-

Broad data on employment, sales and job openings remain solid

-

E-commerce boom is shaking out some traditional retailers

A furious pace of store closings and bankruptcies has drummed up fears that U.S. retail is collapsing. Not so fast: Many indicators suggest that retail employment is unlikely to shrivel and the economy will withstand any shock from the sector’s rout.

Granted, the industry’s current woes can’t be ignored. Retail sales account for almost half of consumer spending, which in turn makes up about 70 percent of the economy. Retailers employ 15.9 million people, or about one in every 10 U.S. workers, and positions at certain types of stores may become harder to find.

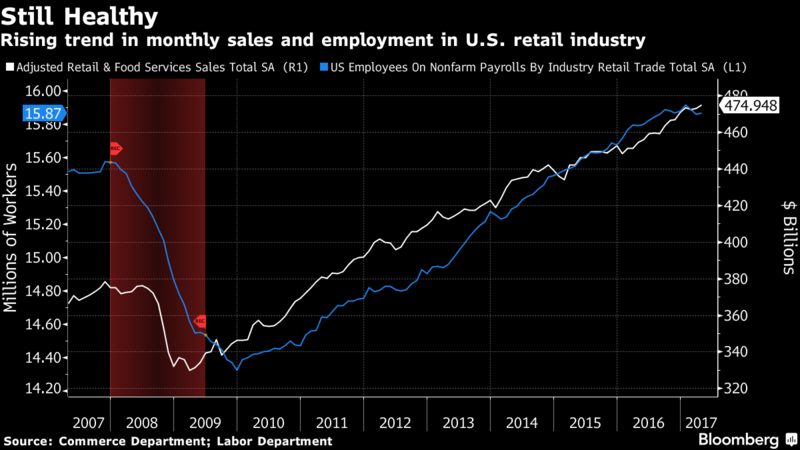

For starters, the broad trend in retail purchases is moving higher: Excluding auto dealers and gas stations, sales were up an annualized 4.6 percent over the past three months. Even with recent job losses, retail headcount is close to its 12-month average. Such figures suggest the industry is hardly about to shrink or fade away.

Even with the “eye-catching headlines about store closings” and other recent struggles in retail, “we don’t see much of an effect on retail employment and therefore on consumer spending,” said Robert Sockin, an economist at UBS Securities LLC, which issued research last week titled “Reports of Retail’s Death Have Been Greatly Exaggerated”. “As long as there’s demand for workers and the consumer stays healthy, that will keep the retail sector buoyant.”

It’s true that store closings are already outpacing those of 2008, when the U.S. was in a deep recession, according to an April 6 report from Credit Suisse. About 2,880 announcements so far this year exceed the 1,153 over the same period of 2016, the investment bank said. Macy’s Inc., Sears Holdings Corp. and J.C. Penney Co. are shutting hundreds of locations combined, and shoe chain Payless Inc. recently joined the list of retailers filing for bankruptcy.

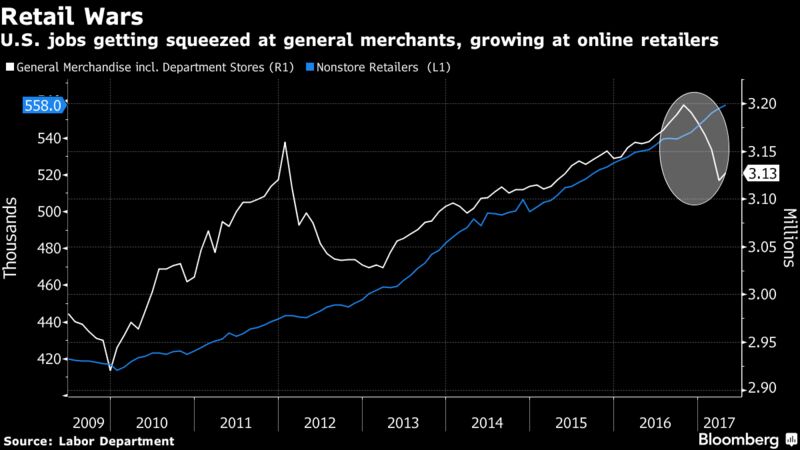

Driving the doom and gloom are pockets of weakness such as department stores and clothing chains that are casualties in the battle between brick-and-mortar and e-commerce. While that has led to consolidation and a shift of market share from traditional and mall-based locations to more agile online businesses, the latter’s share of total retail sales remains below 10 percent.

Employment data reflect the pain — general-merchandise stores lost jobs in five of the past six months while nonstore retailers are expanding payrolls, though not at a fast enough pace to make up for the shortfall. Still, e-commerce giant Amazon.com Inc. plans to hire more than 30,000 part-time workers over the next year, in addition to 100,000 full-time positions, for its growing network of warehouses around the country.

With the industry in a so-called overbuilt situation, a real-estate shakeout is not uncommon every few years, and the rise of online retailers is worsening the distress this time. Underneath the hubbub is the news that some companies are actually expanding their selling space and realizing the need to have a strong presence both physically and online.

Ulta Beauty Inc. plans to add 100 stores a year, with a goal of eventually having 1,700 U.S. locations. Amazon is opening bookstores and online eyeglasses-retailer Warby Parker is setting up more stores. Adding to the mix, Wal-Mart Stores Inc., the world’s biggest retailer, is intensifying its e-commerce push, while Kenneth Cole Productions plans to shutter stores in favor of selling on the Internet.

Malls and their stores, while not as much of a destination as they were in their heyday, aren’t about to vanish completely. A report from Cowen & Co. shows most customers still prefer to shop in physical stores 75 percent of the time.

Stores open and close all the time, so what really matters are net closings and net employment dictated by companies’ expansion and contraction rather than just store closings, according to UBS. Based on historical patterns, Sockin expects net retail jobs to rise in 2017.

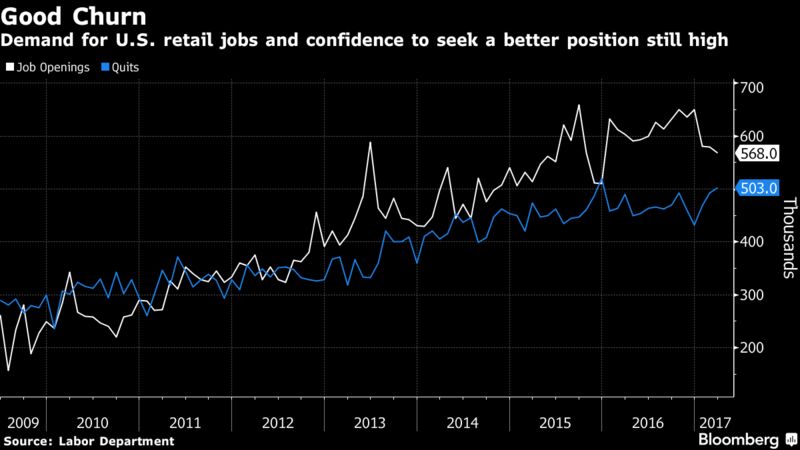

At 4.2 percent, the retail unemployment rate is below the nation’s 4.4 percent, and the industry’s job openings and quits — a measure of confidence in being able to find another job — each posted the second-best March in more than 15 years.

And the American shopper, the pillar of the household spending-driven economy, remains on solid ground amid robust job growth, improving finances, and low borrowing costs.

Even as department stores lose traffic, consumers are spending on services and shopping at sellers of health and beauty products, electronics, furniture. Their purchasing power is the best bet against the misplaced fear that the ailing retail industry is heading to the graveyard.

As Jack Kleinhenz, chief economist at the National Retail Federation, put it, “while we’ve seen these headlines, the consumer hasn’t gone away.”