by Tanya Gazdik

Source: www.mediapost.com, October 2022

Automakers spent an estimated 22% less in September on national TV compared to the same period a year ago, according to iSpot.tv.

Total spending was $211.5 million, compared to $239.5 million in September 2021.

TV ad impressions also slid, but not as much, down 10.6% year over year to 24 billion for September 2022 compared to 30.8 billion a year ago.

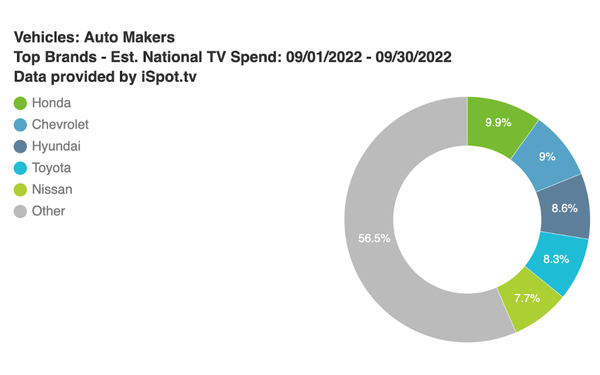

The top five brands by spend for the month are Honda ($21.2 million), Chevrolet ($19.3 million), Hyundai ($18.5 million), Toyota ($17.7 million) and Nissan ($16.4 million).

The most-seen automaker ads for the month are Honda: Forever Determined (4.58%), Nissan: 60 Years In 30 Seconds (3.33%), Ram Trucks: Moments (2.70%), Lincoln: A Glimpse (2.49%) and GMC: Outside And In (2.15%).

Honda aired 22 times more national TV ads year-over-year in September, which is part of the larger spend number (both relative to its peers and its own estimated national TV ad spend a year ago).

Chevrolet, meanwhile, spent 10% less year-over-year, but made college football a larger part of its September ad buy, up from 0.55% to 2.84%.

Hyundai was focused on NBC, which accounted for nearly 76% of its September spend due in very large part to the NFL (almost 85% of Hyundai’s NBC spend was allocated toward “Sunday Night Football” and “Football Night In America”).

The top five brands by share of automaker TV ad impressions for the month were Hyundai (8.18%), Toyota (8.12%), Chevrolet (7.73%), Nissan (7.17%) and Honda (7.06%).

The biggest spend increases among top 15 brands by spend for September compared to a year ago were Honda (+153.8%), GMC (+108.3%), Acura (+69.1%), Subaru (+58.4%) and Mercedes-Benz (+41.6%).

Honda emphasized the NFL far less compared to last September – 39.9% of est. national TV ad spend in Sept. 2022 vs. 89.8% in Sept. 2021 – but the brand also spent on SportsCenter and various HGTV shows as well, which was not the case in Sept. 2021.

GMC’s increase comes in large part due to the NFL, as it spent nearly three times more during games this September compared to a year-ago.

Acura doubled its NFL spend year-over-year, but also focused on Bravo’s “The Real Housewives of Atlanta” (No. 2 by spend for the brand after Acura did not buy national linear ads during the show last September).

The top programs for automakers by TV ad impressions share of voice for September 2022 are: NFL (11.92%), college football (11.12%), SportsCenter (1.13%), MLB (1.10%) and “Today” (0.96%).

Football’s return means automakers are relying on NFL and college games for reach once again. In September 2022, 23% of auto brand TV ad impressions are delivered by NFL and college football games, versus 17.8% in Sept. 2021.

By emphasizing TV ad impressions during football games in September, automakers had a clear focus on the broadest reach for new messaging, said Stuart Schwartzapfel, senior vice president, media partnerships at iSpot.

“Creatives around new 2023 vehicle inventory took center stage for many auto brands, while others leaned on broader brand messaging to attract potential customers on the promise of both present and future innovation,” Schwartzapfel tells Marketing Daily.

Share of TV ad impressions for reality programming also came in slightly higher year-over-year, at 12.10% (compared to 11.92% last year).

The top networks by share of automaker TV ad impressions in September 2022 are NBC (11.31%), FOX (6.90%), ESPN (6.25%), CBS (5.86%) and ABC (5.36%).

Sunday Night Football helps guide NBC to the top, accounting for over 47% of automaker TV ad impressions on the network (up from 38% the previous year).

The NFL delivers nearly 41% of automaker TV ad impressions on FOX as well, while college football makes up 46.1% on ESPN.

Tennis (and retiring superstar Serena Williams, in particular) is also a boost for ESPN, as the U.S. Open contributes 7.5% of automaker impressions on the network in September, compared to 3.1% last year.