Thanks to retransmission consent agreements between local TV stations and cable/satellite companies, total local television station revenue totaled $28.4 billion in 2016, data released today (4/20) from BIA/Kelsey finds.

In 2016, stations received approximately $6.8 billion from retransmission agreements made individually or through ownership groups with cable and satellite providers in every market.

Adding to this revenue, local television benefited from increased election advertising in numerous states and also experienced double-digit growth through its digital media offerings.

“The dependence on retransmission fees has become incredibly important to local stations and many publicly traded ownership groups because it amounts to nearly one-third of their revenue,” said Dr. Mark Fratrik, SVP and chief economist at BIA/Kelsey. “The fees provide a sound financial basis for the stations and have also become the foundation for many of the larger stations. Our analysis also uncovered that even mid-size and smaller market stations are increasingly relying on the income provided by these fees.”

For the first time, BIA/Kelsey’s Media Access Pro and its Investing In Television Market Report include retransmission consent estimates on local television.

Although the agreements are not made public, BIA/Kelsey developed a modeling formula that used its public information and industry knowledge to provide a deeper examination into the revenue streams for each station.

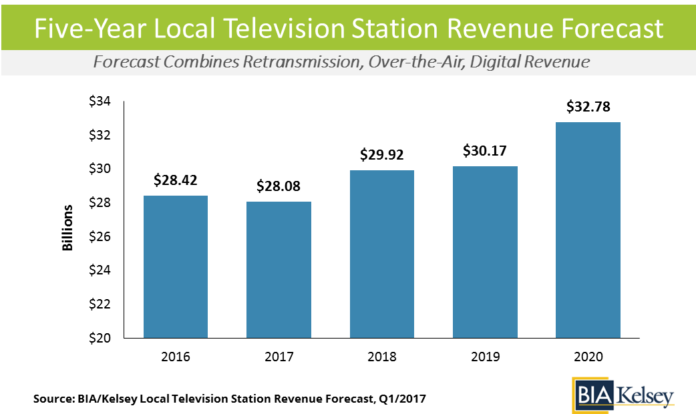

BIA/Kelsey’s new estimates predict that on a market-by-market basis, retransmission fees will continue to rise over the next five years, based on specific household growth rates, as well as expectations on price increases and consumer behavior.

Additionally, television has been experiencing strong growth in over-the-air (OTA) revenues, which is attributed to local television’s continued ability to reach high concentrations of the population.

While presidential election years typically add an uptick in advertising, it appears that statewide and local races, in particular, added significantly more to station revenues.

Three such markets include Reno, NV; Charlotte, NC; and Springfield, MO where advertising revenue increased by more than 30 percent in 2016. The industry’s OTA advertising revenue increased by 11.4% in 2016 but in 2017 BIA/Kelsey predicts that OTA revenue will decrease by 4.1%.

Digital revenue for the television industry grew to $1.006 billion, a 10.4% increase over 2015, as local stations improved their social media and online activities. BIA/Kelsey expects digital revenues to increase another 8.8% in 2017. The chart below shows the total revenue for the local television station industry for 2016-2021.

“Stations continue to embrace the digital innovations that bring them viewers and that effort is paying off in increased local ad revenues,” said Fratrik. “The local television markets are remaining healthy and will remain that way in the foreseeable future as long as they continue to improve their news, weather and programming options across all channels.”