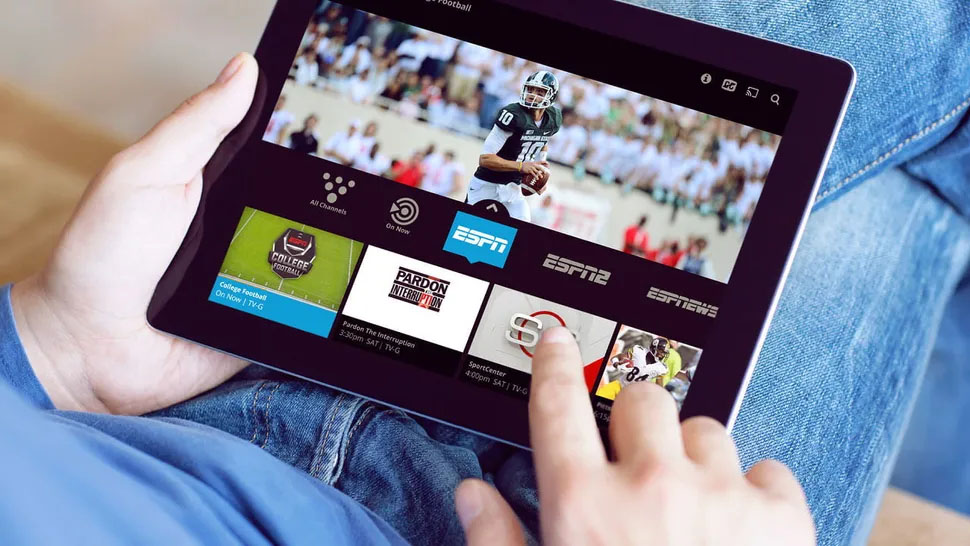

(Image credit: Sling TV)

By

Source: www.nexttv.com, November 2023

Virtual pay TV companies now control more than 20% of U.S. pay TV. And since they’re not beholden to traditional broadcast retransmission rules, that’s bad news for station groups

On the surface, cord-cutting in the third quarter didn’t look too bad, according to the first glance at Leichtman Research Group’s latest tally of the top operators serving 96% of the U.S. market.

Domestic pay TV companies lost just 465,471 customers, with huge collective gains by virtual MVPDs YouTube TV, Hulu+Live TV, Sling TV and Fubo (+1.33 million subs) offsetting to a large degree losses by traditional MVPDs.

In fact, for the first time, vMVPDs now control more than 20% of the market tallied by LRG.

But with virtual operators not subject to the same FCC broadcast retransmission rules as linear companies, this is bad news for station owners. Not only are there fewer U.S. pay TV homes due to cord-cutting, the ones that are left are increasingly those for which broadcasters have far less leverage in terms of negotiating retrans revenue.

Case in point: Gray Television’s indie KTVK-TV in Arizona, now the local TV home of the Phoenix Suns, which is about to be pulled off increasingly powerful YouTube TV.

“We think the third quarter reiterates the weakness in some of our companies due to their high exposure to pay TV decline,” wrote Steven Cahall, media analyst of Wells Fargo.

Cahall published retrans revenue vs. their overall revenue for some of the biggest and most exposed U.S. broadcasters:

Nexstar Media — 54%

Sinclair Broadcast Group — 53%

Fox Television Stations — 49%

Tegna — 47%

Gray Television — 41%