More stores are opening than closing this year

Doom and gloom often surrounds discussion of brick-and-mortar retail. It’s hard not to see the demise of traditional stores like Sears and Toys ‘R’ Us as bellwethers for the industry. Many stores are closing locations, but is it as dire as it seems on the surface?

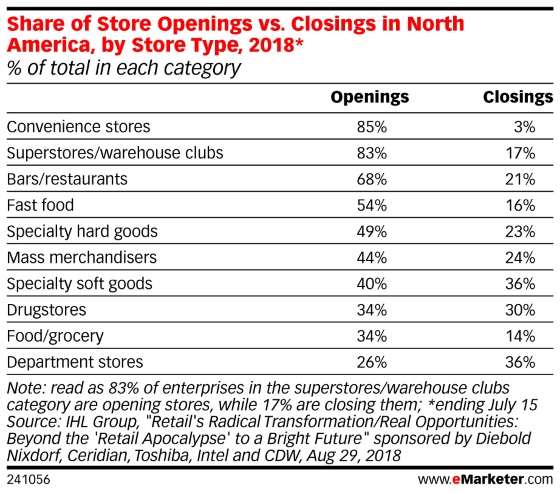

Not across the board. According to recent analysis by IHL Group, all retail segments in North America, except department stores, are opening more stores than they are closing. There has been a net increase of 2,570 retail stores—excluding restaurants, which have experienced even more openings—in the past two years.

This charge is being led by superstores and warehouse clubs where 83% of this segment are opening stores in 2018, while only 17% are closing them. (Convenience stores are an anomaly since oil companies don’t always break out retail from gas stations.) Taking food, drug, convenience, mass merchants/warehouse (FDCM) as a whole, 3.7 stores on average are being opened for every one that is shuttered.

Mall-based stores including department stores, the traditional anchors, as well as specialty stores had narrower opening-to-closing ratios. Department stores experienced negative growth; 36% were closing stores while 26% were opening, according to the IHL Group analysis.

According to the eMarketer Retail Database, Sears had the largest decline in retail store sales growth (23.1%). Additionally, Bon-Ton Stores (9.1%), Macy’s (8.0%), JCPenney(4.5%), Neiman Marcus (2.7%) and Nordstrom (1.0%) all experienced decreases while Kohl’s remained flat.

The segments opening the most stores this year is very telling. No. 1 and No. 2 are disproportionate since Walgreens and 7-Eleven added Rite Aid and Stripes, respectively, but drugstores, convenience stores and dollar stores made up the top five. Along with department stores, specialty retailers like Best Buy and Ascena Retail Group were among the top store closings.

The number of middle-income US consumers has been shrinking since the 1970s, the same time period when malls and department stores were built—overbuilt, in hindsight—to cater to this middle-class majority. Retailers are now feeling the effect of bifurcation as discount stores are thriving, as well as merchants catering to higher-income shoppers.

by Krista Garcia