by Joe Mandese @mp_joemandese

Source: www.mediapost.com, May 2023

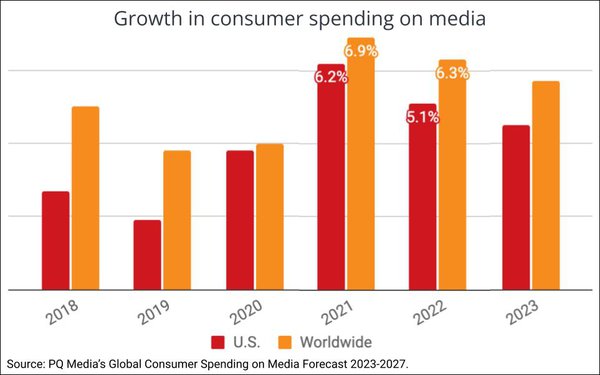

After surging in response to the COVID-19 pandemic, growth in consumer spending on media is trending downward once again, both in the U.S. and worldwide, according to the latest edition of PQ Media’s annual forecast.

Globally, consumer spending on media — both content and technology — decelerated to 6.3% (rising to $2.186 trillion) in 2022, following 2021’s 6.9% surge, which was the strongest growth in a decade.

In the U.S., growth in consumer spending on media decelerated to 5.1% (rising to $510.2 billion) in 2022, down from a gain of 6.2% in 2021.

While the U.S. remains the largest consumer media marketplace — accounting for 23.3% of worldwide consumer spending — it is expanding at a slower rate than the rest of the world.

South Africa was the fastest-growing of the top 20 consumer media markets, rising 9.8% in 2022.

Going forward, PQ forecasts consumer spending on media will “lose even more steam during the 2023-2027 period, as the pandemic-driven forces that sparked unexpected spending surges in many media and tech categories in 2020-2021 continue to fade,” PQ CEO Patrick Quinn states, noting: “While the pandemic effect briefly interrupted key secular trends in that two-year period, this was simply a near-term disruption of long-term industry trends that will continue over the next several years, resulting in slower growth or outright declines across various digital and traditional media content and tech categories.”

In addition, macroeconomic headwinds, such as inflation, interest rate hikes, regional banking failures and geopolitical tensions, have led many consumers to trim discretionary spending budgets. For example, broadband internet access, computer tablets, DVD players, pay-per-view and print book clubs posted their lowest growth rates ever in 2022. Economic uncertainty led to end-user spend being curtailed on items that posted growth spikes during the pandemic, such as streaming video services and print books.