Even older generations, who are typically slower to adopt digital technologies, are now going online at higher rates than ever before.

Tyler Renaghan|VP of Retail, Upside

Source: progressivegrocer.com, June 2023

Recent news coverage has once again put print circulars in the spotlight, particularly with Kroger’s recent move regarding changes to its print circulars. In April, Kroger made waves by revealing the phaseout of mailed circulars nationwide. It’s evident that print circulars are no longer an effective customer acquisition tool for grocery stores. There are several compelling reasons that it’s best to leave them in the past.

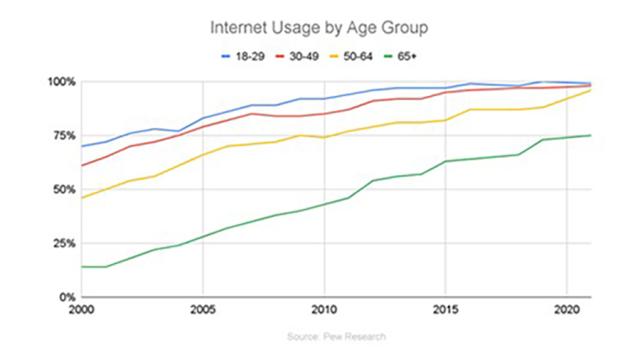

To begin with, consumer buying habits have drastically changed in the digital age. Even older generations, who are typically slower to adopt digital technologies, are now going online at higher rates than ever before.

Print circulars fail to meet customers where they are — on their phones — or when they are deciding where to buy. Moreover, the lack of engagement data from print circulars leaves retailers in the dark about whether customers even look at those circulars, let alone whether they lead to incremental purchases. This lack of information about a grocer’s return on investment is increasingly problematic as the cost of print circulars continues to rise. Production, printing and distribution expenses add up quickly, with the U.S. Postal Service estimating that a direct mail campaign targeting 1,001-5,000 households can cost as much as $7,400, with an unknown return. In some cases, retailers have unintentionally stopped sending print circulars for extended periods, only to find that sales remained unaffected.

To serve customers online, grocery retailers with the necessary resources have embraced digital circulars. Digital platforms are far more advanced in measuring customer engagement and have seen a lot of success. Retail apps are the second most engaging app category after games, with an average of 60 interactions per session. In terms of profitable customer acquisition, however, transitioning to digital circulars alone is insufficient.

Digital circulars offer the potential for tracking and attributing their impact, but their ability is limited. Commonly used QR codes, for instance, provide insights into only a single transaction and don’t capture the customer’s lifetime value. Even when QR codes are employed, they often result in an accelerated sale, with customers using them to stock up on pantry essentials, especially frequently purchased center store grocery items. While this may provide an initial boost in sales, it carries the risk of cannibalizing future sales, since the customer may not need to make additional purchases in the near future.

Also, whether they’re print or digital, circulars have limited reach. Direct mail campaigns based on ZIP codes reach only a fraction of a store’s potential market, and the distribution of digital circulars is often limited to an existing customer base or the email addresses a grocer can acquire.

Finally, circulars lack personalization, which affects the grocer’s return on investment. Circulars promoting blanket-item or category-level offers disregard customer preferences and often cannibalize a grocer’s expected profits. According to the USDA, the average household is 2.2 miles from the nearest supermarket, yet consumers travel 3.8 miles to their usual supermarket.

Digital advertising and marketplace platforms offer clear advantages over circulars. Unlike circulars, they’re not limited by ZIP codes or geofences, allowing for broader targeting and reach. Plus these platforms can deliver personalized promotions directly to consumers’ mobile phones, effectively driving real behavior change by presenting the right promotion at the right moment. This personalized approach caters to individual preferences and needs, ultimately leading to profitable in-store visits.

Digital marketplaces and marketing platforms also allow real-time adjustments based on available margins and inventory requirements. For example, marketplaces can enable dynamic promotions that determine the lowest discount rate necessary to incentivize users to make a transaction, ensuring profitability and the ability to respond to market trends. In contrast, circulars offer a fixed, static discount rate and lock in customer expectations in advance, often leading to shortages or surpluses of advertised products. Consequently, regularly priced items go out of stock 8% of the time, while discounted items suffer from shortages more than 10% of the time.

Grocers that continue to use circulars are overspending on an outdated customer acquisition tool that fails to demonstrate its value. The weekly circular hinders investment in more personalized, proven and profitable methods to expand market share. It’s time for grocers to embrace the digital age fully and adopt measurable and targeted alternatives that leverage consumer behavior insights to drive growth. By leaving print circulars behind, grocery stores can unlock the true potential of customer acquisition in the modern era.