by Karlene Lukovitz @KLmarketdaily

Source: www.mediapost.com, November 2022

Netflix and Disney+ may add significant numbers of new subscribers by launching reduced-price ad-supported streaming tiers (AVODs), but within the U.S., they may not be drawing from significantly different audience pools, demographically, than those of their premium subscription-based tiers (SVODs).

Or at least that seems a logical conclusion, based on a new analysis of actual transactions-based data from Antenna, which finds that the two types of streamers’ age, ethnicity, gender and income demographics are “overwhelmingly similar.”

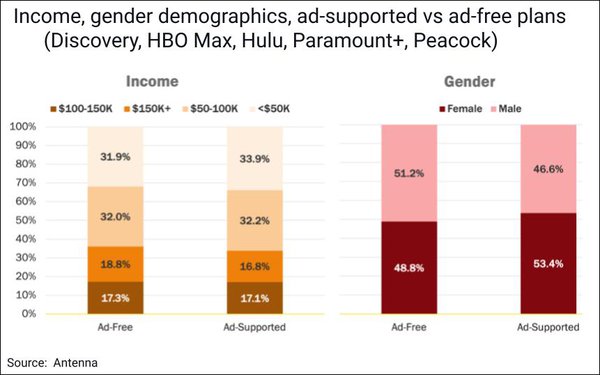

Even when it comes to household income, the differences are surprisingly minimal (chart above).

Subscribers to ad-supported plans skew only slightly lower, with 33.9% at a household income under $50,000, compared to 31.9% of ad-free subscribers.

Among subscribers with household incomes over $150,000, 16.8% opt for ad-supported services, compared to the 18.8% who opt for ad-free.

Gender-wise, ad-supported subscribers skew slightly female, representing 53.4% of ad-supported users, compared to 48.8% of ad-free plan subscribers.

Ad-supported subscribers also skew slightly older, with 43.7% over the age of 50 compared to 41.7% of those on ad-free plans.

In ethnicity terms, SVOD and AVOD subscribers are nearly indistinguishable. Both are 67%-plus White, about 16% to 17% Hispanic, 11% to 12% Black, and 4% Asian.

Antenna’s underlying data consists of raw transactions from a panel of millions of U.S. consumers who have opted in to contribute their purchase information, anonymously, for market research purposes. Antenna cleans and models the data, then weights the panel for demographic and behavioral skews. (More on methodology here.)