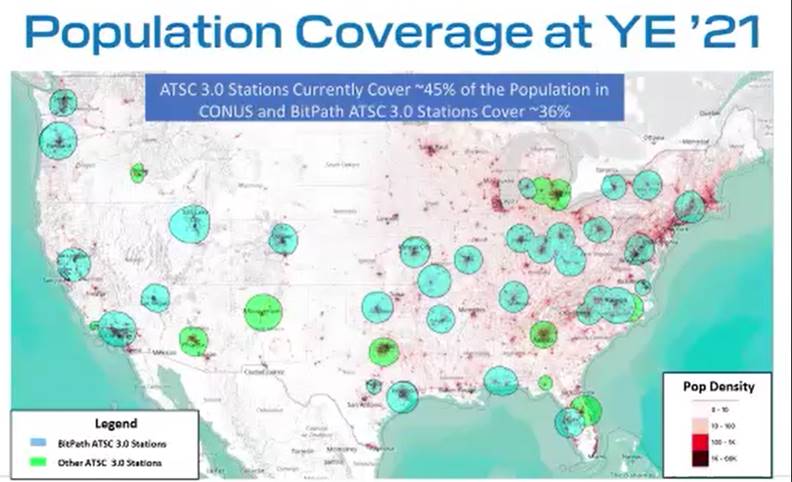

ATSC 3.0 infrastructure will position TV stations to not just create their own OTT platforms, but also lease a portion of their spectrum for datacasting, location services and many other new revenue possibilities. Leading experts on monetizing NextGen TV offered their predictions and blueprints at a TVNewsCheck webinar last week sponsored by LTN Global. Above, map showing ATSC 3.0 coverage at the end of 2021 from E.W. Scripps.

By TVN Staff

Source: tvnewscheck.com, January 2022

While the new ATSC 3.0, or NextGen TV, broadcast standard gives broadcasters a wide range of capabilities including 4K UHD support and the ability to deliver enhanced, interactive content, using their spectrum to deliver data to devices other than living room TVs is likely to be the first source of tangible 3.0 revenues, broadcasters said in a TVNewsCheck virtual event sponsored by LTN Global last week.

Out of the 45% of U.S. households currently reached by 3.0 signals, about 36% are part of the BitPath consortium created by Sinclair Broadcast Group and Nexstar Media Group to pursue new revenue opportunities in 3.0. And executives from those companies said that datacasting will be their initial focus as they work to expand their broadcast footprint into more markets through 2022.

“We don’t have a lot of capacity in 3.0 today, so we have to be economical with our usage of data bits for anything other than core over-the-air service,” said BitPath President John Hane. “So we’re looking first at areas where we get a lot of bang for the bit, and we believe initially that the first thing we want to pursue is location services. Because the market for that is huge, it already exists — you don’t have to explain it to people — and we think we have a very promising niche within it.”

Hane was a panelist on the webinar “Bringing In New Revenue Streams from ATSC 3.0” moderated by LTN Global VP of Major Accounts Mary Crebassa, who gave an overview of 3.0 rollouts and set sales to date and noted a recent BIA Advisory Services study projecting that datacasting revenue from NextGen TV could reach $5 billion by 2027.

Location services through 3.0 were obviously applicable to mobile devices, Hane said, but would likely first be used by commercial customers in B-to-B applications. He said location services were relevant to a range of industries including automotive and transportation, trucking, dispatch, delivery and Internet of Things (IoT).

Location services through 3.0 were obviously applicable to mobile devices, Hane said, but would likely first be used by commercial customers in B-to-B applications. He said location services were relevant to a range of industries including automotive and transportation, trucking, dispatch, delivery and Internet of Things (IoT).

“So we want to start with that, and we think there are others within IoT, particularly security, that we think are very promising and don’t take a lot of data but provide disproportionate value,” Hane said. “So those are the types of places we want to look into in the beginning.”

BitPath is going to be doing some location services field trials in the first quarter of 2022, starting with Sinclair’s WIAV-CD in Washington, D.C., which Hane said has “great coverage in D.C.” despite being low-power. Other markets targeted for location services trials include Portland, Ore.; Salt Lake City; and Las Vegas, where BitPath hope to demonstrate location services applications during the NAB Show this April.

Nexstar EVP and CTO Brett Jenkins said he is also excited by low-bandwidth applications for 3.0, like delivering IoT data, as a way for stations to find new revenues outside of the “pretty mature” traditional broadcast TV business.

Nexstar EVP and CTO Brett Jenkins said he is also excited by low-bandwidth applications for 3.0, like delivering IoT data, as a way for stations to find new revenues outside of the “pretty mature” traditional broadcast TV business.

“I think the IoT space is primed and a good example of how ATSC 3.0 can fill a role that current traditional wireless infrastructure doesn’t fill,” said Jenkins. “It’s a big pipe, it’s always on, it’s ubiquitous. And, it’s very, very low-cost to deploy from a capex standpoint.”

Jenkins said there is already proven demand for the datacasting applications being discussed in 3.0. It comes in the form of the existing diginet business in ATSC 1.0, where stations multicast secondary channels that are often programmed by third parties.

“There’s a market for broadcast bits today, and it’s developed over the past several years in this multichannel, multicast diginet business,” Jenkins said. “It’s pretty clear that there are companies that make money in that space and they come to broadcasters and want to use our spectrum because it’s very efficient and has great distribution.”

Broadcasters should be “moving fast and headlong towards ATSC 3.0” sheerly because of the capacity gains the new standard affords, said Kerry Oslund, E.W. Scripps VP of strategy and business development. While the total data payload of a 3.0 signal varies depending on the modulation scheme being used and the services being carried, Oslund said the new standard will allow stations to offer twice as many HD channels as today and as many SD channels as they would ever want to do.

Broadcasters should be “moving fast and headlong towards ATSC 3.0” sheerly because of the capacity gains the new standard affords, said Kerry Oslund, E.W. Scripps VP of strategy and business development. While the total data payload of a 3.0 signal varies depending on the modulation scheme being used and the services being carried, Oslund said the new standard will allow stations to offer twice as many HD channels as today and as many SD channels as they would ever want to do.“All of those are revenue opportunities,” Oslund said. “The other part I’d classify as another ‘C’, and that’s commerce. And inside of commerce I’d include addressable advertising and interactive advertising, and also as we move forward, the ability to transact through your television set just by using the remote control.”

ATSC 3.0 set sales projections (E.W. Scripps)

Through consortiums like Pearl TV, Scripps and other station groups have been working to develop a “broadcast app” that will run seamlessly on NextGen TV sets and support an array of interactive applications. Oslund described some of the “enhanced content” possibilities supported by the IP-based 3.0 standard and its broadband backchannel.

“Win, play, vote, buy, bet, inform,” he said. “For us to take what we already do, or new versions of what we already do, and apply those words is super-exciting.”

All of the new opportunities in 3.0 are data-driven, whether one is delivering video, e-learning or GPS augmentation (location services), said Mark Aitken, Sinclair SVP of advanced technology, and “so for us the focus is data distribution as a service.” He noted that ATSC as a standards organization has actually been focused on allowing interconnectivity between multiple TV stations so they can work together to deliver data.

Aitken has long been a proponent of using 3.0 to reach mobile devices. While he said there are still infrastructure issues that need to be tackled, “ultimately all of these new services will be available to people wherever they are, on the device that they’re most used to having in front of them.” For now, he likes the near-term opportunities that can be pursued in the living room.

“I think the first out-of-the-box revenue that is soon to be achieved is built around the interactivity, as Kerry said, the broadcast app,” Aitken said. “Which brings consumers in front of not just our broadcast over-the-air content, but a whole as big-as-the-Internet kind of reach inside of that environment. Because a new 3.0 television set really is a browser, in every meaningful way. When you bring that level of experience together, of live linear broadcast as we’re used to it, data distribution as various augmentations to that with different types of files, and OTT, there’s not a losing proposition.”

Jenkins also views additional capacity and Internet capability as two of the big improvements 3.0 brings to the traditional TV business. He said his thinking on how broadcasters will program their 3.0 services has evolved from a few years ago, when he still considered TV to be a “lean-back experience” and expected that broadcasters would focus on delivering 4K UHD and improved audio.

He said the pandemic has fundamentally changed how people consume TV programming, as they have learned to “pull” and “interact” with their TV much more than two or three years ago.

“I do think that ATSC 3.0 brings us now the ability to take those linear experiences and make them a little more lean-forward, in the way consumers have now trained themselves to use their televisions,” Jenkins said.

While Jenkins still views TV as the “killer app,” he thinks adding smart enhancements to the traditional viewing experience will resonate with consumers.

“And it’s just obvious that is going to bring a lot of value to our clients in the advertising space,” he said.

Aitken said that targeted, dynamic advertising within 3.0 broadcasts likely won’t take off until 2023. That’s because it will require integration between 3.0 reporting systems, OTT and the “boots-on-the-ground” sales personnel at stations and the systems they currently use to sell and traffic ads.

Aitken said that targeted, dynamic advertising within 3.0 broadcasts likely won’t take off until 2023. That’s because it will require integration between 3.0 reporting systems, OTT and the “boots-on-the-ground” sales personnel at stations and the systems they currently use to sell and traffic ads.

But broadcasters have already primed the pump for delivering targeted advertising via 3.0 through their existing efforts with ATSC 1.0. With some smart engineering, broadcasters like Sinclair and E.W. Scripps are using broadband connections today as a way to replace traditional spots on connected TVs with dynamic, targeted commercials.

“Digital budgets and CTV budgets are opening up to us already in 1.0, as we’re able to replace ads in a 1.0 environment,” Oslund said. “The more we do right now with getting those CTV CPMs on linear television, by making linear television and dumb inventory smart, is all setting us up for even better success with 3.0.

“I don’t know how much our audience knows about what is happening in the addressable space with 1.0, but it’s moving very fast. Those budgets are opening up to us, and we will be able to see those CTV CPMs come to linear television this year.”