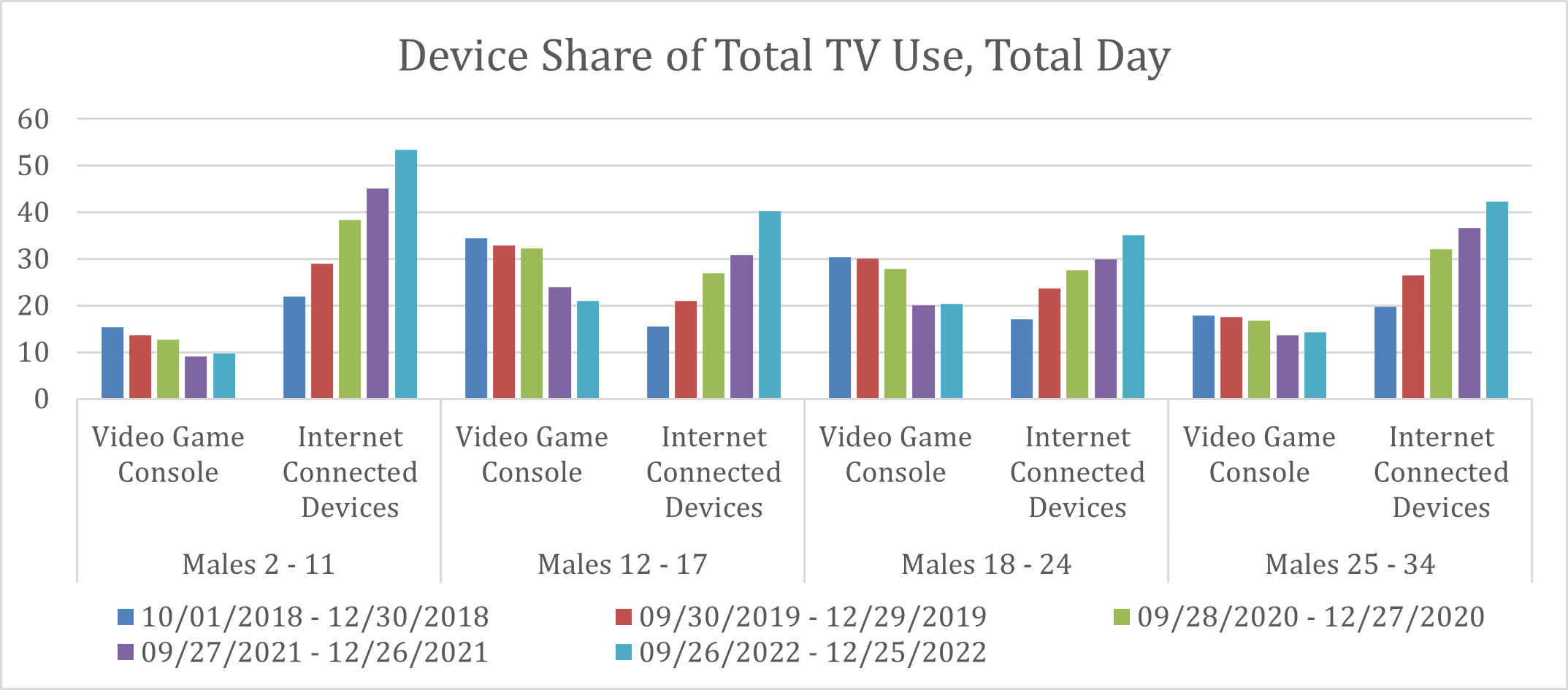

The main reason for the cutback in the extremely high levels of videogame usage turns out to be streaming. Nielsen Chief Research Officer Pete Doe suspected as much. We ran an analysis to see if he was right, and he was, as can be seen from this graph:

Streaming approximately doubled its U.S. young male usage from 2018 through 2022 based on the above graph. We would guess that the great increase in the availability of free trials and ad-supported streaming provided a tempting alternative to videogames which had not existed before.

There is other evidence that videogames have reached a peak and may be levelling off. For 2022, the Entertainment Software Association and NPD Group (now merged with IRI as Circana) reported a 5% drop in overall U.S. videogame sales (to $56.6B) compared with 2021, even though U.S. console sales were up 8% at $6.57B in 2022 as one component of the total. The U.S. is only about a quarter of the global market for videogames while China is about half of it, according to Variety, making the global videogame market about $230B in 2022. However, bullish projections for further growth continue to be published. (When virtual reality merges with videogames, look out!)

To the extent that certain brands aim at the 18-34 audience, videogames should play an important role in the media mix. The granular demos in which videogames have over a ten share include Males 2-49 and Females 2-34. In the last week of March, out of 6964 telecasts on broadcast/cable, the number of telecasts in the U.S. with over a ten share of HUT against Adults 18-34 is a mere 23 (0.3%), and 14 of them are live sports events (thank you Peter Katsingris @Nielsen!) which as we all know have some of the highest CPMs on TV because of their known high ROI effects. Somehow, I suspect that a high reach sports schedule is not necessarily going to have high reach among gamers.

How are advertisers using videogames? Dave Morgan, who led newspapers into digital in the ’90s, and as TACODA led digital into addressable behavioral targeting in the ’00s, also as Simulmedia led television into ad-supported videogaming in the 10s. When I asked Dave about how he is managing to insert ads into videogames, he replied: “At Simulmedia, we use our TV+ ad platform to help advertisers and agencies find their target audiences in a de-duplicated way across all of streaming and linear TV, and now AAA video games. The platform is powered by Nielsen’s core respondent viewer data, but also by second-by-second viewing data from 10’s of millions of smart TV’s and set-top boxes in the U.S., as well as Simulmedia’s proprietary PlayerWON ad serving technology for console and PC-based video games. Linking all this together helps marketers reach their audiences with certainty, efficiency, speed and unmatched transparency.”

I pressed him for more details on how the user experiences those ads in videogames. “The PlayerWON ads are deployed primarily on free-to-play multiplayer games,” he replied. “They are full screen, connected TV creatives (15’s and 30’s) that are opt-in, skippable and typically tied into the video games rewards currency. When players are at natural breaks in play, such as waiting in queue for other players to show up, they are promoted to see if they would like to watch an ad or two. If they consent, the ads take over their screen. If they watch it in full, they are credited with points in the game’s reward program.”

This seems to me to be a psychologically appropriate way to get ads into a videogame without having a backfire effect from players. I bet Dave is going to have some data soon on the ROI of this approach. Given how hard it is to reach Males 18-34 in general, and the continued massive popularity of videogaming, it looks as if Dave’s track record is going to go on and on.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author’s views and do not necessarily represent the views of MediaVillage.com/MyersBizNet.

Bill Harvey

Bill Harvey, who has just won an Emmy® Award for his invention of set top box data, has spent over 35 years leading the way in media research with pioneer thinking in New Media, set top box data, optimizers, measurement standards, privacy standards, the … read more