Source: www.mediavillage.com, January 2021

We’ve known for years that on-air promotion is the most effective and efficient marketing tool television networks have. Promos allow viewers to “try on” or sample the product. They sell to a predisposed audience in a familiar environment. They are the shortest distance in time and space between an audience and a show. And they have a cumulative effect, as they build brand impressions day-in and day-out. But there’s one drawback. Promos are usually preaching to the choir.

To grow ratings, networks need to do more than just increase time spent viewing with their current audience. They need to expand their reach — get new viewers to sample their channels or services.

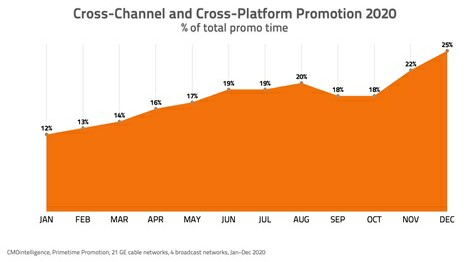

That’s why it’s been fascinating to see the evolution of internal cross-promotion (promoting content and brands from other services in the portfolio). Among the 25 general entertainment networks CMOintelligence audits, the amount of promo time dedicated to cross-promotion more than doubled during the last year.

This is indicative of an accelerated move to portfolio strategies — the idea that falling ratings have lowered all boats, necessitating sister channels to work together in “convoys.”

However, it’s important to note that much of this cross-promotion was actually cross-platform promotion to portfolio streaming services.

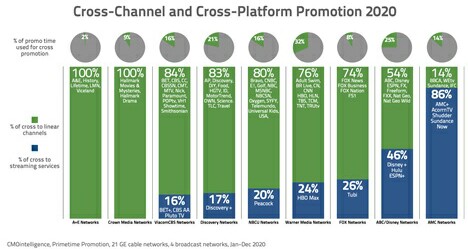

16% of cross on CBS, BET, Comedy Central, MTV, Paramount and VH1 combined went to BET+, CBS All Access and Pluto.

17% of cross for Discovery and TLC combined went to Discovery+. (And note that promotion for Discovery+ only began in December.)

20% of cross on NBC, Bravo, E!, Syfy and USA combined went to Peacock.

24% of cross on TBS and TNT combined went to HBO Max.

26% of cross on Fox went to Tubi.

46% of cross on ABC, Freeform, FX and Nat Geo combined went to Disney+, Hulu and ESPN+.

And a whopping 86% of cross on AMC went to AcornTV, AMC+, Shudder and SundanceNow.

Why the shift to cross-platform promotion? Obviously, most of these streaming services launched in the last year and media companies realized their linear air was the best way to drive sampling of them.

But also, cross-platform promotion is more efficient. Most streaming services are a collection of content from multiple linear channels plus the entire back catalog.

Instead of airing different spots promoting different shows on different linear channels, streaming promos can point viewers to a single entertainment destination. Overall, you get more bang for your promo buck, and help alleviate attribution confusion.

Is this another nail in the linear coffin? I don’t think so. While the balance will continue to shift, I believe both linear and streaming will survive and thrive. I often use the example of your automobile’s sound system. You have linear – radio — where someone programs the entertainment for you, and on-demand — an MP3 player or similar — where you program the entertainment for yourself. People move seamlessly between the two platforms depending on the kind of experience they’re interested in.

One of the big questions will be how these streamers differentiate their brands beyond their content. Essentially, they all have the same message: “We’ve got a great collection of new and classic content.” Linear channels, even general entertainment services, still retain unique brand positions that help viewers understand why their content is right for them.

This article was written by Lee Hunt, the founder of Lee Hunt LLC, a New York-based consultancy focusing on brand strategy, content architecture and competitive analysis for entertainment brands. He is also publisher of CMOintelligence, the syndicated service that tracks and analyzes the on-air marketing of 42 linear and streaming services; and partner in CMOmarketplace, the online exchange that connects buyers and sellers of creative services.

Click the social buttons above or below to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.