Source: www.mediavillage.com, October 2023

Whip Media’s fifth annual SVOD study, based on the responses of 2,000 U.S. users of its TV Time (Whip Media’s TV and movie tracking app used by more than one million consumers) provides all new visibility into overall consumer satisfaction with today’s major streaming platforms, including Netflix, Disney+, Max, Apple TV+, Hulu, Peacock, Paramount+, and Amazon Prime Video.

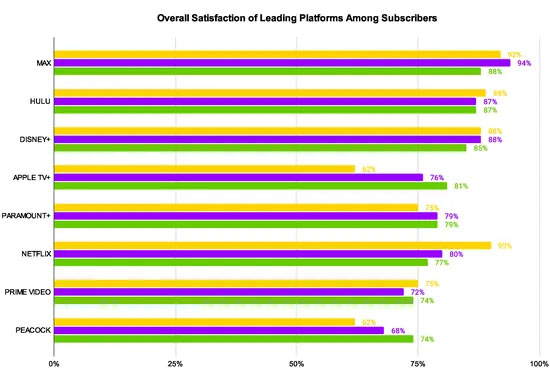

When we first fielded the study in 2021, 30 points separated the platform with the highest satisfaction (Max, 92%) and the lowest (Peacock, 62%). The spread contracted to 26 points in 2022 and 14 points in 2023, or a 53% decrease over the last three years.

This year’s study shows that subscriber satisfaction among the top tier of platforms, as a function of content quality, variety and derived product value, is gradually declining while midtier platforms rise in satisfaction. The narrowing competitive SVOD market indicates that there is high demand for showing the right mix of original and library content while consistently maintaining a delightful viewer experience — all of which subscribers have come to expect as part of overall value.

The top three platforms are the same as last year, but the order has changed. Max held on to its #1 position. Hulu is ranked #2 and showed no change in overall satisfaction from last year. The Disney majority-owned platform is only one point behind Max (87% vs. 88%).

“We’re so proud that Max continues to lead the industry in overall viewer satisfaction, said Lori Locke, Executive Vice President and Chief Accounting Officer, Warner Bros. Discovery. “Warner Bros. Discovery is committed to delivering the quality programming, experience and value that have made Max the go-to network for our tens of millions of viewers – something that is clearly reflected in this report.”

Midtier platform trends accelerate as overall satisfaction rises

The midtier of streaming platforms, including Apple TV+, Hulu, Peacock, Prime Video and Paramount+, are rising in overall satisfaction due to their strength in quality and variety of programming, and user experience.

Apple TV+ took the spotlight and is ranked #4 in overall satisfaction among subscribers, increasing +5 points from last year to 81%. Apple TV+ remains solidly ahead of Netflix and Prime Video in overall subscriber satisfaction.

Hulu continues to return solid satisfaction in the quality and variety of originals and across other measurements. The platform exhibits a relatively stable performance with a three-year average overall satisfaction of 88%.

Notably, Peacock showed the largest gain in overall satisfaction, increasing 6 points to 74%, and was galvanized by subscribers’ strong reception to the quality of its original content.

Weakening trends among platform leaders persist

This year, Netflix is joined by the previous leaders in satisfaction, Max and Disney, ranked #1 and #2 in 2022, respectively, in attempting to respond to broad pressure across content and engagement measurements that indicate changing customer perceptions of leading service value.

Netflix continues to fall in satisfaction from 2022 and 2021, declining 3 points and 13 points, respectively; yet, the veteran streamer still holds on to the top rankings in the categories of user experience and programming recommendations, which subscribers have rewarded since 2021. Compared to other major platforms, in 2023 Netflix has experienced greater value perception issues in addition to a challenging operating environment. More significantly, the platform’s #1 rank in the category of “indispensability” also weakened for a third year.

Disney was hit particularly hard in the categories of quality and variety of original series. While 77% and 71% of respondents are satisfied with Disney’s quality and variety of originals, respectively, the platform shed 7 points in each category from last year – the largest decline of all SVODs.

Max held on to its #1 position while experiencing its largest decline in overall satisfaction among all SVODs, falling 6 points to 88% from 94% last year. Max carries strength in the quality of its original programming and is still ranked #1 for a second year in a row while declining 3 points.

How to navigate the evolving SVOD market

This year’s survey demonstrates that overall satisfaction among the top tier of streaming platforms – Netflix, Disney+ and Max – is waning, while the major mid-tier service players – Apple TV+, Hulu, Peacock, Prime Video and Paramount+ – have been boosted in satisfaction and rank. Shifting consumer preferences are shaping new content and delivery opportunities at the expense of the higher fee platform leaders, and to the benefit of midtier platforms.

We asked subscribers if they planned to spend more, less, or the same amount of money on streaming services in the next year. Among the 30% of subscribers who said they plan to spend less, 52% said canceling their service(s) “indefinitely or temporarily” were the most common actions, respectively. Notably, 37% said they would use more free streaming services, also known as FAST channels, which is an accelerating global trend in how audiences are consuming media.

Subscriber churn and optionality are both increasing as millions of users are willing to substitute new streaming platforms – even if temporarily – to reach a most resonant mix of original and library content. SVOD players must make smart and data-informed strategic content decisions to keep their paying customers engaged and understand how to appeal to viewers who still seek a traditional, linear television content viewing experience.

You can access Whip Media’s full 2023 Streaming Satisfaction Survey at this link.

This article was written by Debbie Neveu, Senior Vice President of Transformation for Whip Media, the entertainment industry’s leading content performance tracking, revenue reporting and content intelligence platform. Neveu is an entertainment, finance, and business transformation executive with 20 years of experience working with iconic media and entertainment brands.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author’s views and do not necessarily represent the views of MediaVillage.org/MyersBizNet.