null GETTY

Bill Rosenblatt Contributor

Source: forbes.com, June 2019

The Interactive Advertising Bureau and PwC released their third annual study of advertising revenue in podcasting last week. Although the study’s headline is yet another year of steep growth, the numbers show that growth has peaked and is slowing down. The numbers show that podcasting will need to find other sources of revenue if its commercial viability is ever going to be proportional to its growing listenership.

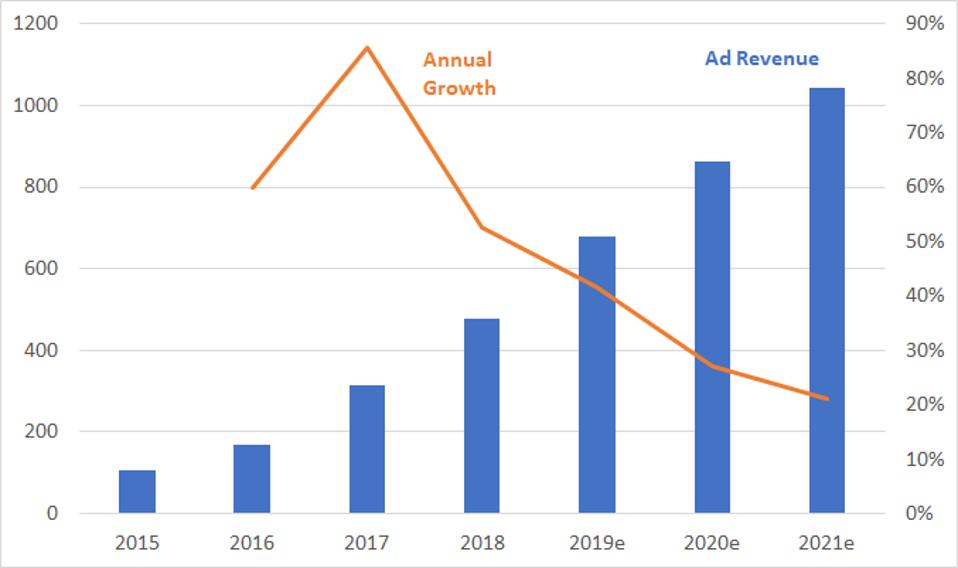

Podcast advertising revenue, $millions. Source: IAB/PwC.

GIANTSTEPS MEDIA TECHNOLOGY STRATEGIES

The study indicates that podcast advertising brought in $479 million in 2018 and estimates that it will scrape past $1 billion by 2021. Last year’s revenue is a 53% increase over 2017, but growth is expected to slow down to about 20% in a couple of years.

These numbers are much lower than those from other forms of ad-supported online audio content. PwC’s Global Entertainment and Media Outlook last year estimated $1.65 billion in ad revenue for internet streams of AM/FM radio stations in 2018, growing to $2.2 billion by 2021. The larger category of ad-supported streaming music also includes digital radio services like Pandora and iHeartRadio and interactive services like YouTube and Spotify Free. Together these services delivered about $1.6 billion to the music industry last year (RIAA figures), which suggests that they took in over $2 billion in ad revenue. For comparison, broadcast AM/FM radio earned $16 billion last year (PwC figures).

At the same time, the audience for podcasting has reached mainstream levels: Edison Research’s Infinite Dial study estimated monthly podcast listenership in 2018 at 73 million, or 26% of Americans aged 12 and over. That compares with 189 million, or 64%, for online audio overall. In other words, while podcasting has 40% of the listenership of online audio overall, it brings in less than 15% of ad revenue.

This is yet another indication that podcasting has to look beyond ad revenue if it is going to be a financially attractive medium. Podcasters currently use two ways of earning revenue directly from listeners: subscriptions and crowdfunding. Paid subscription services such as Stitcher Premium and Luminary are new and off to a slow start, in part because listeners have always expected podcasts to be free. But crowdfunding for podcasts has been around for a long time.

Crowdfunding for podcasts takes several different forms and is hard to measure. Some podcast producers collect contributions through standard online payment systems such as Stripe and credit cards while others solicit them through general crowdfunding platforms like Kickstarter and Indiegogo. A Chinese startup called Himalaya has a podcast app with a built-in tip jar.

The best source of crowdfunding revenue numbers is Patreon, which allows listeners to set up regular contributions per month or per podcast episode. Patreon reports that the number of podcasters using the platform has quadrupled over the past three years, with an eight-fold increase in revenue.

Patreon publishes subscribership figures for its creators; it also publishes revenue figures for those creators who opt in. Data from the top 200 podcast producers on Patreon shows that they have an aggregate total of over 460,000 subscribers and suggests—by extrapolating from podcasters who allow their revenue figures to be published—that total subscription revenue for the top 200 is about $26 million. That’s a reasonable estimate for total annual revenue for podcasters on Patreon: On the one hand, it’s high because it assumes that all of those podcasters have published episodes for the entire past year; on the other hand, it’s low because it’s only for the top 200, and subscribership follows a typical long-tail distribution curve.

Even if total crowdfunding for podcasts is ten times that amount, it’s still only about half the amount that podcasts take in through advertising.

The other limitation in revenue that comes through in the IAB/PwC study has to do with the types of ads that run on podcasts. Most ads in podcasts are native ads, read by podcast hosts and baked into the overall podcasts. Other surveys suggest that listeners don’t mind (or even like) these kinds of ads, but they don’t scale. The IAB/PwC study finds that 63% of podcast ads in 2018 were native, although that’s down from 67% in 2017. If podcasters try moving to more scalable types of ads—whether produced by podcasters or ad agencies—they risk alienating their audiences.

Finally, ads are much more expensive and time-consuming to sell and track than crowdfunding is. Tim Ferriss, of 4-Hour Workweek fame—one of the most popular podcasters in the world—just announced that he is starting a six-month experiment in which he will drop all ads and sponsorships and rely solely on crowdfunding; he says that “sponsors and ads chew up a TON of time.”

The question of whether podcasting will become a true mainstream commercial medium, or stay true to its roots as a quirky indie outlet, will remain unresolved for a while, but it won’t be for lack of experimentation and innovation.

Follow me on Twitter or LinkedIn. Check out my website.