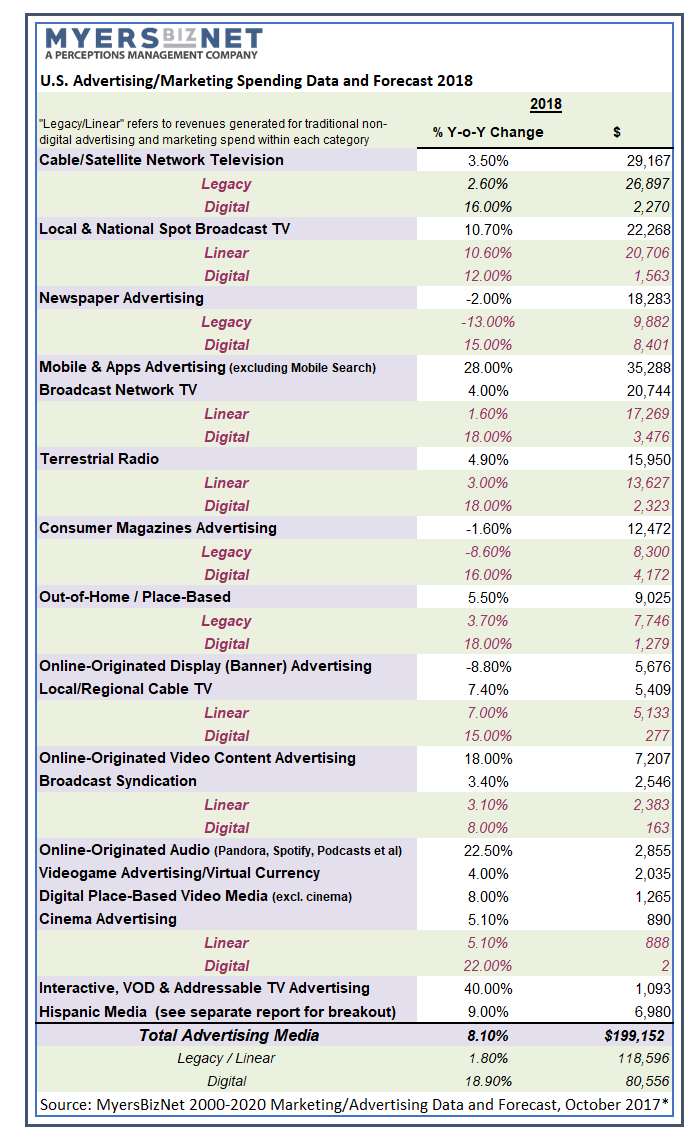

Marketers will invest nearly $200 billion in media-directed advertising investments in 2018, an increase of 8.1% over 2017 spending, which registered only 1.5% more than the $181.5 billion spent by advertisers in 2016. In a model best described as a “rising tide lifting all ships,” even newspaper and consumer magazine revenue declines will slow as their digital investments begin to bear fruit. Digital ad spending growth continues to drive the business, with digital media increasing 19% (including the digital assets of legacy media as outlined in the table below). Legacy/linear revenues are projected, in the new MyersBizNet U.S. Advertising/Marketing Spending Data and Forecast, to increase only 1.8%, but this is good news compared to the 7.1% estimated decline in 2017. The only category projected to suffer significant declines is online originated display (banner) advertising, which Myers forecasts will decline 8.8% to $5.7 billion. Political advertising will spur local advertising growth with Hispanic media, addressable TV/VOD, mobile, online originated video and online audio experiencing strong momentum. Among legacy national media categories, out-of-home and digital video place-based and cinema advertising are the strongest categories. Our full report also includes ten below-the-line/shopper marketing categories — scroll down for details. MyersBizNet’s full 2000-2020 Marketing/Advertising Expenditure Report is being issued later this month and is available to MyersBizNet member companies.

MyersBizNet is the only independent non-publicly traded media industry forecaster, with an unequaled record of accuracy. MyersBizNet is the only economic analyst that covers and reports data on all 28 marketing communications categories, including ten “below-the-line” and 18 traditional “above-the-line” media advertising categories. Myers economic reports also exclusively separate legacy/linear and digital spending within each category.

BY JACK MYERS